19 Millionth BTC Mined – How Far Have We Come?

News

|

Posted 05/04/2022

|

7764

As the 19 millionth bitcoin is mined, several large public buyers have sparked renewed interest in Bitcoin as pristine collateral. Shrimps and Whales are leading widespread coin accumulation, alongside the Luna Foundation Guard who added over 21k BTC to their balance in nine days.

It has been an eventful week in the Bitcoin market, with an uptick in large public buyers such as MicroStrategy, and the Luna Foundation Guard, announcing, or completing significant Bitcoin purchases. With Bitcoin having a deterministic supply schedule and ultimate supply hard-cap, these events represent yet another step towards Bitcoin being perceived by the market as a form of pristine collateral.

The perception and utilisation of Bitcoin as a form of financial collateral has been a steadily growing trend and continues to span into new applications and use-cases. The Luna Foundation Guard (LFG) was a dominant buyer throughout last week, with the ultimate intention to use accumulated BTC as a backstop for the UST algorithmic stable coin. In addition, inflows into wrapped WBTC, Canadian ETFs, and general investor accumulation on-chain has been historically strong, especially following the local price lows set on 22-January.

The following factors are significant drivers of the market presently;

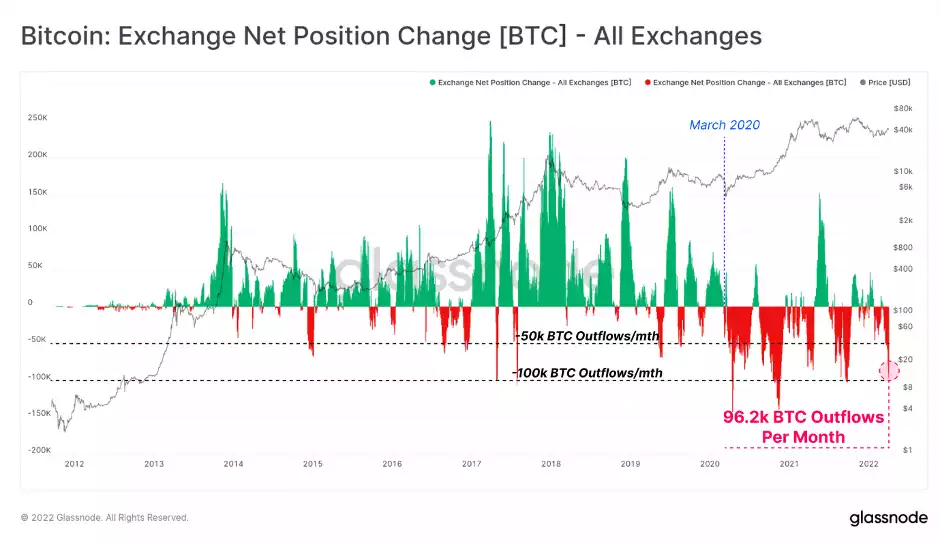

- Exchanges continue to see significant net coin outflows, with aggregate exchange balances hitting multi-year lows. BTC is flowing out of exchanges at a rate of over 96k BTC/month, signalling historically strong accumulation is taking place.

- Accumulation is being driven by Shrimps (<1 BTC) and Whales (>1k BTC), both of whom have added significantly to their balances over recent weeks.

- Large scale accumulation by the Luna Foundation Guard has taken place, with an increase of total holdings by 21,163 BTC (over $1.3b worth!) over the last 9-days. Additionally, the total supply of wrapped Bitcoin on Ethereum (WBTC) has grown by 12.5k BTC showing a continuous demand for BTC as collateral in DeFi products.

- Coins have continued to flow into Canadian Bitcoin ETF products, with total holdings increasing by 6,594 BTC since 22-Jan This is a 10.5% growth in coin holdings, despite the plethora of macro and geopolitical risks and headwinds that are in play.

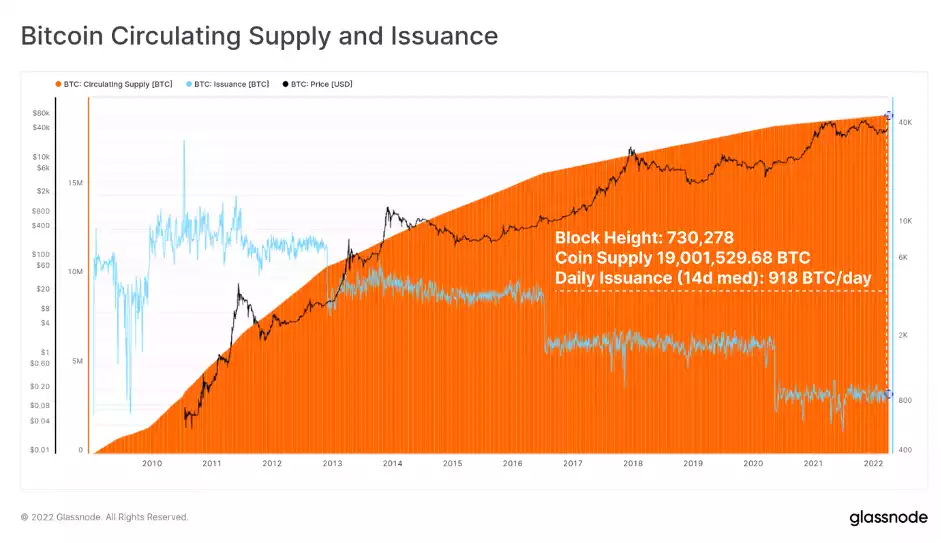

This week the total Bitcoin supply reached the 19-millionth coin mined, leaving less than 9.52% of the final 21M supply left to be mined over the next ~118 years.

