A Turning Point for Shares?

News

|

Posted 28/07/2015

|

2505

We are seeing a distinct change in 2 of the world’s biggest stock markets that may indicate the easy money game is no longer working.

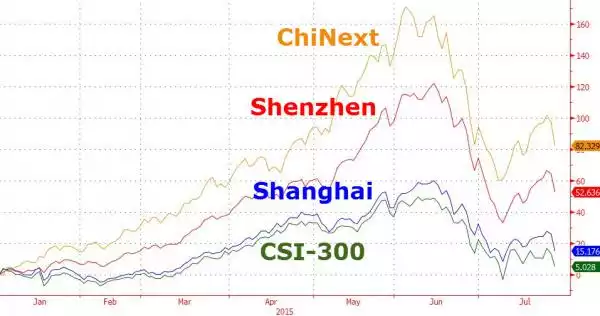

Yesterday right toward the end of trade, the Shanghai Composite plunged nearly 8.5% in its biggest one day drop since the start of the GFC and second biggest in history.

In the US we are seeing the S&P500 break key resistance lines not broken since the post GFC rally began and looking like the formation of a down trend. Note each time prior when there was a downturn it was reversed by the US Fed starting a new round of QE. Funny that now it is happening again they are talking about RAISING rates… the opposite of previous stimulatory responses. What could possibly go wrong?

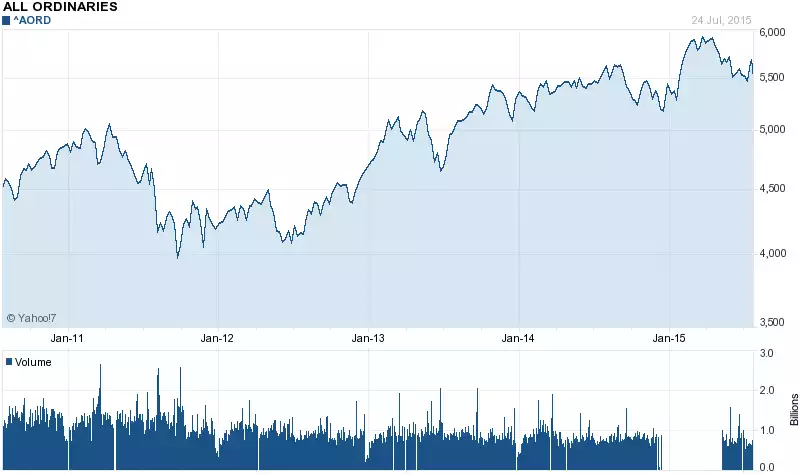

Our Aussie All Ords seems to be on a similar path…

So there appears to be a choice between buying something at or just past its top, or buying something (say, gold and silver) that looks at or near its bottom...