Ainslie Intelligence, Trading Signals update

News

|

Posted 13/08/2019

|

6529

This week’s Ainslie Intelligence trading signals will be a little different due to some interruptions caused by our office renovations. That aside let's jump into some of our most interesting charts of the last week.

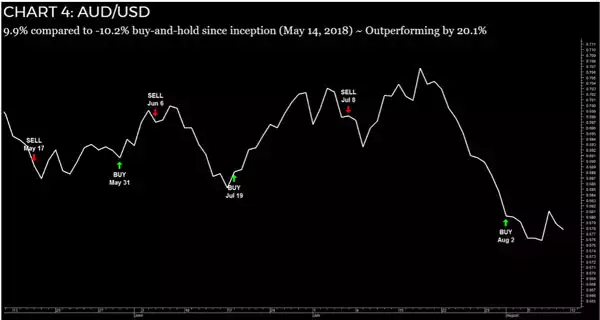

The fears of a no-trade deal between the US and China is leading the global economy towards another recession, the weight of which is having a bitter effect on the AUD. Recent dovish comments from the RBA and the lack of major economic data/events has caused the pair to flatten off over the last week.

The AI placed a buy on August the 2nd and hasn’t flinched since. The AI is currently down 0.4% on the trade but has had a consistent trading record with this pair. Since beginning trading this pair in May last year, we are outperforming a buy and hold strategy by 20.1% using no leverage.

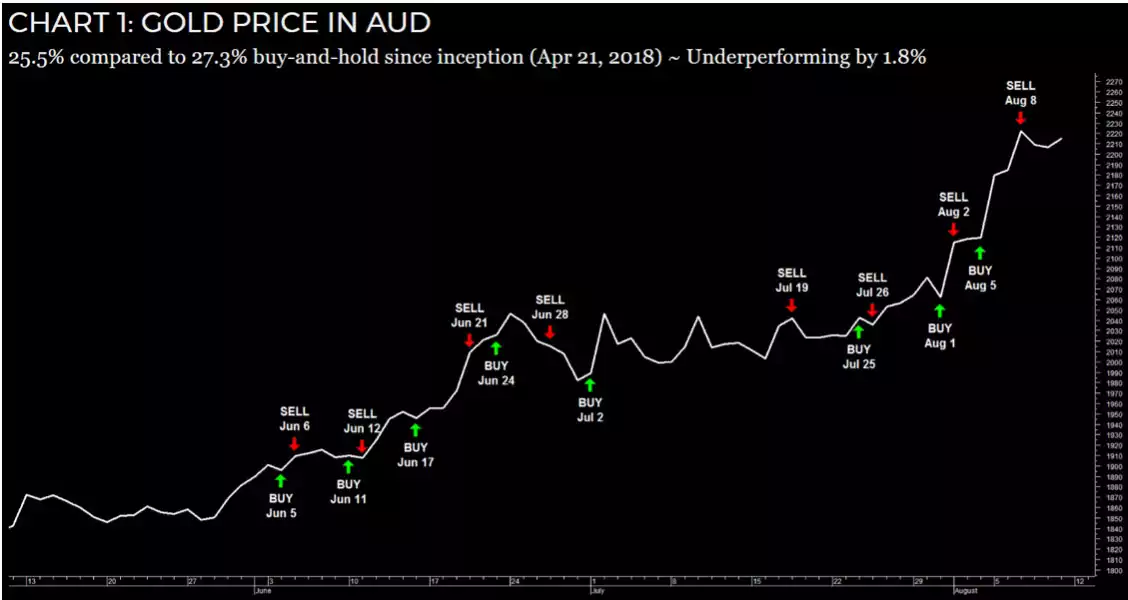

Last week we saw the precious metals markets continue their bullish trending action. Gold is at all-time high levels in Aussie dollars and silver is closing in on breaking through its 2016 highs. Gold is still roughly $400 from breaking its USD all-time-high and while the metal is bullish in USD, the weakness in the Aussie is the primary reason that the metal is continuing to find historic new highs.

Gold could continue to surge in Australian dollar terms as the Reserve Bank of Australia is widely expected to deliver more rate cuts in 2019. Also, the market is beginning to consider the possibility of the RBA eventually hitting the zero lower bound and embarking on unconventional policies like quantitative easing.

The AI has been very impressive considering that it is continuing to find profit in the “unknown” for gold. In the last 2 months, this pair has made 9.5% over 15 trades. The AI has been locking profits in and re-entering buy positions with impressive accuracy as seen on the 5th of August.

