100% to Lose Money – Our Special K Setup

News

|

Posted 02/12/2020

|

7061

This recession, and the journey out of it, is increasingly being referred to as a K shape as many acknowledge the V just isn’t happening for many. The K is also playing out in investors expectations as well. Normally shares and precious metals tend to be uncorrelated and indeed often negatively correlated. Its what make precious metals such a perfect balancing asset in a portfolio heavy in equities as many are (whether you know it or not… ala your managed super for instance). However of late we have seen growing instances of a highly positive correlation as we saw last night where the S&P500 was up 1.1%, NASDAQ up 1.3%, gold up 2.2% and silver up 6%. Platinum continued its month long climb, up another 3.7% and cracking the US$1000 mark for the first time since August. Blind Freddy can see this is a market torn between playing momentum and stimulus versus safe havens and hard assets. Not coincidentally Bitcoin also surged to a new all time high (almost touching US$20,000) last night too before a healthy correction this morning.

One only needs to look at the mix of headlines to get further insight into this Jekyll and Hyde financial setup. Arguably the driver of the equities market was whispers of maybe a compromise relief package maybe being considered by both sides of Congress… maybe. And then to add some balance to said whispers, US Fed chair Powell in testimony before Congress said:

"Recent news on the vaccine front is very positive for the medium term,", however "significant challenges and uncertainties remain, including timing, production and distribution, and efficacy across different groups." and therefore "the outlook for the economy is extraordinarily uncertain and will depend, in large part, on the success of efforts to keep the virus in check." and while economic activity "has continued to recover from its depressed second-quarter level" in recent months "the pace of improvement has moderated".

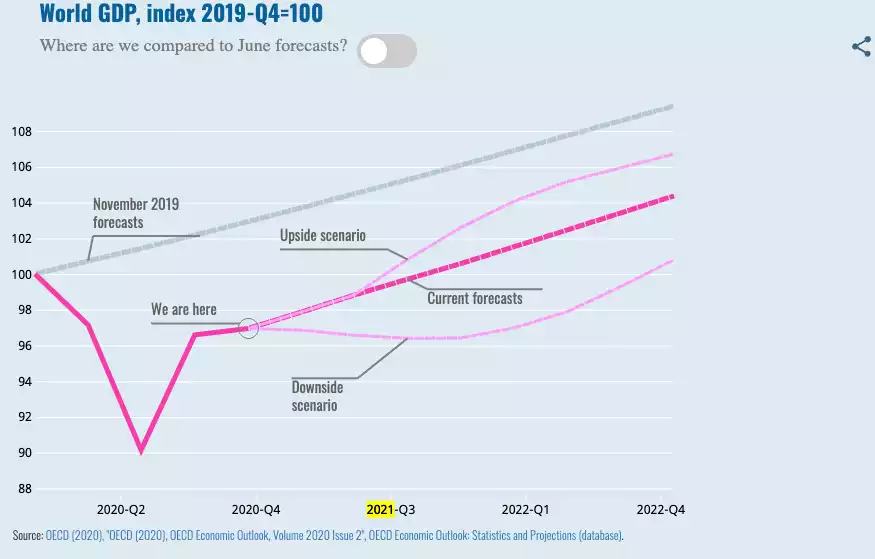

Looking beyond the US, last night the OECD released their latest Economic Outlook, slashing their previous 2021 forecast due to continued social distancing and lockdown impacts.

However a very large contributor to this figure is the assumption of a continuing 8% GDP surge from the word’s second biggest economy, China.

