Aussie Debt Distress Spiking

News

|

Posted 31/08/2018

|

7604

News was awash yesterday with Westpac raising its mortgage rate out of cycle with the RBA cash rate. We have repeatedly warned of this coming and the broader implications behind it. Australia relatively cruised through the GFC because our ship was in order and China came to the rescue. Since then however, to service our insatiable appetite for debt funded housing, and lured in by the cheap debt from near zero or negative northern hemisphere interest rate environments, our banks have borrowed over $1 trillion from off shore. So whilst our domestic official rates are stuck at 1.5%, overseas rates are on the increase and so too the servicing cost of all that debt for the banks. They of course pass that on.

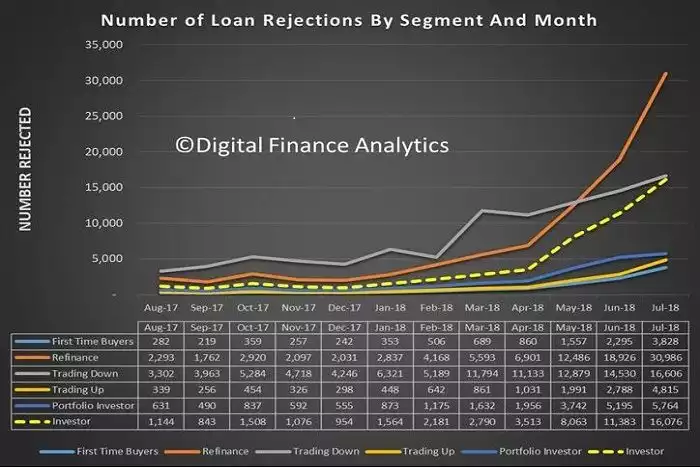

On Wednesday the ABC ran a story titled “Mortgage refinance rejection spike exposes number of Australians in debt distress” that contained some truly alarming numbers, lead by the following chart:

From that article:

“It's being described as a "mortgage mirage". It's an offer from the bank that looks too good to be true and, as it turns out, for many it is.

"About 40 per cent of people who tried to refinance were unable to do so," Digital Finance Analytics principal Martin North said.

"If you go back a year it was 5 per cent."

Data from DFA and investment bank UBS show there has been a spike in the number of failed mortgage refinancing applications.

The reason this is occurring is that, while those applicants cleared the bar for their original loans, that bar has now become a lot higher, following years of banking reform and the fallout from the banking royal commission.

So, now, they simply don't qualify for the same amount of debt they once did.

"When people took out the loans there was a lot of widespread fudging of the numbers," chief investment officer with funds management firm, Forager Funds, Steve Johnson said.

"People were getting loans on the basis of a four person family having $30,000 a year of living costs living in Sydney.

"And it's quite clearly impossible to live in Sydney on that much money a year.

"The biggest issue is that people have borrowed too much money relative to their income and that is a very difficult problem to unwind."

But, Mr Johnson said, it is not just the banks that have messed up.

"I think the banks have done a lot of unconscionable things, and I think credit has been far too easy to come by, but there is also an element of personal responsibility here in terms of people saying, 'well, the bank offered to lend me $1.5 million but I don't really think that is a sensible amount of money for me to borrow'."

Mr North has calculated there are now close to 1 million Australians on the edge of mortgage stress — defined by Digital Finance Analytics as borrowers who are going further into debt or eating into savings because their expenses are greater than their income.

Given that, it's understandable that when the big four banks advertise discounted mortgage rates, financially stressed-out households flock to the banks to bag a better deal.

"And then they're stuck, because suddenly they find that that wonderfully alluring low rate that's being hung out to them is inaccessible," Mr North said.

He calls these borrowers "mortgage prisoners" because they go home empty-handed, trapped in a financial squeeze.”

Financial squeeze indeed… You will recall a similar setup with property in the US where people were enticed into loans they couldn’t even hope to afford, went on to borrow more against their rising property price to buy essentials like plasma TV’s and JetSkis, etc, and surprisingly that didn’t work when the property market corrected and so ensued a ‘forced sale’ exacerbation of that ‘correction’ into an outright crash.

The speed of deterioration of those Australian figures above are alarming. Rejections since April this year are up 349% and since December we’ve seen rejections up from 2,031 to 30,986, a 1426% increase! If you are comfortably sitting back thinking it’s not your problem, the implications for the Australian economy are far broader. From that same article:

“Independent banking analyst Brett Le Mesurier warned there are also important implications for the economy.

"There are certainly signs of deterioration," he said.

"I suspect the issue is not so much their ability to service those loans, it's more the other spending they don't make anymore and the broader impact that has on the economy.

"I therefore expect that to push downward pressure on economic growth."”