Austrian Money Supply Growth & USD Falter: Another Recessionary Warning

News

|

Posted 24/07/2017

|

6480

Named after the famed Austrian School economist Ludwig Heinrich von Misus who passed away in 1973, the Mises Institute is an Alabama based organisation which exists to promote the teachings of von Misus and disseminate analysis based upon the Austrian Economics theory.

Economist and Political Scientist Ryan McMaken of the Misus Institute recently published an assessment of the US Dollar supply growth and his conclusions are supportive of other leading recessionary indicators such as those we’ve covered relating to credit growth using FRED data in the past weeks.

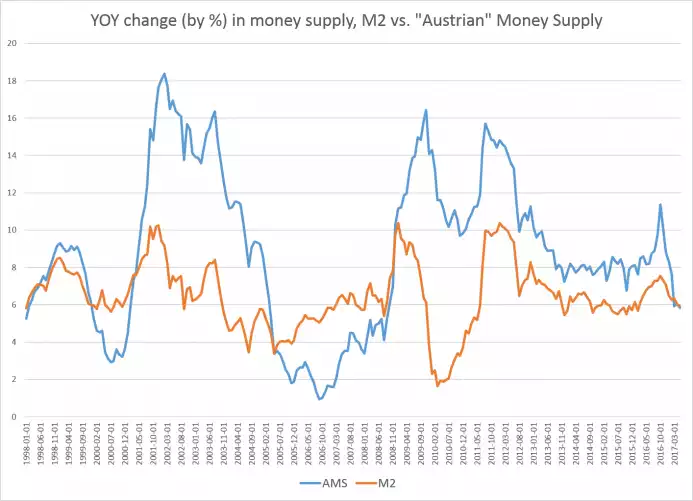

Ryan notes that according to the Austrian Money Supply Measure, the rate of growth in the US Dollar supply has fallen to its lowest in 8 years and 9 months. The AMS measure tends to produce a higher (and arguably more accurate) assessment of monetary expansion than the M2 metric and perhaps not so coincidentally, M2 supply growth now sits at a 1 year and 8 month low as pictured below courtesy of mises.org.

Notably, Ryan states that “Money supply growth can often be a helpful measure of economic activity. During periods of economic boom, money supply tends to grow quickly as banks make more loans. Recessions, on the other hand, tend to be preceded by periods of falling money-supply growth.”

The key here is Ryan’s use of the word “preceded” which flags this metric as yet another leading indicator in the already growing pile of indicators available. It is noteworthy that this data doesn’t represent a contraction of supply (central banks have ensured a continuous supply growth in recent history) but rather a significant reduction in the rate of increase.

Ryan’s succinct conclusion is best reproduced verbatim. “The current subdued rates of growth in the money supply suggests an economy in which lenders are holding back somewhat on making new loans, which itself suggests a lack of reliable borrowers due to a lackluster overall economy. This assessment, of course, is reinforced by the Federal Reserve's clear reluctance to wind down its huge portfolio, and to end its ongoing policy of low-interest rates — concerned that any additional tightening might lead to a recession.”

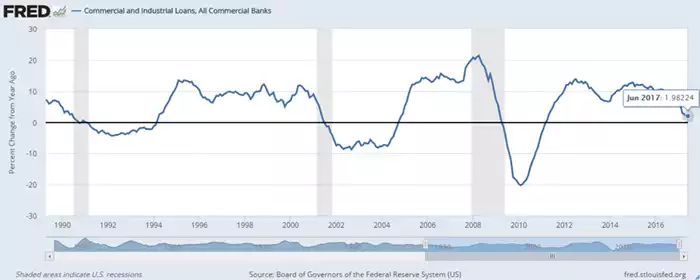

The following plot generated this morning for our readers using the fred.stlouisfed.org series shows a variant of the US commercial and industrial loan data that we discussed earlier this month. This time discarding seasonal adjustment, we can clearly see an association between falling commercial lending rates and official periods of recession. Note the current decline through 1.98% highlighted also occurred during the GFC, the Dotcom recession and the 1990 recession which contributed to Bill Clinton’s 1992 campaign.

In concert with these economic warnings we also see gold strongly recovering from recent lows, now having broken the near-term technical resistance level of $1,250 that we referenced on the 19th to sit at a Friday close of $1,254.50 as pictured below. This marks a 3 week high, an increase of 2% for the week and importantly sees the gold price now above both 100 and 50 day moving-averages; a bullish sign.

These price gains are occurring in a languishing USD environment. The Dollar Index fell by another 0.4% on Friday and the EUR/USD pair saw an increase of 0.2923%. Commentators are attributing this shift to ongoing political unease within the White House, mixed US economic data and, in the case of Myra Saefong, “raising uncertainty surround the likelihood of another U.S. Federal Reserve interest-rate hike this year”.

One needs to wonder about the extent to which these catch-phrases can be used to explain the graphs that we continue to present. It could be possible that an arguably more fundamental appreciation of the deterioration of the global economy is being more broadly adopted; something supportive of safe-haven buying.

As always we recommend a balanced approach to investing which is a topic that will be addressed at the NUU Understanding Money Conference scheduled for Saturday 26th August. This conference will exhibit a range of presenters on a number of topics from the definition of money, its past and future, cryptocurrencies and of course gold as the oldest form of money. Ainslie Bullion will be presenting at the event and we look forward to seeing you there.