2020 Wrap and 2021 Forecast

News

|

Posted 23/12/2020

|

21519

Let us join the chorus of “what a year!”. However, in a year of personal hardship, there has been some great gains for investors in precious metals and crytpocurrencies and the response by governments and central banks around the world has set us up for a very bullish outlook for both.

So lets look at how everything performed over the year:

Gold +15%

Silver +32%

Platinum -3%

Bitcoin +205%

Ethereum +357%

ASX200 -1.3%

S&P500 +14%

MSCI global +13%

As we know all too well, the 1 Jan to 23 Dec figures these represent don’t tell the full story of a rollercoaster in between. From that crash in March, the liquidity squeeze that saw EVERYTHING sold off barring the USD and then the unprecedented tsunami of freshly printed money, nay, currency injected into the global economy we then saw the dual trade of ‘this can only end badly’ into precious metals and crypto and ‘this free money is awesome, this time is different’ into shares.

So, the million dollar question is, where are we at and where are we going? Again, we have two distinct camps for 2021 with vaccine the big determinant. In one camp we have the ‘vaccine will fix everything’ proponents who are piling into shares despite sky high valuations on the hope a post vaccine rebound will be so incredibly strong as to somehow see earnings outperform share price AND the share price climb even further. On the other we have those who say the second/third waves, now exacerbated by the new mutations, and the speed of getting the vaccine to billions around the world don’t align, the damage will be done before enough are vaccinated and moreover, the damage is ALREADY done through the sheer amount of currency and debt added to the system, i.e. point of no return.

If we look at where we are now in terms of the charts and technical analysis firstly with Raoul Pal for Macro Insiders who just published his following views:

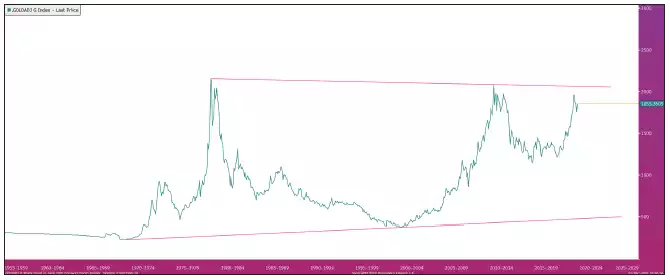

“We can buy when gold breaks this down channel... any day now...”

“And you can see how important this level is when you look at the long-term chart of gold in inflation-adjusted terms... this is a HUGE pattern and is suggestive of gold doubling or tripling from here...”

By way of explanation for the above, Pal is talking to a so called ‘cup and handle formation’ which in technical analysis is where a profit target is derived by measuring between the bottom of the ‘cup’ and the pattern’s breakout level, and then extending that amount up from the breakout. On the chart above that means around $3,500 but the momentum and fundamentals discussed above mean that could easily translate to a 2x or 3x from the current level.

Incidentally, an early thesis theme for Pal in 2021 is a strong Emerging Markets performance. If correct (as he was for bonds to end of 2019 and bitcoin in 2020) that is very constructive for gold as well. Many of the largest EM’s have a cultural affinity for gold as a store of wealth and it looks like more wealth is coming their way to convert. At the central bank level too they are underweight gold (5%) compared to their western counterparts (15%) and so we may see more central bank buying as their economies grow.

