Ainslie Adds Bitcoin Cash!

News

|

Posted 27/02/2018

|

11242

We are pleased announce the introduction of Bitcoin Cash (BCH) to the Ainslie crypto offer and thus offering you the Top 5 cryptos by market capitalisation (1. BTC $164b 2. ETH $83b 3. XRP $36b 4. BCH $20b 5. LTC $12b)

Bitcoin Cash (BCH) came into existence in August 2017 by way of a hard fork of Bitcoin (BTC). As defined on the BitcoinCash.org website ‘Bitcoin Cash is a peer-to-peer electronic cash for the Internet. It is fully decentralised, with no central bank and requires no trusted third parties to operate.’ The primary motivation behind BCH was solely to carry out more transactions, faster.

At the time of the fork BTC holders received one ‘bonus’ BCH for each BTC they owned. The catch was though to ensure you received the free BCH tokens you needed to hold the private keys for your BTC yourself, in other words, not have the BTC stored on an exchange as some exchanges were not providing the ‘free’ BCH tokens.

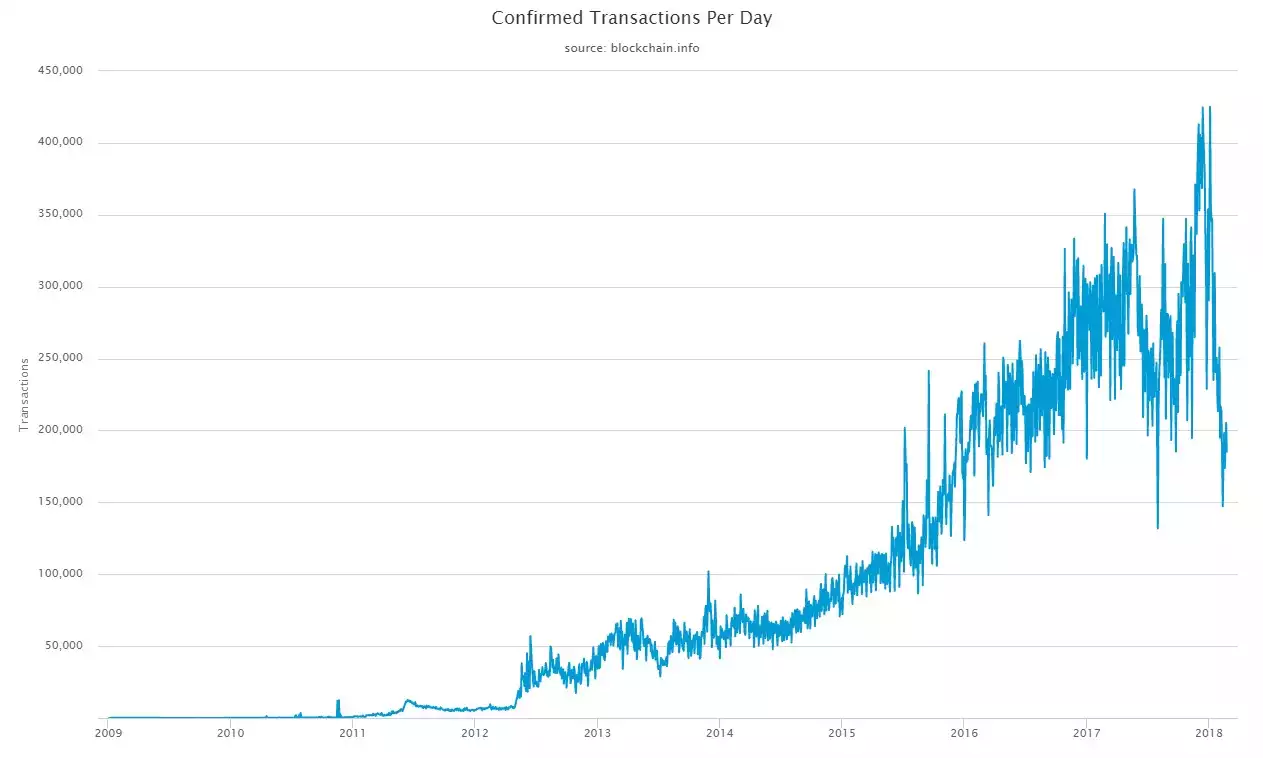

The driving forces behind the creation of Bitcoin Cash were the scaling issues for Bitcoin which resulted in slowing transaction times and increasing fees. Bitcoin currently has a 1mb block size limit meaning that Bitcoin can only handle 4.4 transactions per second. As you can see in the chart below, at its craziest peak in mid December last year there were over 425,000 BTC transactions per day. Users will remember the delays if you didn’t crank up your transfer fees. Bitcoin Cash attempts to overcome these scalability issues principally by increasing the block size to 8MB.

As a side note, you can see just how much transactions have fallen in this latest correction and also how they are already rebounding. If you look at the last big dip on 1 August 2017 (132,000 transactions) the price had a bottom too at just $2710. Is history about to repeat?

