China (and globe) Hit With Surging Costs – Stagflation Cometh

News

|

Posted 15/10/2021

|

9941

China, it seems, can’t grab a break. Amid the turmoil of the much talked about property crisis, the Chinese engine room, manufacturing, is showing signs of stress that may force Beijing’s hand on the monetary stimulus lever at the very worst time.

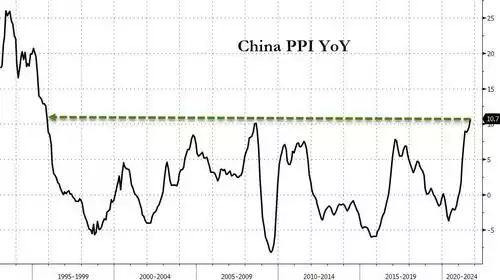

Last night we saw the highest Producer Price Index (PPI) print since 1995 with an incredible 10.7% rise in September after the 9.5% in August that shocked the market and dispelling that August print as a ‘blip’. (FYI the US is only marginally better with an 8.6% print in September).

For now the CPI rate is subdued at just 0.7% for the same period (helped by falling pork prices) but at some stage the factory door price rises need to be passed on or businesses go broke. Beijing will then be forced to address inflation through monetary tightening at exactly the time when they need to keep it loose to stop a full property market implosion and cementing a ‘stag’ in front of that inflation word. From Bloomberg:

“We think the risk of stagflation is rising in China as well as the rest of the world,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. “Persistent inflationary pressure limits the potential scope of monetary policy easing.”

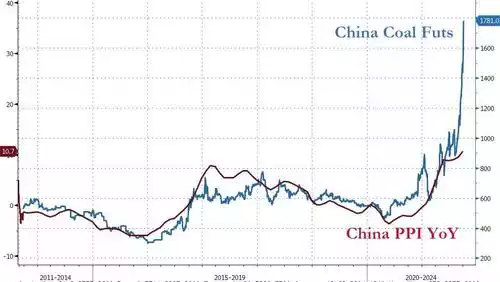

The forward signals are not great either. The September manufacturing Purchasing Manager’s Index (PMI) printed a surprise contractionary 49.6, its first contraction since COVID saw it plunge in February 2020. The country is plagued by the rising costs outlined above, production bottlenecks and electricity rationing. That electricity rationing is of course directly tied to coal which is both hurting Australia but also seeing coal prices explode in China. The chart below shows how closely China’s PPI follows the Chinese coal price and what that could possibly mean for inflation.

That chart would imply PPI of high 30’s% which would seem ludicrous. However as we wrote Monday that is not without precedent in mainstay construction and manufacturing materials such as silicon and polyurethane already.

PMI’s are a critical barometer as they tell of the prevailing direction of both manufacturing and services sectors from where the rubber hits the road, the producer.

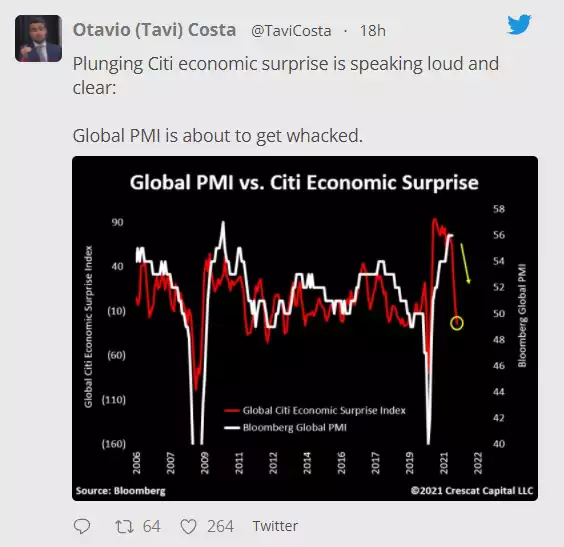

This is also clearly not a China-only issue. The tweet below from Crescat’s Otavio Costa is very very concerning for the global economy:

Citi’s Economic Surprise Index measures the degree to which economic data is either beating or missing expectations. As you can see it is at its lowest since the COVID crash… The market keeps expecting (hoping?) that things are better than they actually are. If the global PMI crashes to the extent history and the chart above would indicate, that is bad news for global growth.

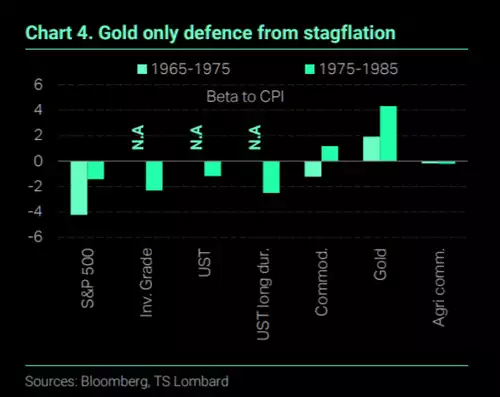

If, as it seems, that contractionary PMI is due to supply issues as evidenced by the above PPI prints then you have the spectre of poor global growth and high inflation at the same time. That, as we have discussed at length this week (here and here), equals stagflation. And as a reminder of gold’s performance in a stagflationary environment….