3 More Wise Men

News

|

Posted 16/01/2017

|

5852

Good morning and a happy new year to our readers. As our last news article of 2016 focused on the year that was, today we look ahead at the year that will be. To do this, we follow our 3 Wise Men theme from November’s Future Proof Portfolio seminar and provide some insight from another 3 wise men delivered over the break.

The first is market cycle researcher and former Goldman Sachs employee Charles Nenner. In an interview released just yesterday, Charles comments on the Trump rally which has seen strong gains since the US election. Although Charles doesn’t see a sell signal yet in the equity markets, he is not taking on any new long positions as he is not seeing much more upside potential. This is an idea supported by the this morning’s AFR headline “Wall Street's faith that US President-elect Donald Trump's promised fiscal stimulus will spur growth and inflation is showing signs of flagging”. Two possible exceptions are the energy sector given an anticipated upside breakout in crude and consumer staples which he considers oversold. Broadly however, Charles is bearish because he sees most of the good news surrounding the anticipated fiscal changes in the US as being already priced into markets. Charles is “totally out of bonds” citing that most brokers who made a career in the bond bull market have never seen a bond bear market which he believes we’ve arrived at.

Furthermore, Charles sees interest rates rising in 2017 but not substantially. He sees emerging markets doing badly, Europe struggling and the USD topping. Based on his work in cycles, he is expecting a significant market pullback in the latter half of 2017 claiming that “the whole bottom is going to fall out” and says that it is likely to be “a drawn out affair”. Regarding gold, Charles sees prices rising albeit slowly, concluding that the low appears to have passed. “It’s a good idea” to hold physical gold and silver. In his closing words, Charles expresses sympathy for Trump as his inauguration coincides with a negative cycle and “those don’t usually work out too well”.

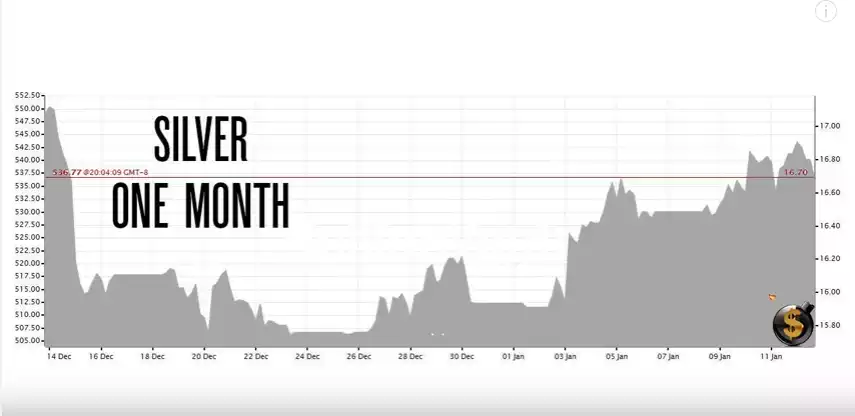

Next we hear from Jeff Berwick of The Dollar Vigilante who has released a nice summary of 2017 to date. He notes that Bitcoin stole the headlines in the first week of 2017, gaining nearly $200 in the first 2 days of year before giving back those gains and more since. Gold and silver however have been performing nicely with gold starting the year at $1154 and rising to exceed $1200 recently. Silver has been similar, starting at $15.93 and coming close to hitting $17 since. Jeff reminds us that gold rose against all fiat currencies in 2016; rising 9% against the USD, 13% against the Euro and 31.5% against GBP, continuing its bull run from 2002 with only 2 down years in the last 15.

Jeff points out that gold’s rise in 2017 is somewhat correlated with the rise seen at the start of 2016 as pictured below. From the first day of 2016, gold and silver rocketed higher. Gold didn’t stop rising until it hit nearly $1400 in July. Jeff suspects that we may be looking at a repeat of that performance this year but given the geopolitics at play currently, he doesn’t see reason for the second half pullback experienced last year.

Lastly, we bring you commentary from Bill Holter who writes for JSMineSet in collaboration with Jim Sinclair. Bill’s first two articles of the year discuss the theme “2017: The year of the truth bomb”. In an interview released on January 7th, Bill states that “the hologram that we’ve been living will end and the curtain will be pulled back”; referring in part to the Wikileaks revelations of late and the ultimate end to the relentless accumulation of debt required for current living standards. Bill suspects that Trump will preside over a bankruptcy stating that “credit is going to seize up, the US is broke, there’s nothing left unencumbered”. He goes on to say that “one man’s debt is another man’s asset. If the liability can’t be paid then on the other side of the balance sheet the assets have to be marked down”; a scenario not applicable to physical gold and silver. Credit will be a big theme this year according to Bill and “you’re already seeing the starting rumbles of it”. Bill reminds us that “the world turns on credit” and when credit dries up, he predicts an asset price pullback as a result of debt side collapses.

In summary, there are many voices sounding warnings for the landscape in 2017 and with credit and counterparty risk identified as significant themes, diversification into physical assets makes sense now as much as ever.