Australia’s ‘House of Cards’

News

|

Posted 29/11/2017

|

8116

Last week we wrote of the troubling set up for Australia’s economy. If you missed it, it is a must read. That article included the extraordinary statistic that Australia has enjoyed the world’s longest running property bull market – 55 years.

Earlier this month Bloomberg reported UBS stating that bull market is “officially over”:

“The housing boom that has seen Australian home prices more than double since the turn of the century is “officially over,” after data showed prices now flatlining, UBS Group AG said.”; and

“There is now a persistent and sharp slowdown unfolding,”

“This suggests a tightening of financial conditions is unfolding, which we expect to weigh on consumption growth via a fading household-wealth effect.”

Now we see Bloomberg weighing in again, and this time putting it in to perspective in a global sense even further:

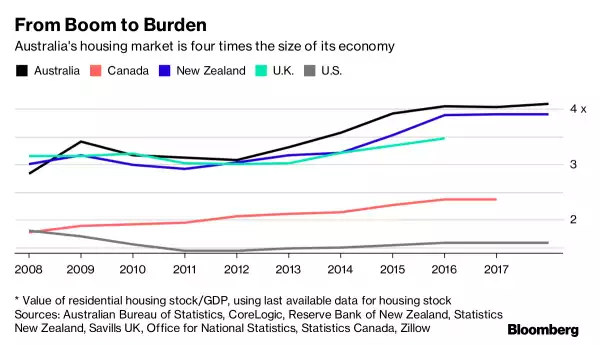

“The party is finally winding down for Australia’s housing market. How severe the hangover is will determine the economy’s fate for years to come. After five years of surging prices, the market value of the nation’s homes has ballooned to A$7.3 trillion ($5.6 trillion) -- or more than four times gross domestic product. Not even the U.S. and U.K. markets achieved such heights at their peaks a decade ago before prices spiraled lower and dragged their economies with them.”

This graph in part begs the question…so how are we paying for this? Bloomberg go on to note:

“Aussie households have racked up record private debts and aren’t getting the pay rises to help service them. That’s a core concern for the RBA and frequently cited as a deterrent for hiking interest rates. Macquarie Bank has said such debt levels mean any hikes will have triple the impact on consumers than tightening cycles in the mid-1990s. With retail sales looking grim and wage growth near record lows, debt will likely vex policy makers for years.”

“The risk is that it leaves the Australian economy extremely exposed, and a minor shock could become far more significant,” said Daniel Blake, an economist at Morgan Stanley in Sydney.”

The answer to how property prices continue to outstrip wage growth comes down to one single factor…. personal debt… the second highest in the world. All debt that might feel dandy now with record low interest rates, but what about when (not if) they rise? Can you have your smashed avo on toast and eat it too?

From property website Domain.com:

“The number of Australians optimistic about the year ahead has dropped to a never-before-seen low as mortgage holders eye a combination of record-high household debt and the possibility of interest rate hikes in 2018.

According to a Roy Morgan survey taken in mid-November, 31 per cent of people think 2018 will be “better” than 2017 – the lowest figure recorded since the survey began in 1980.”

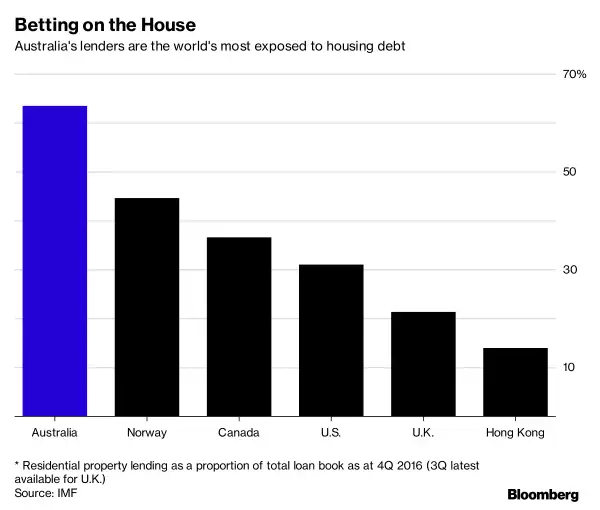

The article again reminded us that whilst you might be reading this all relaxed because you’ve paid off your mortgage, don’t own property, or have a share portfolio going well; a property crash in Australia see’s that $5.6 trillion ‘house of cards’ bring everything down with it. Australia’s banks, the same banks that completely dominate our sharemarket like no other, are more exposed to housing debt than any other in the world:

Throw in the unintended consequences of a banking enquiry and that mix of a bubble looking to burst, over indebtedness, stagnant wages, RBA saying the next rate move is up, and now poor sentiment and you have a volatile cocktail imploring you to balance your wealth.