Another Signal of a US Recession

News

|

Posted 05/04/2017

|

4801

On Monday we discussed the US now having passed the modern era average of uninterrupted growth and very much past the recession ‘use by date’ in post war terms. As discussed yesterday Australia is on the cusp of a record run of not having a recession. Comments from the RBA governor yesterday may not instil much confidence though. From today’s AFR:

"Too many loans are still made where the borrower has the skinniest of income buffers after interest payments," Dr Lowe said late on Tuesday.

The remarks came after the Reserve Bank left the cash rate steady at 1.5 per cent for a seventh-straight meeting – effectively trapped by the need to avoid adding more fuel to the property market with another rate cut while being unable to hike because unemployment has worsened and inflation remains too weak.

Amid concerns such loans are akin to the disastrous "subprime" mortgages that plunged the US and global economies into crisis in 2008, Dr Lowe warned Australian banks they needed to maintain a "very strong focus on serviceability assessments".

"In some cases, lenders are assuming people can live more frugally than in practice they can, leaving little buffer if things go wrong".

"Growth in employment is slow and wage growth is the lowest in some decades," he said.

"We will want to see an improvement here before we can be confident that growth in the overall economy is strengthening."

The RBA remains stuck between inflating the property bubble further and providing the fiscal stimulus the broader economy appears to need.

The US on the other hand is presenting clearer signals that a recession may be closer than some give credit…. And it is credit that is screaming a warning. London’s The Telegraph’s Ambrose Evans-Pritchard wrote over the weekend:

“Credit strategists are increasingly disturbed by a sudden and rare contraction of US bank lending, fearing a synchronised slowdown in the US and China this year that could catch euphoric markets badly off guard.

One key measure of US corporate borrowing is falling at the fastest rate since the onset of the Lehman Brothers crisis. Money supply growth in the US has also slowed markedly. These monetary and credit signals tend to be leading indicators for the real economy.”, and

“Elga Bartsch and Chetan Ahya from Morgan Stanley said the credit squeeze is a warning sign and needs watching closely. “On our estimates, the credit impulse turned negative at the end of 2016. We have not seen such a sharp deceleration in bank lending to US corporates since the Great Financial Crisis,” they said.

“Historically, credit downturns have led recessions. The plunge could reignite concerns that a highly leveraged US corporate sector may react strongly to even limited interest rates increases,” they said.”

This, combined with falling GDP estimates and company earnings, of course is in stark contrast to a market riding a wave of hope…

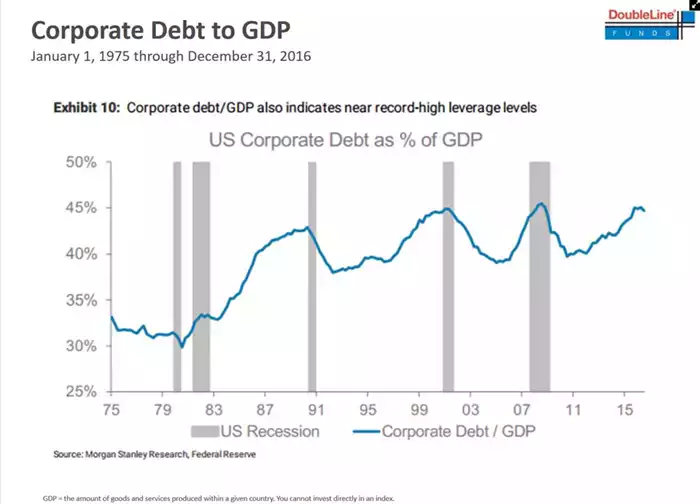

And whilst credit is coming off, so too is GDP and so when put against GDP we get another historic signal of an imminent recession:

And so you can see why many are more than a little perplexed that the US Fed is raising rates in such a weak environment.

“Corporate lending has ground to a halt and I am staggered that the Fed is raising rates. They have made a very big mistake,” said Patrick Perret-Green from AdMacro.” (from the same The Telegraph article).

But you see, just as our RBA is stuck between a rock and a hard place, so is the US Fed. As we’ve said many a time, if they don’t raise they both lose credibility and fuel more speculation with cheap money whilst also depriving themselves of any fiscal ammunition (via the ability to lower rates) on the next crash… BUT… If they do raise rates, or do so too quickly, they are likely to trigger the very crash they wish to prepare for…. It may however be too late.