2 Quotes – 1 inevitable outcome

News

|

Posted 01/03/2019

|

6869

If you want a little insight into why we find ourselves in this current economic trap lets just look at 2 quotes. One is from a previous Chair of the US Federal Reserve, and one from the current.

Firstly, last night on CNBC ex Chair of the US Fed Ben Bernanke said:

"What I'm saying in the simplest possible terms is that Congress can pass any budget and the Fed will monetize it"

You see, the current debt ceiling is going to be reached very soon and then they will again run out of accounting tricks in about June so yet again, the risk of a shutdown. Bernanke says not to worry about such trivialities as budgets, deficits and living within one’s means; just print more money because we are the world’s reserve currency and the US Fed is in control of the printing presses.

Now this is what the current Chair of the US Fed, Jerome Powell told the US Senate Banking Committee:

“The U.S. federal government is on an unsustainable fiscal path……debt as a percentage of GDP is growing, and now growing sharply... And that is unsustainable by definition.”

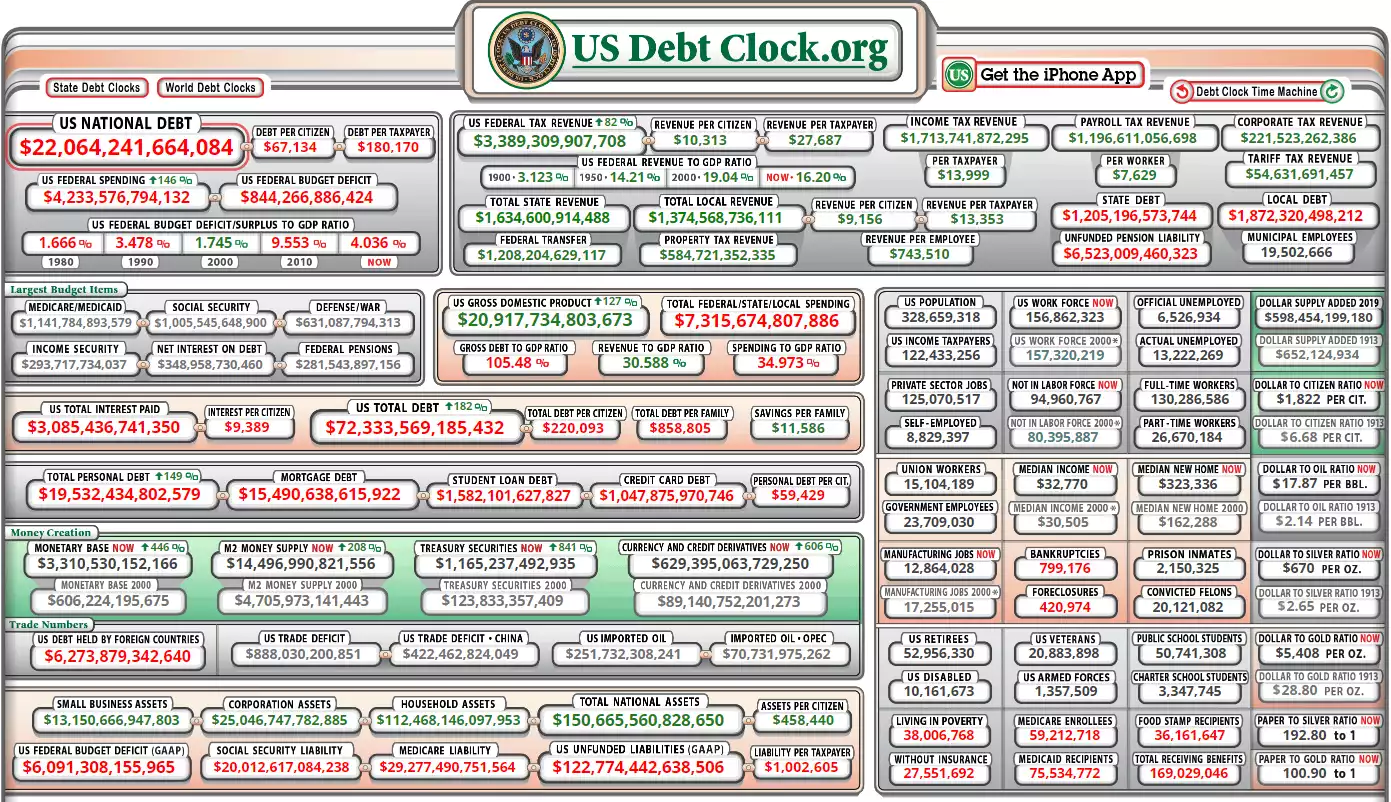

As a reminder, at the current $22 trillion of government debt on the books (and remember there is around $123 trillion of unfunded liabilities not on that balance sheet) the US has a debt to GDP of 105%. That’s up from just 82% before the post GFC spending spree. If ever you want to get a complete picture of the US fiscal mess visit www.usdebtclock.org . Below is a snapshot at the time of writing this:

However whilst Powell warns of the problem he was clear in stating it was not the Fed’s problem to fix. ‘Fix’ is the operative word here. Bernanke outlined how the Fed could ‘accommodate’ the problem, not ‘fix’ the problem. Powell said:

“We need to stabilize debt to GDP. The timing the doing that, the ways of doing it —through revenue, through spending — all of those things are not for the Fed to decide.”

i.e. the problem rests with our politicians, the US Congress in this instance but this is a common issue all around the world. Just note the money about to be splashed about in the lead up to our next election (we discussed the property side of this on Monday).

The next problem is that politicians run relatively short, finite terms in office (after that, it’s not their problem). They want to maximise those terms and so need to stay popular with enough people to get re-elected. We therefore get the rise of the socialist movement as evidenced in the US through Bernie Sanders (presidential runner 2020) and the meteoric rising star of Alexandria Ocasio-Cortez (affectionately known as AOC). Their policies are maybe best summarised in the following ‘info-graphic’….

So the spending won’t stop. Indeed the future ALREADY COMMITTED spending (the unfunded liabilities referred to earlier) isn’t even being accounted for in the US.

So that leaves the growing popularity (amongst more voters) of a so called ‘wealth tax’. The IMF proposed a 10% tax on the net wealth of individuals to capture the wealthy without affecting the less well off. 2020 Presidential runner Senator Elizabeth Warren has proposed a "wealth tax" on Americans with more than $50 million in assets, AOC is proposing a 70% marginal rate on income above $10m, and the list goes on.

However Graham Summers of Phoenix Capital Research states that if you taxed the top 1% at 100% you’d only pay less than 6 months of current deficits.

History shows there is no magic solution to currency debasement and excess debt. History is littered with so called ‘resets’. Man and our greed simply can’t be trusted with a fiat currency not backed (i.e. constrained) by gold. History also shows that one form of money prevails each time… precious metals.