A Bet Each Way… Gold v Hope

News

|

Posted 27/02/2017

|

4230

Regular readers will know we are more than a little bit concerned about how overvalued financial markets appear. The thing is, this hope rally could well continue for a bit longer as long as the Donald talks up tax reform and infrastructure spending. That of course means the inevitable crash afterwards could well be bigger too.

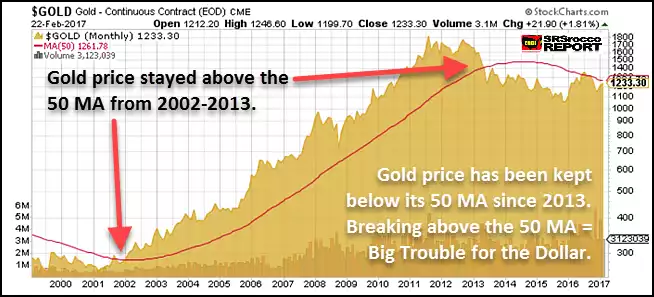

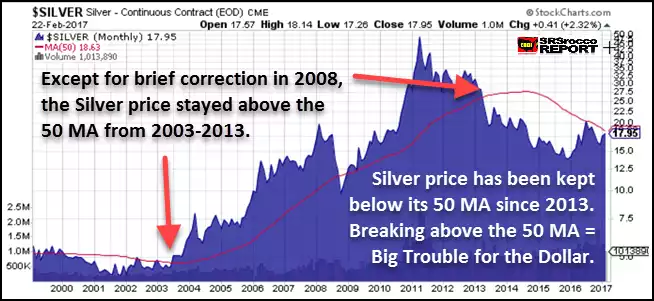

The action in markets looks a little like the herd are having a ‘punt’ on shares but the smart money are keeping their insurance in place at the same time. i.e. shares are at all time highs but safe havens of gold, silver, bonds, and (more recently) the VIX are rising too. Gold and silver are now up 9% and 14% respectively for the year (3% and 8% in AUD), bonds yields are falling, and the S&P500 up 5.7% and our All Ords up just 1.2%. The charts below tell the story, but note that after Friday night’s rally gold is now up to $1258 (just $2 shy of the resistance line of $1260) and silver $18.42, now well and truly smashed through the 50 month MA and 200 day MA. i.e. both are coming off bottoms and look to be breaking out to the upside.

We have also seen US treasury yields dropping (meaning bond prices going up). This chart shows clearly the disconnect of both shares and bonds rising together lately…

Even the counterintuitively low VIX this year has started rising… a sure sign of market unease (note the chart below has the VIX inversed to illustrate the disconnect):

And finally, as regular listeners to our Weekly Wrap will know, this year has been notable in economic data prints out of the US diverging in terms of ‘soft’ data such as sentiment surveys versus ‘hard’ data such as actual orders etc. In this sense the next chart is self explanatory and oh so telling in terms of what is supporting this share rally… hope.