AUD Most Shorted in 3 Years

News

|

Posted 31/10/2018

|

6103

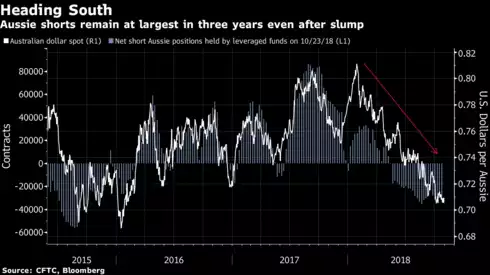

A report this morning on Bloomberg revealed leveraged funds are shorting the Aussie Dollar the most in 3 years.

Visiting CIO of $14.5b Canadian money manager Hexavest Inc, Vincent Delisle, said yesterday in Sydney he expects the AUD may drop to a 9 year low of just 67c as the RBA remains, and maybe becomes even more dovish.

From Bloomberg:

“The Aussie has already tumbled about 9 percent this year due to record-low interest rates, a sell-off in risk assets, and concern a trade war with the U.S. will crimp growth in China, Australia’s major trading partner.

A lot of damage has already been done to the Aussie, Vincent Delisle, co-chief investment officer at Hexavest, which oversees the equivalent of $14.5 billion, said in an interview in Sydney. A number of other major central banks are trying to catch up with the Fed, “if the RBA’s not playing that same game, bad news near term is you get a weaker currency,” he said.”

The RBA meets next Tuesday and essentially all economist believe they will hold the cash rate at 1.5% and expecting it to stay there until mid next year at least.

As global central banks embark on their tightening ‘promise’, that 1.5% Aussie cash rate, once ‘high’ globally and attracting funds from around the world bidding up the AUD, is now looking underdone and the money is leaving accordingly. Delisle predicts the RBA will “probably talk a more dovish scenario, will make a difference relative to other markets,” and of course that ““is going to weigh down on the Australian dollar,”.

For Aussie holders of gold, silver and platinum, a falling AUD sees the price of your metal go up against that USD spot price.