Aussie bullion holders well positioned

News

|

Posted 28/09/2015

|

4880

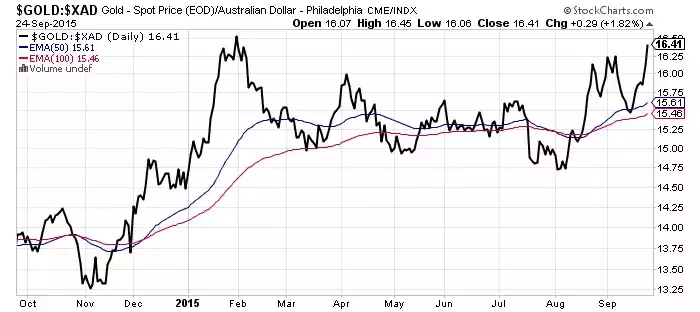

As we mentioned in our last weekly wrap, Friday’s combination of stronger USD priced gold and a further weakening in the AUD saw a significant jump in the gold price which put it at an eight month high (see the chart below). Although we sometimes see spikes in the spot price of metal, there are now many indicators of something more fundamental being at play. We are currently about five weeks into what is a new era of stock market and currency volatility. That’s long enough for investors to start to think longer term and consequently adjust their investment outlook. The fact is that it’s becoming increasingly difficult to sell the idea that Australia is on a path of prosperity. Let’s look at a few issues that are cause for concern with regards to Australia’s economy and currency outlook – exactly the type of issues that bullion provides insulation from.

Politically, our new leadership team has given us a confidence boost as exemplified by the latest ANZ Consumer Confidence print of 114.5; a near 26% jump in one week. At the same time however, the media is reporting further uncertainty on a plethora of issues including taxation, superannuation reform and issues surrounding Australian property prices. With Scott Morrison’s emphasis on spending rather than revenue last week, speculation is focusing on what expenditures may be cut. Uncertainty and confidence do not coexist for long.

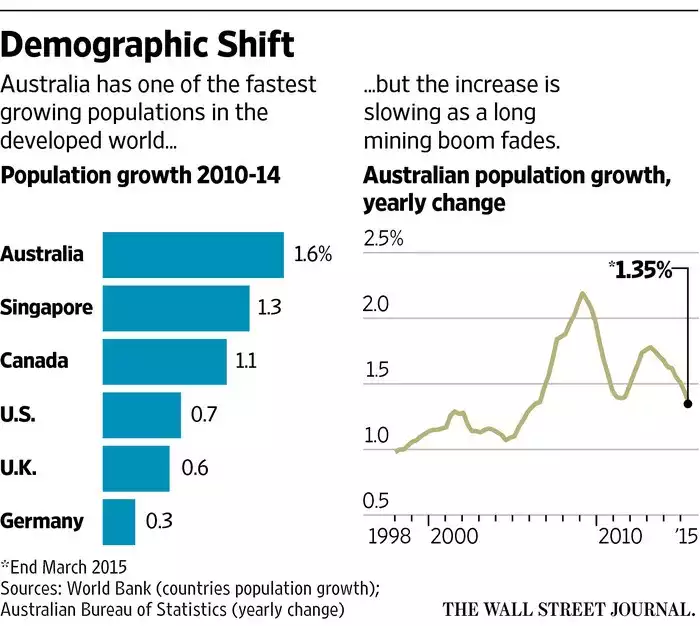

Last Thursday, the ABS released data on Australia’s sliding population growth which represents a deterioration of one of our strongest growth areas at a time of increased recession risk. In the last year, 45% fewer people migrated to Australian than during the 2008 peak. With the mining boom over, consumer spending fuelled by strong population growth has been important. The following graph from the Wall Street Journal indicates this slide.

Just this morning, the ABC released research from recruitment firm Robert Walters which claims that today, almost 90% of Millennial and Gen-Y workers in Australia want to head overseas to work “to escape our country's slowing economy and rise in unemployment”. As productive workers leave Australia, issues with consumer demand, economic capability and population ageing are exacerbated.

As we have already discussed, the Fed’s weakening ambition and ability to raise interest rates above the zero bound has brought negative interest rate policies (NIRP) into mainstream Western media. Andrew Haldane, the chief economist at the Bank of England, released a highly discussed piece which was revealing in terms of the mindset of central bankers. Of interest was the notion of zero interest rate policies (ZIRP) having strategically failed. If the Bank of England and the Fed are looking to NIRP as a way to overcome the zero bound on a permanent basis, the stability of all fiat currencies could become dramatically weakened.

Evidence that Australian investors are already seeing potential in bullion acquisition is not only illustrated by the stock shortages experienced by bullion dealers of late and by the increase in AUD priced gold, but also by Australian listed gold miners which have been under heavy selling pressure in recent times. Such stocks have seen signs of recovery of late. With a portfolio of gold exploration tenements within Australia and Brazil (and with multiple recent comparisons between Brazil’s economy and our own) Beadell Resources is a small yet appropriate example. Beadell’s stock is up approximately 38% in 8 trading days as gold’s supply and demand situation becomes apparent to investors. See the chart below. Our article last week on Nordgold’s expansion is also evidence in support of the gold mining industry.

Although these are only a few observations, Australian investors with a portfolio allocation in precious metals have a number of reasons to smile. Such investors are insulated from the declining AUD and the subsequent erosion of wealth without exposing themselves to other fiat currencies in a world of competitive devaluation. Similarly, bullion investors position themselves outside of traditional stock investments that are a function of economic health and are highly volatile. Such investors isolate themselves from capital controls such as those seen recently in Greece and do not need to worry about reliance upon government deposit guarantees. Additionally, bullion investors are poised to benefit from an area where demand far outstrips supply and where we’re already seeing evidence of the upside potential that many indicators have been projecting for some time.