AUD surges as ECB destroys the bond market

News

|

Posted 11/12/2020

|

5699

Last night the AUD smashed through the 75c mark for the first time since June 2018. Waking this morning, with gold down 1.6% and silver down 1.2% you may have thought the spot price had an ordinary night but in USD terms they held firm. It’s all this rising AUD which has gone from sub 70 to now over 75 just since the beginning of November. No coincidence then that this period has also seen gold in AUD terms fall from $2700 to the current $2435 and silver fall from $34.10 to $31.80. This has been the ‘risk on’ trade of ‘everything’s awesome’ reflation trade in full force, an environment which the AUD likes. By comparison this same period has seen Bitcoin rise from $19,200 to the current $24,400 (after reaching $27,000 at the beginning of December). Between the 2 real monetary assets, Bitcoin has overshot the correlation trend against real yields and gold/silver is lagging (for now).

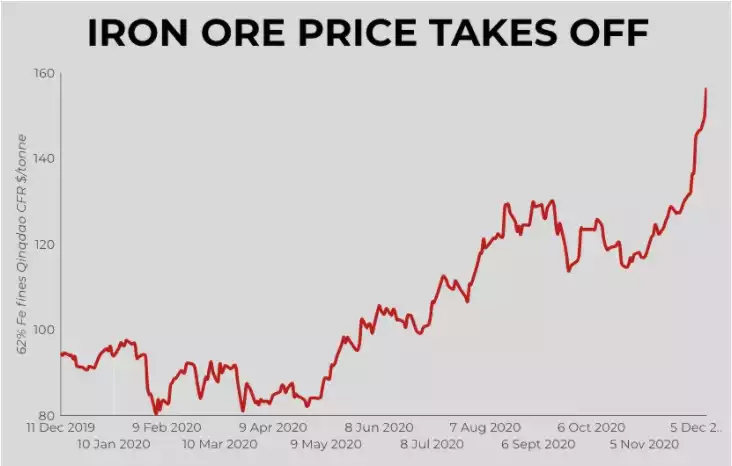

A lot of this AUD strength can also be attributed to the meteoric price of ore which last night broke through $150/tonne on fears of a cyclone in the Pilbara.

