2000 Years of Economic History

News

|

Posted 13/09/2017

|

7132

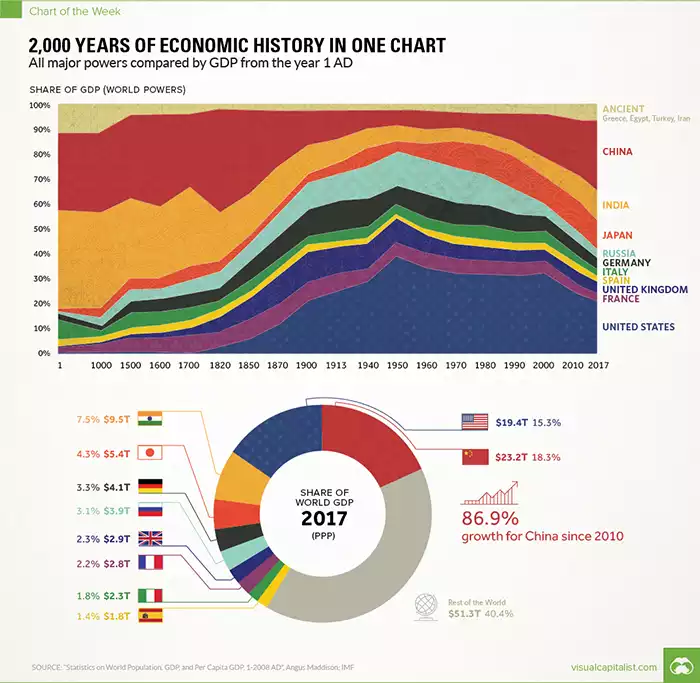

The good folk at Visual Capitalist have come up with another intriguing graphic putting things into perspective. Below is a representation of the share of GDP around the world over 2000 years and a more in depth breakdown for this year. Before you look, please note a couple of things, the X axis is non linear which in large part if due to the scarcity of data for the much older periods. Secondly you will note in the breakout below that China has a higher GDP than the US? Note the PPP in brackets under 2017. PPP, or Purchasing Power Parity, is another way of measuring GDP where the gross figure is normalised between countries based on a basket of goods available in each. It recognises that you can buy far more in say China or India for the same USD as you can in the US, and hence the GDP figure has a different ‘power’ in that economy. It levels the playing field.

The key takeaway for us is the resurgence of the ancient heavy hitters of China and India since around mid last century. China and India are the world’s 2 biggest gold consumers and they are also the fastest growing. Check out the little sub-graph showing the growth rate of China since 2010! That bodes incredibly well for gold demand. So why is this happening? The Visual Capitalist guys explain:

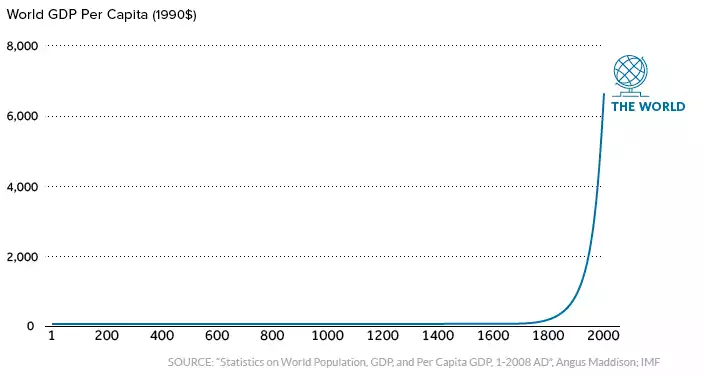

“But there’s one other story that ties it all together: the exponential rate of human economic growth that occurred over the last century.

For thousands of years, economic progress was largely linear and linked to population growth. Without machines or technological innovations, one person could only produce so much with their time and resources.

More recently, innovations in technology and energy allowed the “hockey stick” effect to come into play.

It happened in Western Europe and North America first, and now it’s happening in other parts of the world. As this technological playing field evens, economies like China and India – traditionally some of the largest economies throughout history – are now making their big comeback.”