Another Bullish Signal for Silver

News

|

Posted 26/05/2017

|

6218

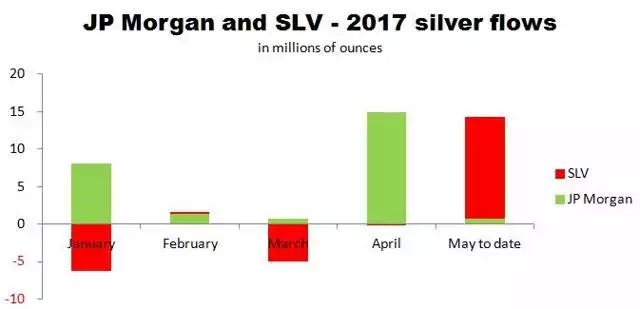

On Tuesday we updated last week’s report on the ‘epic’ set up in futures contracts for gold and silver on COMEX. To say it was bullish is an understatement. But of course paper is only part of the story, there is physical demand as well, and that has been very interesting over the last couple of months too. Two of the biggest players, J P Morgan and the ETF Silver Trust (SLV) have been exceptionally heavy buyers of late. The chart below shows JPMorgan bought no less than 14.9m oz in the month of April alone and SLV 13.5m oz in May.

That these purchases happened after silver’s sizeable correction in April, make it all the more remarkable. They were mopping up when everyone was selling.

We’ve written before of Ted Butler’s (and others) thesis of JP Morgan shorting the market with paper silver (forcing the price down) whilst simultaneously buying up subsequently cheap physical silver. The actions of April’s purchases above and the massive reversal in short reductions on COMEX over the last couple of weeks certainly appears to gel with that thesis. It begs the question, are they about to ‘let her go’?