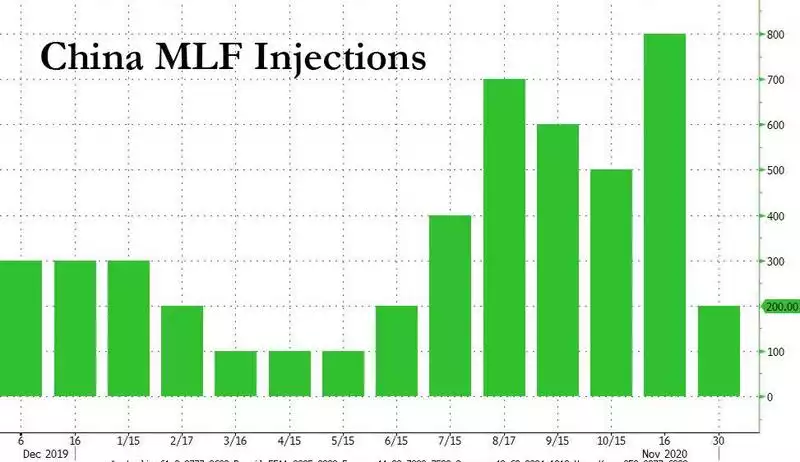

Now China is a famously opaque state controlled ‘enterprise’ that no one really knows the validity of the data it produces. In a move seemingly quite contradictory to these growth figures is news yesterday of another US$30billion of liquidity injection via a Medium-term Lending Facility (MLF) of Y200b from their PBOC central bank. This is not an isolated move either as you can see below:

Rabobank’s Michael Every raises the obvious question:

“China’s economy continues to power ahead, with bumper net exports and capital inflows and industrial profits all being recorded: and yet the PBOC just had to inject CNY200bn (USD30bn) in MLF a month ahead of the end of the year to ease liquidity tightness, and that on the back of CNY800bn two weeks ago. Yes, this is gross not net: but why the need for so much PBOC help when everything is going so well? Perhaps because Chinese banks are still trying to repay CNY3.7 trillion [US$563 billion] of short-term interbank debt and purchase CNY1 trillion [US$152billion] of government bonds and repay maturing MLF injections,…and are worrying about SOE [State Owned Enterprise] bond defaults.”

There are also growing concerns about the health of their credit market as Bloomberg reports today:

“Demand for Chinese debt is falling amid investor concern over a string of defaults by state firms and the pressure of U.S. sanctions on some of the nation’s firms.”

If you strip back China’s growth the impacts on the global forecast are huge. Again, as with the K recovery, we have very conflicting signals at a global level.

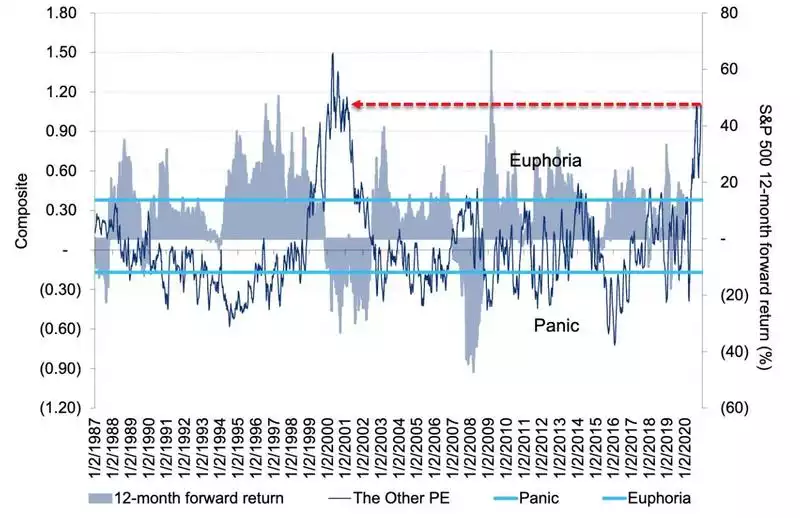

And so, whilst many will continue to play the equities casino either actively, or more likely as part of the massive momentum following passive fund market, the smart money, as evidenced by the massive insider shares selling last month, is rotating to hard assets like gold, silver and platinum and now Bitcoin too. Some will follow the market ‘knowing’ that markets can be ‘irrationally exuberant’ for longer than most predict. However history says we are at levels of blind faith euphoria not seen since the dot.com bubble. CitiBank’s Panic-Euphoria model lays that out very clearly below:

According to them “Current euphoric readings signal a 100% probability of losing money in the coming 12 months if we study historical patterns – indeed, we saw such levels back in early September as well right before a selloff in stocks.”

100% isn’t great odds…

Gold and silver have a track record of 5000 years of preserving wealth through economic turmoil.

Take your pick.