Biden’s $2T & “the most important event of your investing lives”

News

|

Posted 15/01/2021

|

7923

Markets are aflutter with the reports yesterday on CNN of a $2 trillion stimulus package to be announced tonight (US time, this morning ours) by Biden and now the New York Times ‘confirming’ it will be $1.9 trillion and include a $1400 ‘helicopter money’ cheque for individuals to top up December’s $600 cheque to the desired $2000 total.

So lets unpack this a little. Firstly, may we remind ourselves of the need for such an incredible stimulus package when a sharemarket at near all time highs is signalling everything’s awesome.

Last night also revealed more troubling data on the US unemployment situation after Friday’s terrible NFP employment figures (140,000 lost jobs) for December. From the Financial Times:

“The pace of new US jobless claims accelerated last week to the highest level since August, as the labour market continued to struggle amid a relentless surge in coronavirus cases and deaths.

There were a seasonally adjusted 965,000 initial applications for unemployment aid last week, higher than the 784,000 claims during the prior week, according to the Department of Labor on Thursday. Economists had forecast that 795,000 claims were filed last week.”

For context, the ‘stickier’ continuing claims is still 3 times higher than before the pandemic at 5.3m Americans on unemployment benefits, up 200,000 from a week earlier but still nearly half the peak of 10.6m in September. More focus seems to be on the halving from the peak than the tripling of the ‘norm’.

Exacerbating this, the rates of vaccinations in the US has fallen well short of expectations and now the UK strain is there at a time when infections and deaths were already at critical levels.

The Chief Economist for the World Bank, Carmen Reinhart, yesterday reinforced that confused focus by stating "don't confuse the rebound with a recovery." and expanding “a rebound this year still leaves per capita income below where it was before the COVID crisis - calling it a recovery is misleading."

We have spoken often of Raoul Pal’s playbook of this crisis starting with the liquidation phase we saw last February and March, the hope phase arguably still playing out, and then the inevitable insolvency phase. The latter is a balance sheet issue that no amount of stimulus can prevent. Many businesses are structurally broke. Reinhart clearly agrees stating she is "very concerned the longer this goes on the more strain on balance sheets of individuals, households, firms, and countries - it's a cumulative toll that I think will create classic balance sheet problems." As we have continually warned too, there is a misguided feeling of all being OK as the likes of JobKeeper, JobSeeker and ‘mortgage holidays’ are keeping businesses and individuals afloat, meaning, as she says, "there's been a problem that has been delayed but not avoided". She calls this a “quiet” financial crisis as so many are ignorant of what’s really happening.

And so, throwing more stimulus at this situation is simply kicking the can down the road. But it’s not a free ride, bringing us to the second point, and that is debt.

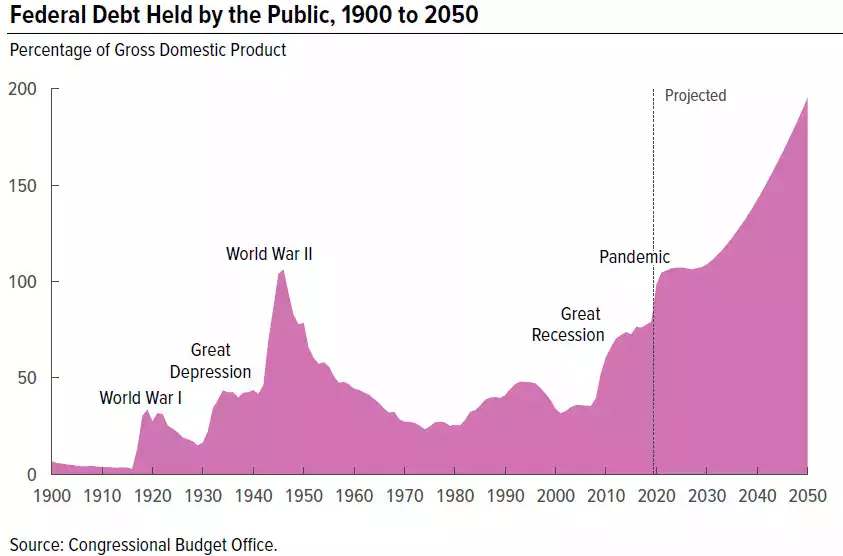

Another $2 trillion in deficit spending adds to the already stratospheric US debt. As a reminder, the US is already near an all time high against GDP, surpassed only by that accumulated to fund World War II. Their own Congressional Budget Office projects this to continue unabated per their chart below:

This stimulus announcement, though largely expected, has seen bond yields rise yet again over night. Rising rates whilst holding that much debt could be catastrophic. The ‘everything bubble’ was already there before the pandemic. Yes the pandemic pricked the bubble, but central banks and governments are desperately pumping air into it again.

Investment legend and founder of GMO, Jeremy Grantham CBE is 82 years old and seen a bubble or two published a paper earlier this year titled “Waiting For The Last Dance - The Hazards of Asset Allocation In A Late-stage Major Bubble”. His opening paragraphs should serve as a warning for all:

“The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behaviour, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.

These great bubbles are where fortunes are made and lost – and where investors truly prove their mettle. For positioning a portfolio to avoid the worst pain of a major bubble breaking is likely the most difficult part. Every career incentive in the industry and every fault of individual human psychology will work toward sucking investors in.

But this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives. Speaking as an old student and historian of markets, it is intellectually exciting and terrifying at the same time. It is a privilege to ride through a market like this one more time.”

It’s not this morning’s $2T announcement at play here, it is the fact that we now have Yellen in charge of fiscal and Powell in charge of monetary stimulus and a ‘blue sweep’ that won’t stop this. Heed his words and protect yourself.