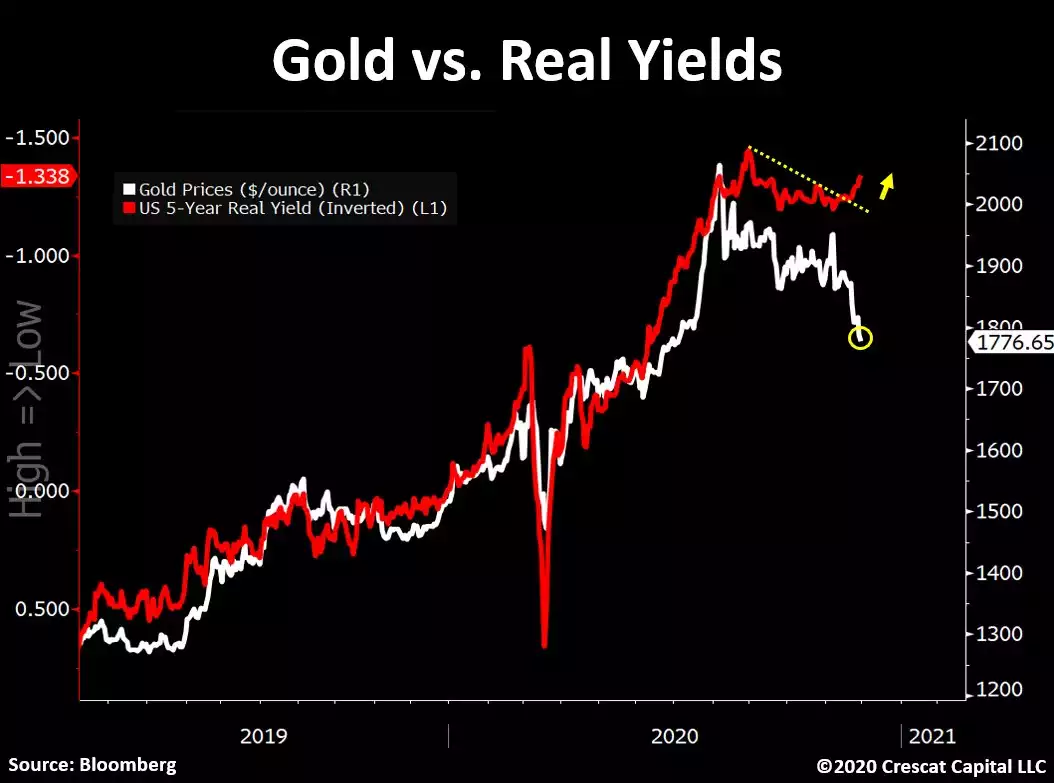

Those real rates of the previous chart are under increasing downward pressure too as central bank stimulus suppresses headline rates but inflation (subtracted from headline rates to get real rates) inches up and always threatens to rocket in response to said stimulus.

Topically, last night the ECB (Europe’s central bank) went even deeper into stimulus, increasing their QE program by EUR500 billion to $1.85 trillion, and extending it out to “at least” March 2022 as it struggles to overcome Europe’s double dip recession. Despite that, the EUR strengthened as the stimulus addicted market was hoping for more. What stimulus was provided was already priced in. That of course put more pressure downward on the USD (the EUR being the major pair), and upward of course on the AUD/USD pair, but did not stop the AUD climbing even against the stronger EUR.

Such is the extent of the ECB’s bond buying program (funded with newly created Euros) that Bloomberg calculated they are about to own 43% of Germany’s sovereign bond market and 40% of Italy’s, putting them on course to own over half of those entire sovereign bond markets in the next quarter. That is quite staggering when you think about it. The Bank of Japan long since moved past such a milestone, turned their attention to Japanese shares via ETF’s to the point where they are now the single biggest owner of shares on the Nikkei. Where does this end? Rules are being thrown out in desperation. From Bloomberg:

“Needless to say, the implications are profound for what's left of bond traders. Japan’s fixed income trading floors have been decimated over the last decade and the markets are so dead that sometimes not a single government bond trades in a day. Despite the fact that there is over $8 trillion of Japanese debt in existence, the Bank of Japan owns around half of it, and sometimes close to 90% of individual issues.

And now that the ECB is wantonly buying up everything, it's Europe's turn.

It didn't have to be this way: when the ECB first started buying bonds in 2015 it was tied to strict purchase rules in an effort to avoid accusations of monetary financing. The central bank was allowed to buy no more than a third of a country’s bonds and had to weight purchases of euro-area member states by the size of the economy and population. All these rules were thrown out this year, when Christine Lagarde scrapped those limits for the central bank’s pandemic purchase program, with another €1.85 trillion being pumped straight into bond markets, including the extra amount announced Thursday.”

As investors and institutions look for safe havens the traditional go-to’s of sovereign bonds and gold are looking more and more favourable toward gold as this plays out. We have of course also seen more institutions putting their reserves into Bitcoin of late as well.

One thing is certain with an AUD heading towards 80c and that is the RBA will not be happy and will also be keeping the pedal to the stimulus/QE metal to try to contain it. Outside of the ore story, Aussies exporters are battling a high AUD and a Chinese trade war.

Another thing is certain and that is central banks are not unleashing unprecedented stimulus because everything is awesome. The effects of that stimulus are driving up financial assets to unprecedented highs, giving the impression of awesome, not the reality.

For Aussie investors looking to get into gold, silver and platinum amid all this stimulus, currency debasement and the reality of the economy it talks to, the high AUD makes for nice cheaper metals to buy for the time being.

Australia, at 0.1% interest rates and CPI at 1.6% is firmly in negative real rate territory. That is gold’s sweet spot. Bonds as the alternative are looking more and more unattractive.