US Stocks Have COVID & Our Immunity is in Recession

News

|

Posted 03/09/2020

|

6679

US Stocks Have COVID & Our Immunity is in Recession

Yesterday you will have seen the news of Australia plunging to its worst GDP fall on record and officially entering its first recession in 29 years. Nothing speaks to the insanity of markets more than the fact that Aussie shares rallied solidly and not because it was better than expected, it was worse. Overnight the US sharemarket hit an important historic milestone and the 2 aren’t divorced.

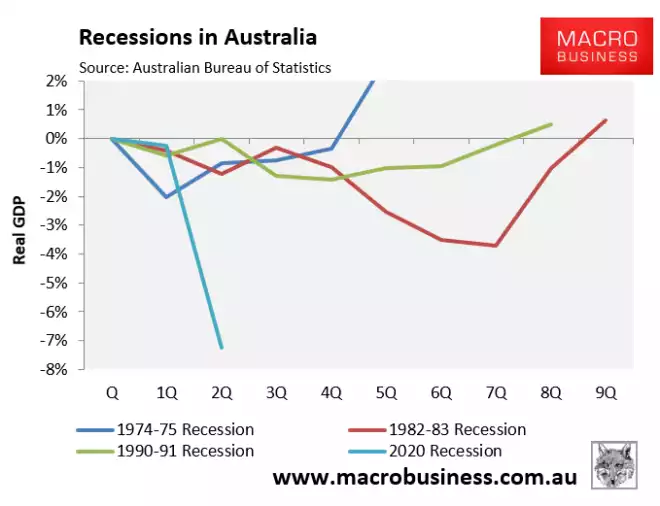

But first, if you somehow missed the local news, here it is in a snapshot:

- GDP for the quarter fell 7% after the -0.3% last quarter, and 100pts worse than the 6% expected

- Year on year GDP plunged 6.3%, compared to 5.1% expected.

- Household spending -- which accounts for about 56% of the economy -- slumped 12.1%, subtracting 6.7% points from GDP

- Government spending rose 2.9%, adding 0.6% - social assistance benefits rose 41.6%

- Investment in new and used dwellings fell 7.3% in the quarter

- Net exports contributed 1% to GDP

- The savings rate soared to 19.8%, the highest rate since 1974

Graphically, you can see how it compares to previous recessions since the 70’s:

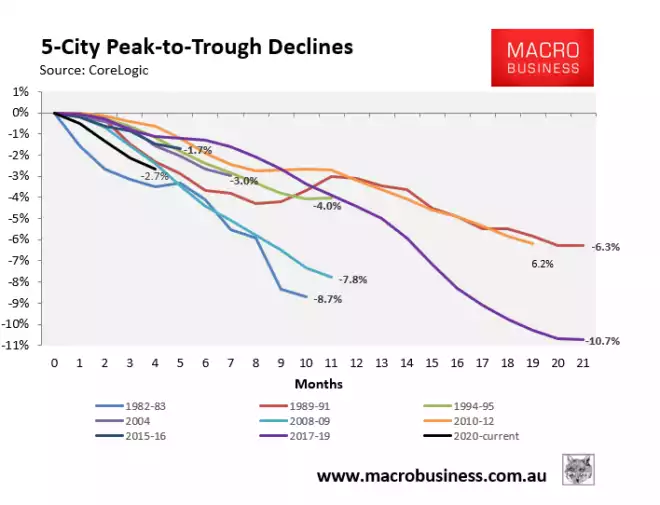

The question at large is ‘where to from here’ and that is crystal ball stuff. Victoria is 25% of the nation’s economy and it is struggling in lockdown whilst other states are seeing a bounce back in growth, albeit anecdotal at this stage and not likely enough. At large too is the effects of border closures and tourism, put at a $33b impact yesterday as the ‘clean’ premiers ignore the PM’s calls to open up their borders and save the economy. None look like budging. The other elephant openly in the room is the property market and how it will fair after the reality of removing government income support, pilfering of super, and mortgage holidays ends next year. Already, without these realities, the damage is being done with the sharpest declines since the 80’s:

And again, with the aforementioned emergency relief measures, we are already seeing stresses in the property market that forebear bad things ahead. Banks are tightening with credit falling, mortgage stress has risen to 40.1% (1.52m households), rental stress is at 41.1% (1.78m households), and property investor stress at 25.4% (826k). They say property prices only fall when people HAVE to sell and those stress numbers during a recession don’t bode well.

Adding to concern is a survey by comparison giant Finder of Australian financial experts and economists.

“When asked when Aussies could expect banks to make the move, half of the respondents said banks were likely to announce out-of-cycle rate hikes during the first half of 2021.