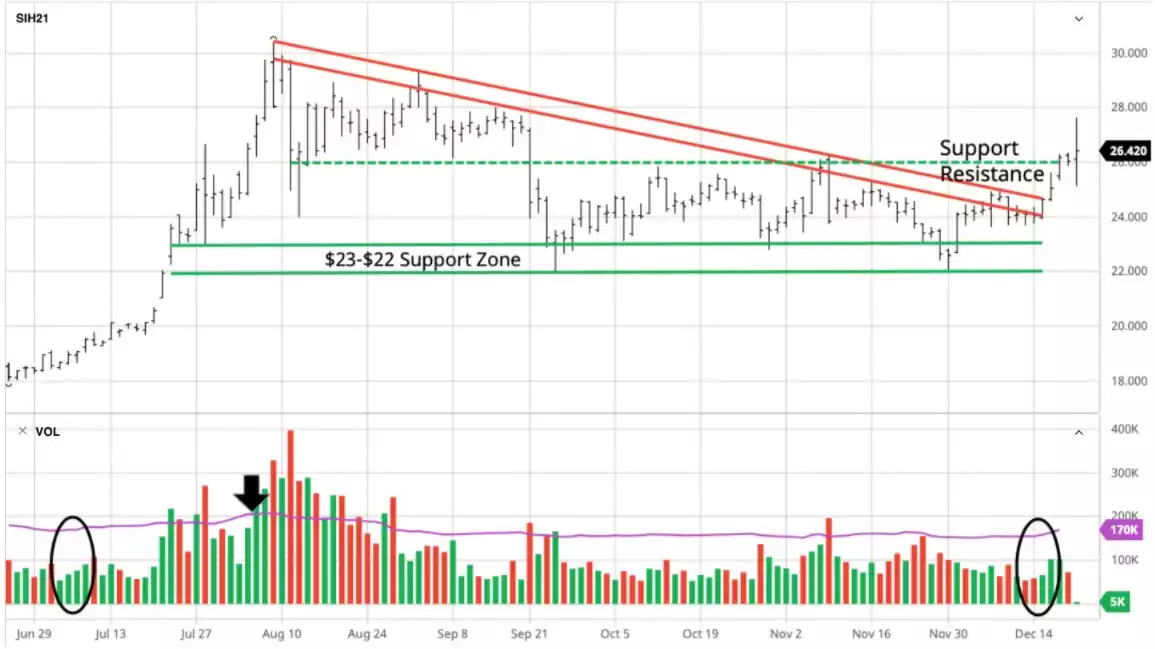

For silver the story is similar but with the added tailwinds due in 2021 of a growing agenda of tying stimulus to environmental initiatives of which solar is sure to benefit. As James Turk just tweeted, silver has already broken through this month, putting it potentially ahead of gold for now:

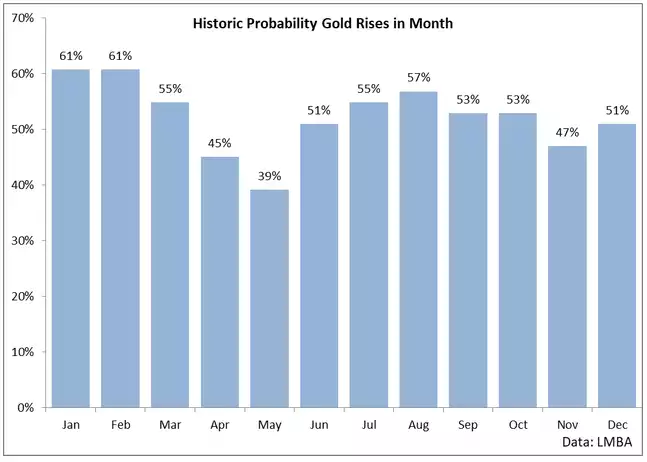

Seasonally too we should see some continued support for gold and silver as the early months are generally the more profitable. That said, strong macro forces will always overcome ‘business as usual’ seasonality.

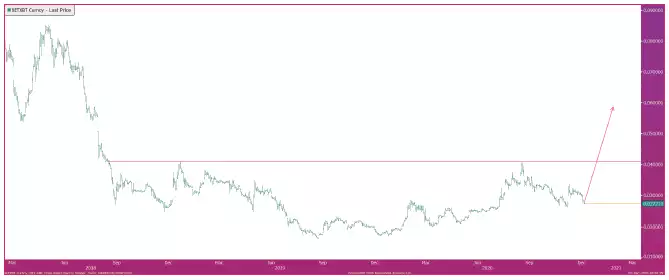

Of course as you can see from the figures above, the big performers of the year were Bitcoin and Ethereum. Pal was pounding the table throughout the year to buy Bitcoin and it was a masterful call. In terms of 2021 he now sees Ethereum potentially outperforming BTC.

