Big End of Town Enters Crypto

News

|

Posted 24/04/2018

|

7934

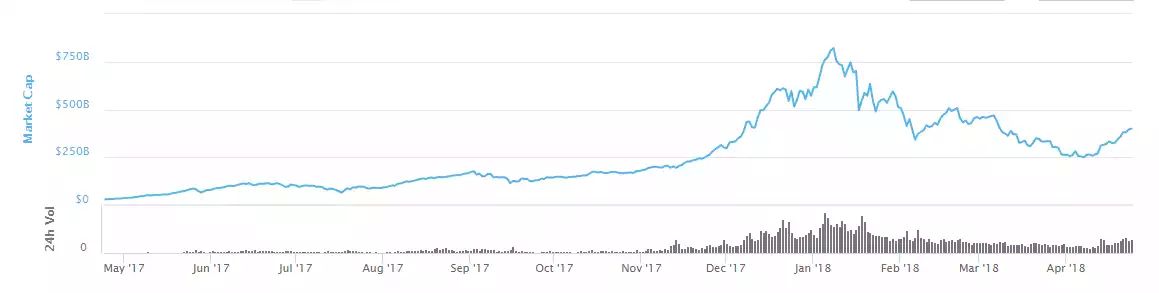

Back on 13 April we wrote of the biggest bounce in crypto since 2017. That bounce has continued since and yesterday the total market capitalisation of crypto currencies surpassed $400b establishing what appears to be a sustained rally. The chart below (from coinmarketcap.com) shows we are still less than half that peak of $821b reached on 8 January but now 1,256% higher than a year ago.

That low still coincides with the reported sell offs for capital gains tax bills in the US. We are certainly seeing a bit of that in Ainslie at the moment with tax bills becoming payable after stellar returns last year. That too ends around now for most in (little) Australia.

From those lows in April we’ve seen Bitcoin up 35%, nearly kissing $9000 again last night. Ethereum is up 73%, Ripple up 87%, Bitcoin Cash up (wait for it…) 131% and Litecoin up 38%.

That Bitcoin Cash rise has been spurred along quite recently on the announcements of a hard fork upgrade scheduled for 15 May increasing the already robust blocksize up to 32MB and also the payment giant BitPay including Bitcoin Cash as well.

More broadly Bloomberg broke the news yesterday that Goldman Sachs have appointed crypto trader Justin Schmidt as Vice President Digital Assets in order to serve the crypto needs of their high net worth clients. Bloomberg also quoted sources saying Barclays is considering opening its own crypto trading platform as well.

Circle, who are backed by Goldman Sachs and recently bought exchange giant Poloniex for $400m, also announced yesterday they are increasing the minimum trade on their OTC (‘over-the-counter’) platform to $500,000 due to a “robust market”. CEO Jeremy Allaire told Business Insider their average trade was now around $1m and routinely see transactions over $100m.

To have such investment banking giants moving into the space brings a whole new level of liquidity and respectability to the crypto space.

Here at Ainslie we now have our own direct BTC Payment portal running live on our webshop. This allows you to buy bullion with Bitcoin directly and immediately from 6am to 10pm 7 days a week. If you want to buy using ETH, XRP, LTC or BCH you can still do this easily through the webshop as well, just not directly (out of hours) like BTC.

Finally if you haven’t spotted it on our homepage, check out our new WHY BUY CRYPTO brochure or pick up a hard copy next time you come in to visit.