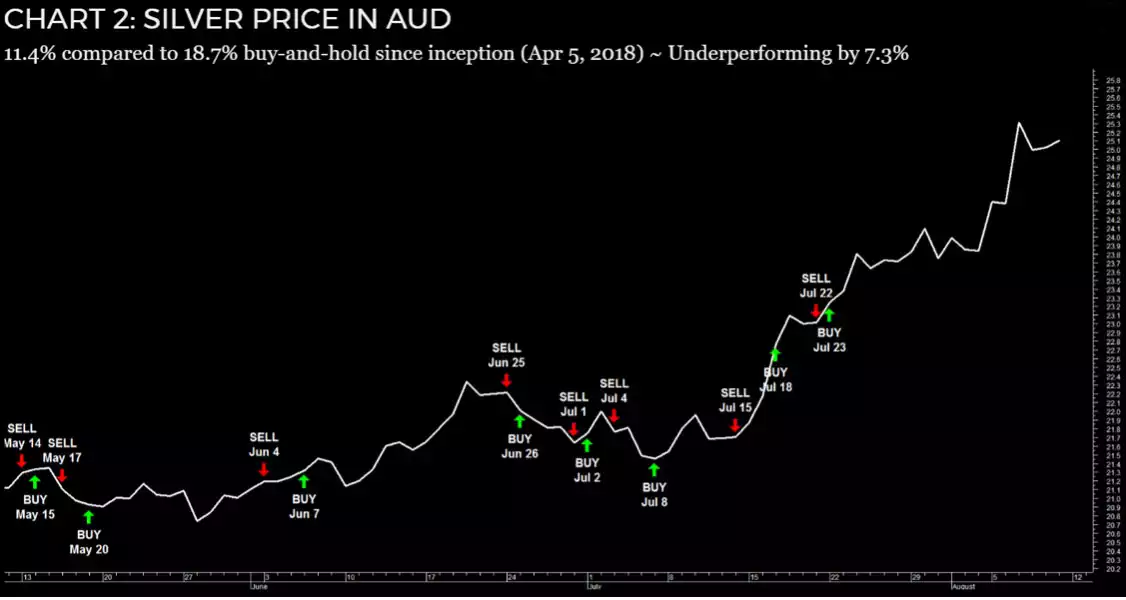

The AI for our Silver price in AUD pair entered a buy on the 23rd of July which it has held since, gaining 8% on the trade so far. We will have to wait and see if the AI locks in the profits from this trade or if it remains confident in the strength of silver.

Without a doubt, precious metals have been a very exciting market to follow this year. But it is important to take a step back and remember that you trade best when you can remain neutral. We continue to lean on the AI’s recommendations during these times to both lock in profits and find opportunities when the market presents them.

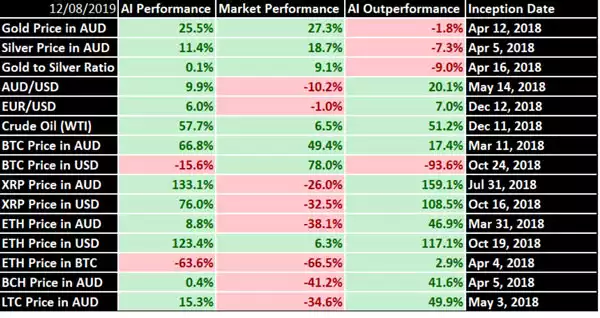

Here are our updated performance figures:

Traditional markets have also been strong performers relative to their complexity. The AI's performance in traditional markets has been commendable when you recognise that they are much larger, resulting in significantly less volatility to take advantage of, yet the returns have still been substantial.

The crypto markets are often our best performers thanks to the characteristically large and volatile price action. We had some excellent results in protecting capital throughout the crypto bear market and have already seen what the AI can do during the bull market of the last few months – just check out our XRP performance!

That’s all for this week, regular videos will return next week. As per usual, our admins are always here to help you sign up and implement Ainslie Intelligence into your trading regimen. Happy trading!

You can subscribe to our AI Signals - ai.ainsliewealth.com.au

Disclaimer:

The information in the report is current as at the date of publication. The report is intended to be used for general informational purposes. It contains general buy/sell recommendations for certain cryptocurrencies, bullion and foreign currencies, which do not take into account any particular circumstances, objectives or situations. Past performance should not be taken as an indication of future outcomes. You should consider obtaining independent advice before making an investment decision.