“Banking profits have nosedived off the back of billions of dollars worth of loan deferrals, a shrinking pool of first-time buyers, low-interest rates and minimal credit growth,” said Finder insights manager Graham Cooke.

“This may send banks scrambling to recoup lost funds by pushing up home loan rates to absorb some of these costs, which will come at a detriment to mortgage customers.””

One would have to question any action that would increase defaults when you are the bank but this is a survey of experts so needs to be heeded. The old saying, “owe the bank $1000 and it’s your problem. Owe the bank $1m and it’s their problem” comes to mind. That said, you wouldn’t want to be an Aussie bank right now. Ipso facto you may be nervous as an unsecured creditor of a bank too…. i.e. a depositor…. There are still plenty coming into our store getting money out of banks and into gold for that very reason.

And as we started, against ALL of this… Aussie shares rallied yesterday!!? If one really wants to look at the ‘blow off’ look of shares right now last night in the US must be instructive.

Last night we saw the largest sharemarket index in the world measured against Forward Price Earnings multiples break the all time high set by the dot.com bubble:

And hitting a key resistance in doing so:

All at liquidity levels not seen since the GFC:

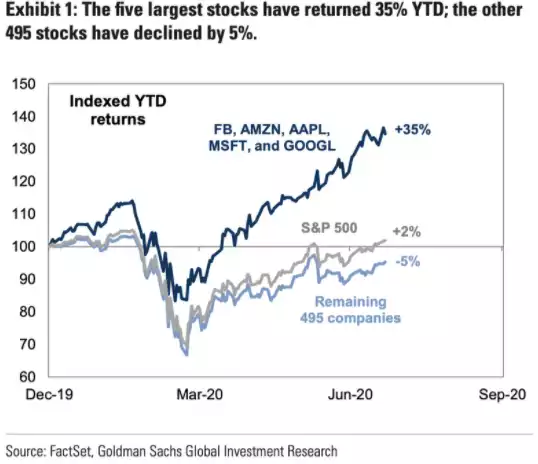

This last chart is incredibly important for a number of reasons. Never before have we seen market breadth so incredibly narrow. The entire S&P500 is so completely dominated by just 5 shares, the so called FAAMG tech stocks, now accounting for nearly 25% of the entire index, that without them, the other 495 companies are all down around 5% for the year.

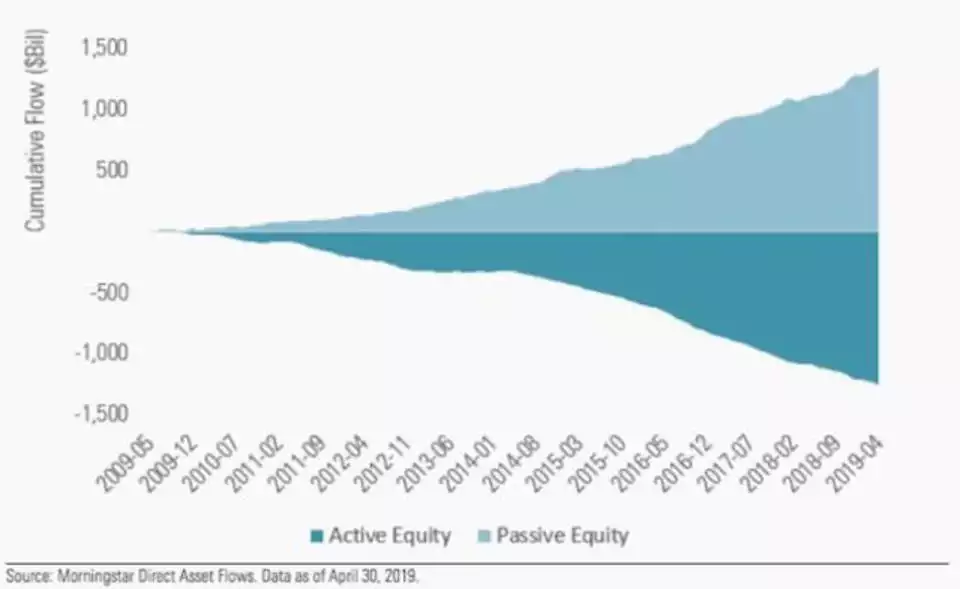

But it is the concentration in just 5 shares when things turn that makes that market liquidity so very scary. However the other potentially larger issue at play is the emergence of these massive passive funds and ETF’s that, as the name suggests, don’t analyse, just follow. When all that money races for the exits at once, and compounded by being largely in just 5 shares, you can well imagine the precipitous spiral that causes.

We’ve all heard the saying ‘if America sneezes, Australia catches the cold’. This aint a cold. Taking the analogy to 2020, America is showing all the signs of COVID-19 and we are inextricably bedfellows with an already very poor immune system.