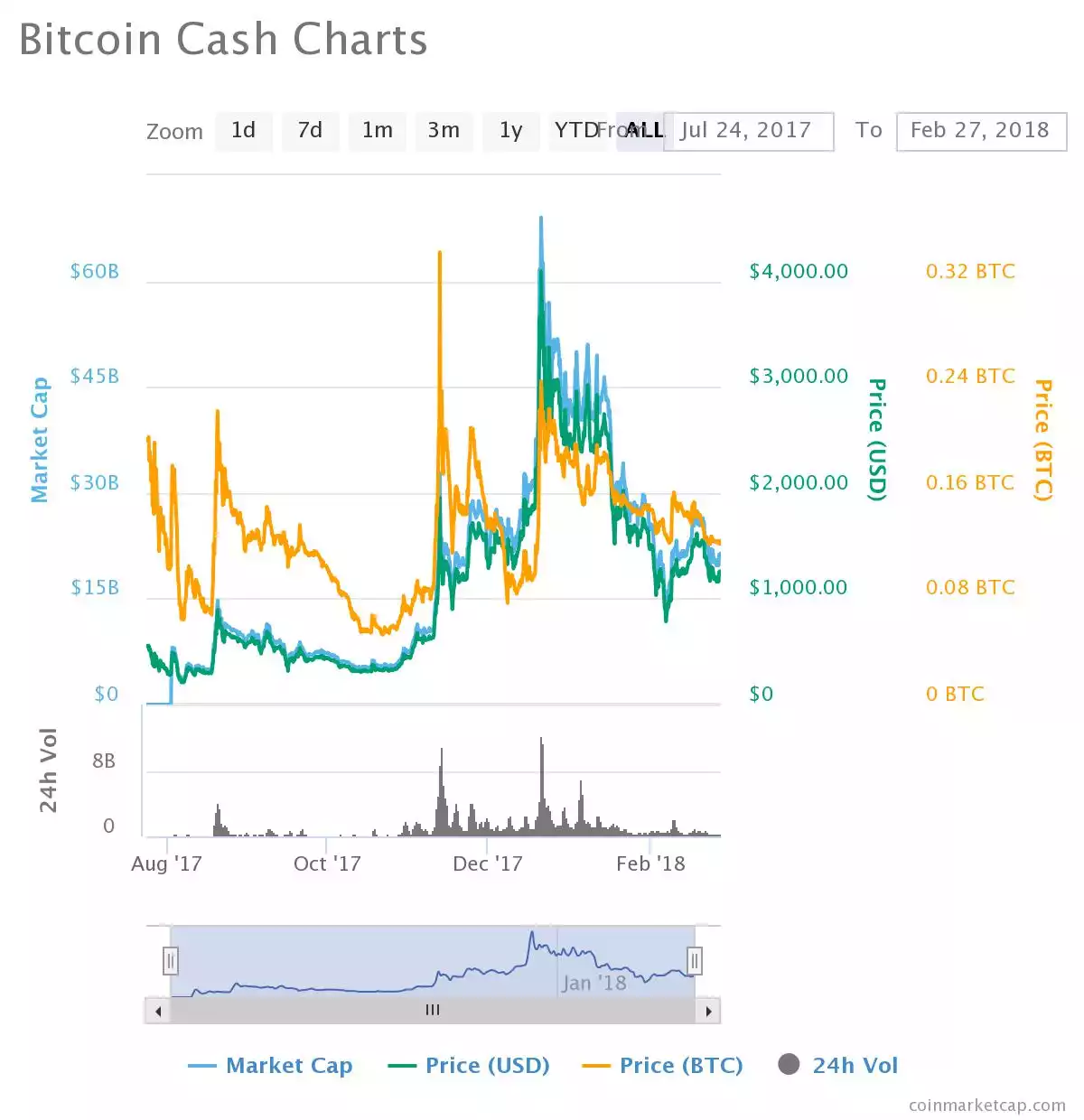

Bitcoin Cash has maintained considerable growth since its inception given the market conditions and is currently sitting at just under AU$1,500 at the time of writing, which is approximately a 2X gain from August 2017. This growth has been fuelled by widespread listings on exchanges and support from wallets which gives the new cryptocurrency credibility and in turn increases its value. Bitcoin Cash’s value has also been bolstered by the increased numbers of miners who have been jumping on board and supporting it.

As with all cryptocurrencies speculation abounds. Will Bitcoin Cash ever overtake Bitcoin and become the primary chain? Only time will tell…

Regardless we have found ourselves where, for now, Bitcoin appears content being the crypto for more serious investment or large transactions by virtue of its unparalleled market cap, history and network effect. Until the Lightning Network and Atomic Swaps are up and running and there is broader adoption of Segwit, Bitcoin will lack the speed and cost effectiveness of Litecoin and Bitcoin Cash and hence maintain their potential as the go-to coins for everyday transactional use and adoption.

As we’ve written many times, the 5 cryptos we sell all are unique and offer something different to the other and hence provide further diversification within your diversification into digital assets.