Another Wall St Record v Gold

News

|

Posted 15/02/2021

|

6216

Another day, another record. For the first time in history the US sharemarket is valued, or more accurately*, priced, at twice the US economy measured by GDP. * Remember price is what you pay, value is what you get. Don’t get the 2 confused.

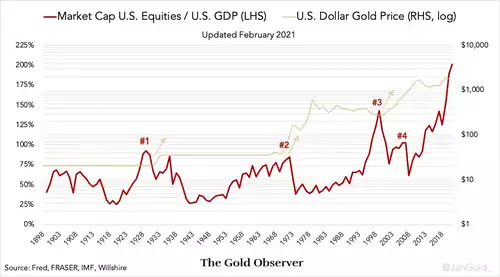

Last week the total US sharemarket (per the Willshire 5000 index) was priced at $41.8 trillion. The IMF’s estimate of the 2020 US GDP was $20.8 trillion. That is a 201% equities to GDP ratio.

Over the past century whenever that ratio hits a high, gold goes on to make strong gains as the value of the equities inevitably corrects. The chart below paints that very clear picture and also puts into perspective the nosebleed levels we are now at. Note the gold price is in logarithmic scale just to whet your appetite a little more…

The author of the chart further demonstrates the ‘unreal’ nature of this US equities market where it is one based on stimulus and hope rather than the true fundamentals of earnings.

Whilst we always talk about the price of gold arguably being undervalued and the factors that will drive it up, the author comes at it from a different and arguably fundamentally more correct angle.

“One can argue that the real price of gold (corrected for inflation) is currently not undervalued. As I have written in a previous article gold’s purchasing power is fairly constant. Today, gold buys you roughly the same amount of commodities and goods and services as it did 50, 100 or 200 years ago.

However, according to my analysis, fiat money is strongly overvalued. As, fiat is the air for the present financial bubbles - fiat facilitates the excessive leverage in the economy. When the bubbles eventually burst, fiat’s value will be corrected (inflation goes up), and the gold price denominated in fiat rises.”

The Fed has printed over 20% of all the USD currency ever created just in the last year. Let that sink in. That ‘money’ has to go somewhere and it has inflated the mother of all bubbles in most financial and property assets. To date it has not caused inflation but the new agenda of fiscal stimulus more directly to Main St not Wall St threatens that to change and potentially change dramatically.