Big Trouble in “Evergrande” China

News

|

Posted 17/09/2021

|

7896

Its Friday and whilst not the 13th, it ends the week that marked the 13th anniversary of Lehman Brothers collapsing and cementing the contagion of what would become the GFC, one of the worst financial crashes in history. So over leveraged was the system that it’s all it took for the whole house of cards to come down. Coincidentally this week also saw China’s largest property developer, $300 billion Evergrande, technically default as well as the Institute of International Finance (IIF) releasing its latest global debt figures headlining another record high.

All eyes have been on the floundering giant for some weeks and this week Bloomberg (with the alarming headline “China’s Nightmare Evergrande Scenario Is an Uncontrolled Crash”) reported that Chinese authorities told major lenders to China Evergrande Group not to expect interest payments due next week on bank loans and that they won’t be able to pay their debt obligations due on 20 September. The risk of contagion should it fail is very real. Its debt is not simply with banks but a complex arrangement including, bonds, suppliers, it’s homeowner customers, and of course shareholders, the latter of two of whom have been protesting across China. Shares are now down to levels not seen since 2014 and falling.

“The turmoil at Evergrande, which spans street protests as well as collapsing prices for its stock and bonds, is the most visible sign of the worsening climate for Chinese property developers. Credit markets are also pricing in significant default risks for some smaller rivals, such as Fantasia Holdings Group Co. and Guangzhou R&F Properties Co.

But economic data for August, released Wednesday, pointed to broader difficulties, with national home sales by value tumbling 19.7% year-over-year, the largest drop since April 2020. Growth in home prices and real-estate investment has slowed, while construction starts fell 3.2% in January-August, compared to a year earlier.”

Beyond the financial we must also remember Chinese property development accounts for the consumption of half the world’s seaborne iron ore and 10% of global copper supply. Guess where most of that comes from…

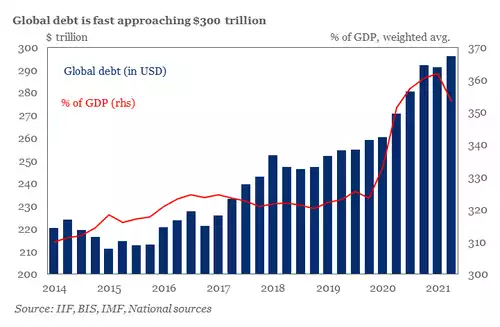

China also featured prominently in the IIF’s latest quarterly global debt report. Hardly a surprise but global debt printed another record high, now $296 trillion, up $4.8 trillion in just the last quarter and taking the tally since COVID to a simply incredible $36 trillion.

The sharpest rise was courtesy of the emerging market group which is wholly dominated by China and collectively added $3.5 trillion of that $4.8 trillion for the quarter and constitutes a third of all the $296 trillion total.

You will note that the debt to GDP red line actually dipped for the first time since COVID struck as the economy starts to recover. Before we get too excited just pause and consider that there is over 3.5 times more debt accumulated than total economic output.

As Australians enjoy the ‘wealth effects’ of rising house prices the report dishes up a salient reminder that this is still debt. $55 trillion of that total is household debt and it is on the rise. They warn "The rise in household debt has been in line with rising house prices in almost every major economy in the world".

Just as we started today, that is GFC revisited. In the lead up to the GFC American’s redrew on their mortgages with reckless abandon on their rising house prices to live large with no regard to the prospect falling house prices or rising rates.

Gold and silver took a big hit last night with a better than expected consumer spending print. Apparently that says everything is now awesome, not that Americans are repeating past errors on a hope of everything outlined above not mattering. History doesn’t always repeat but it certainly often rhymes…

Headlines are dominated today about the impacts of nuclear submarine deals with the US against China. Respectfully we’d suggest there is a far bigger and more immediate threat coming from our biggest customer…