AUD hits 60 handle – more to come?

News

|

Posted 06/12/2021

|

6951

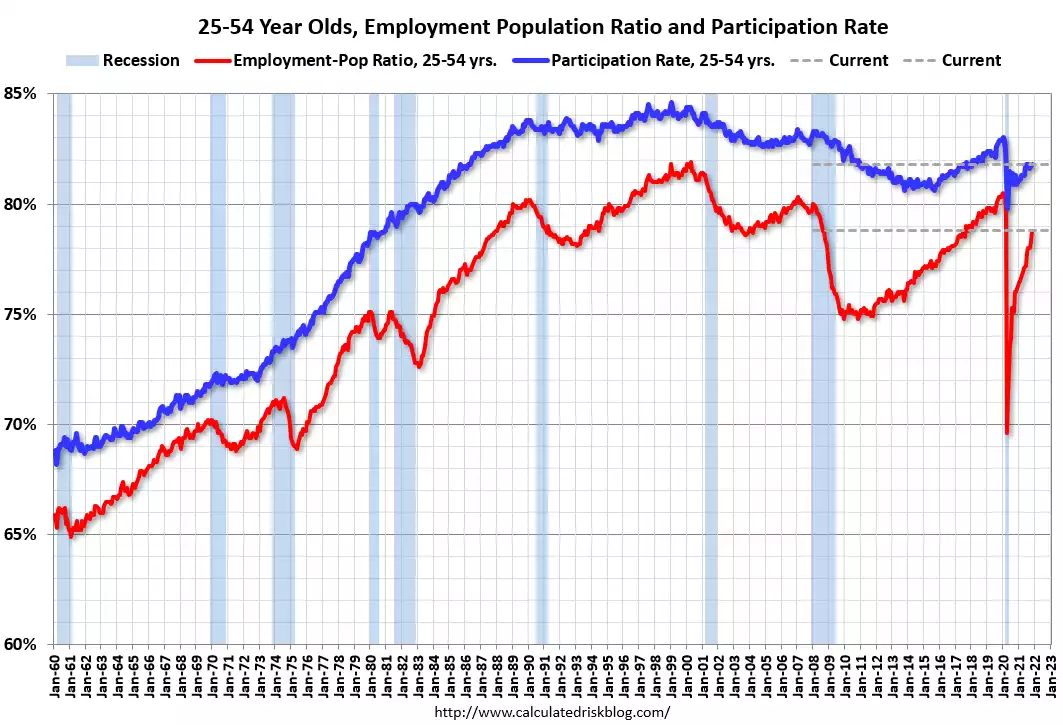

Friday night saw the latest NFP employment figures out of the US and whilst it was a big miss in the number of newly employed at just 210,000 the unemployment rate dropped as participation remains stubbornly low. This has experts wondering if the participation rate has been structurally changed by COVD.

From Credit Agricole:

“…greater uncertainty continues to surround the US participation rate, and whether or not it will return to its prepandemic levels. US policymakers are indeed still trying to assess whether the pandemic has ultimately left permanent structural changes across the US jobs market, which if true could mean that the Fed may be forced to raise rates earlier than thought initially. In any case, most of H122 may be needed for such an assessment, which could in turn see the USD flexing its muscles against the low yielding currencies whose central banks seem stuck in an ultra-accommodative stance forever, namely the JPY and CHF. Later in the day…only a surprising downturn may eventually take some shine off the USD.”

Our AUD hit a 60 handle in response and sitting at 69.99 at the time of writing. You can see below the AUD has been in decline since the early this year. Indeed you will also see that, after the COVID bounce, the AUD firmed as gold fell after the ‘everything is awesome again’ trade from mid last year. It then started falling from March at the same time gold bottomed and has been heading up since.

Macro Business Chief Strategist David Llewellyn-Smith believes this is just the beginning of further falls for the AUD:

“DXY was only firm in response to the BLS so why did AUD get smashed? A few points:

- The US unemployment rate is now 1% lower than Australia’s. This is becoming embedded in an inverted yield spread at the short-end of the curve even if the long remains deluded on Australia.

- If the US participation rate does not lift soon then the Fed will be forced into earlier and steeper hikes. This is obviously growth negative and being priced in a pancaking yield curve. Indeed, the belly of the OIS curve has inverted.

- Then we have OMICRON which is spreading like wildfire in South Africa and does not look especially different in terms of health impacts so there’s a safe haven bid building into DXY and away from risk currencies like AUD.

- Europe is lurching towards virus lockdowns.

- Sure, China is stimulating, but only slowly, and the key commodity-intensive property sector is still reeling.

- The AUD technicals now look pretty close to disastrous as well, and markets are not so short that they can’t get more bearish yet.

It ain’t a pretty picture for the AUD as the global economy hurtles towards a mid-cycle slowdown that increasingly looks like it could take on the outlines of a mini-recession.”

A falling AUD just propels the calls for higher USD spot gold to even higher levels for us. Whilst not of the order we spoke of in Turkey or Venezuela a devaluing AUD means you lose value in your currency but if you hold gold, you see a lockstep appreciation in your money. Real money.