“In crypto-land, I think that it’s possible that over 2021, ETH will outperform Bitcoin. The pattern seems like a clear rounded bottom and inverse head-and-shoulders. It needs to break higher to confirm, which it has not yet done.”

Pal warns that after such an incredible run, we should not be surprised by a large correction in BTC at some stage. The trigger could well be a crash in the US sharemarket. That said, any correction he simply sees as an opportunity to buy more and he is not selling any in anticipation. It is a buy and hold strategy seeing dips only as buying opps.

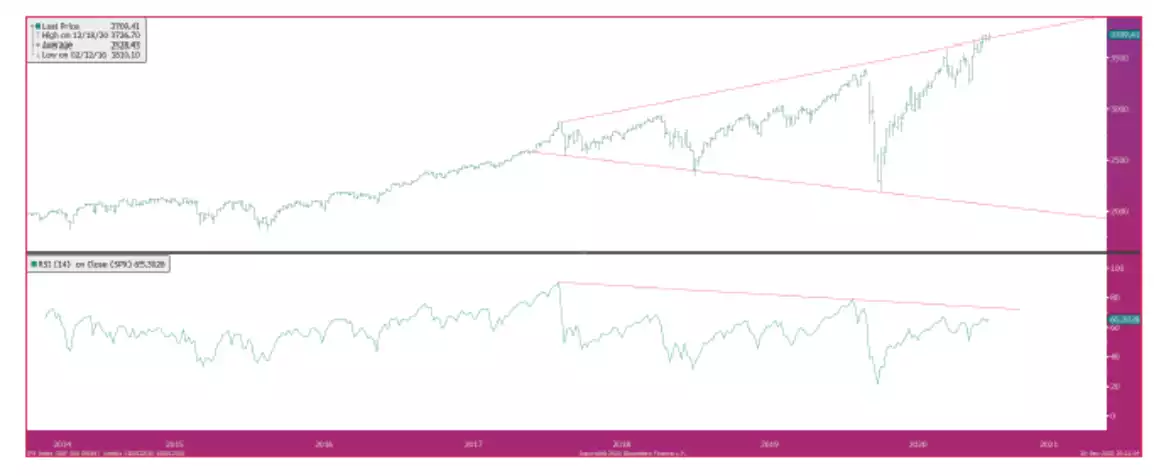

And so, the big question of course is what are these hyperinflated US sharemarkets going to do? Pal and most are reluctant to put any timeframe on this as it is not a natural market and hence hard to pick. He does however share the charts below which paint a very clear picture of a big correction due now-ish…

2020 is a year most are looking forward to seeing in the rear view mirror. There is a lot of hope that 2021 will somehow wash away all the pain of 2020. In terms of our collective health and wellbeing we certainly hope that is the case.

Whilst the injection of a vaccine is at the centre of that hope we cannot and should not ignore the fact that the global economy has been given injections of the economic equivalent of heroin all year in portion sizes never before seen in all history. It is completely unrealistic for us to expect the junky to instantly come clean and without any pain.

2020 saw a very mixed bag of financial fortunes depending on how you were invested. 2021 promises the same because of the very responses from governments and central banks alike.

We want to take this opportunity to thank all our readers and customers for your support throughout the year. We thank you for your patience when things got pretty silly there in March and April. We are expanding our office over the break to ensure we can more quickly meet your needs in times of extreme demand. Next year will see us also add a sub $5000 quick service window to an expanded waiting room as well.

Our Gold Standard (AUS) and Silver Standard (AGS) tokens have outsold all others on Australian exchanges this year and as we notified earlier we are improving the contract and legal construct on 13 January to remove all transfer fees and to make ownership of the metal direct (as opposed to the current option arrangement). We have greatly streamlined the contract, keeping it ERC-20 compliant and also ETH2.0 ready meaning they will be perfect for DeFi use as well.

Finally, we want to wish you and yours a wonderful festive season, hopefully a relaxing break after this tumultuous year, and a very prosperous and safe 2021.

This is the last news for the year and we will recommence in mid January.