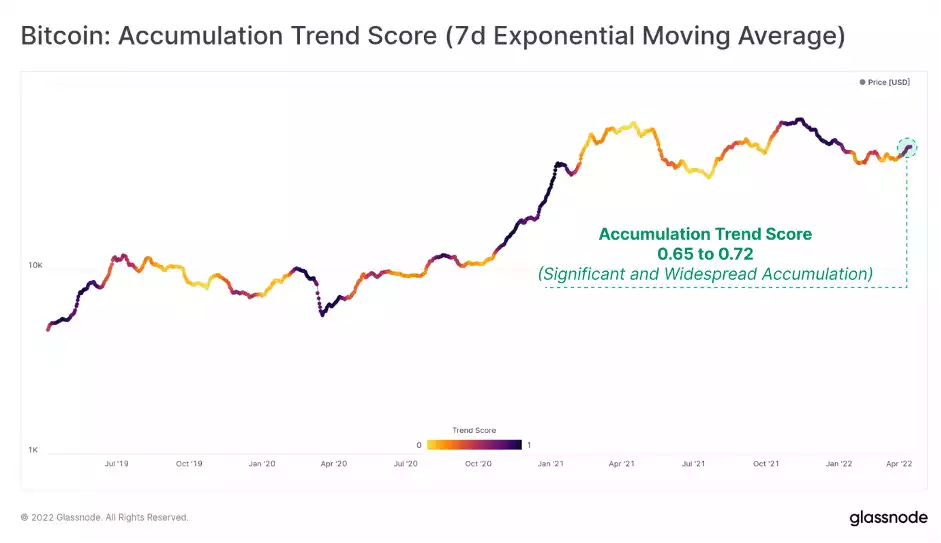

It has been a particularly impressive week for BTC accumulation trends, with both discrete public buyers, and the wider market adding to their balances.

The Accumulation Trend Score tracks the relative on-chain balance change of the market at large. Values closer to 1 (purple) indicate that whales and/or a large proportion of market entities are adding significantly to their balances. This week returned a consistent stream of values upwards of 0.65, which indicates a general trend of accumulation is underway.

We can see that exchange balances have also experienced a historically significant period of BTC outflows in response, reaching an outflow rate of 96.2k BTC/month. Outflows of this magnitude are uncommon, having happened on only several occasions throughout history.

A very noticeable transition from net inflows (green), into a regime of dominant outflows (red) remains in play, a trend that started immediately following the March 2020 market crash.

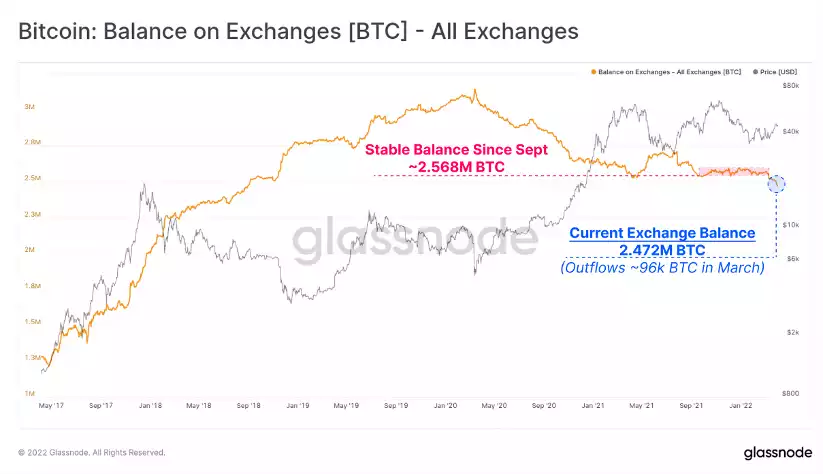

The impact of such a sustained, and high magnitude of BTC outflows is that the total balance held on exchanges has proceeded to multi-year lows. Throughout March, over 96k BTC flowed out of the exchanges we track, reaching levels last seen in August 2018. Note that this represents a notable break downwards from the generally sideways plateau in exchange balances that was established in September 2021.

To conclude, the Bitcoin market has seen several weeks of historically strong accumulation, which has been fairly widespread concerning participation across wallet cohorts. Shrimp and Whales are the most aggressive accumulators of late, with several large public buyers such as LFG and MicroStrategy adding renewed emphasis on Bitcoin as pristine collateral.

What is most impressive is the general increase in Bitcoin demand across ETF products available in Canada, despite the plethora of headwinds such as the conflict in Ukraine, commodity price rises and shortages, and tightening monetary conditions.

In general, the market appears to be viewing Bitcoin and its role in the future economy with a somewhat renewed optimism. This is most clearly reflected in the net trend of outflows from exchanges, and into self or assisted custody (like our Ainslie Cold Storage), a trend that started immediately following the March 2020 liquidity crisis.

With the 19 millionth coin now mined, and general accumulation exceeding daily issuance by many multiples, the scarcity and pristine nature of Bitcoin as collateral may well be returning to the foreground once again.