“What was I thinking” Hindsight v Reading the “Truth”

News

|

Posted 10/07/2020

|

20840

If we all had hindsight beforehand we’d be incredibly rich. The saying that no one rings a bell at the top of the market is an oft repeated one after the top has passed and to be frank, most aren’t even listening at the top regardless. There is always a self-reinforcing narrative to say this time is different. “Don’t fight the Fed” and “V shaped “rocket ship”” are alive and well. Strong gains amid, and indeed despite the sort of economic data before us can make traders feel super human…

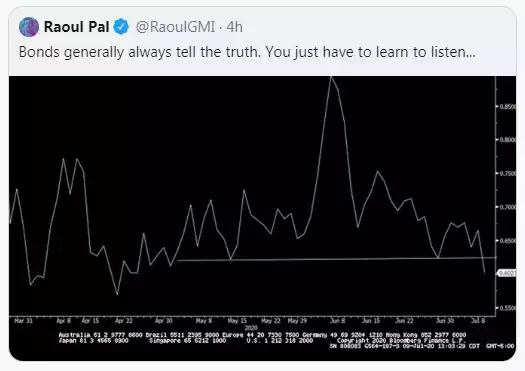

However as Raoul Pal often states, equities markets are based on human emotion and bond markets on truth. We are now again seeing US Treasury yields falling (along with gold rising) as the smart money is calling BS on the recovery narrative. Topically Pal just Tweeted:

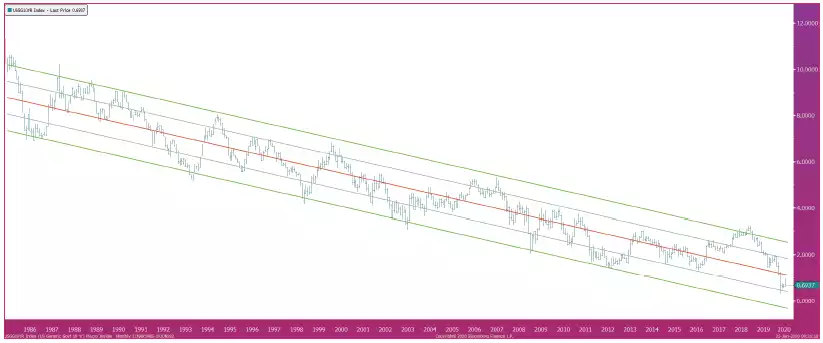

That is a pretty compelling chart technically, telling us yields are likely heading down. You may recall from our last article to this, the macro trend is heading negative.

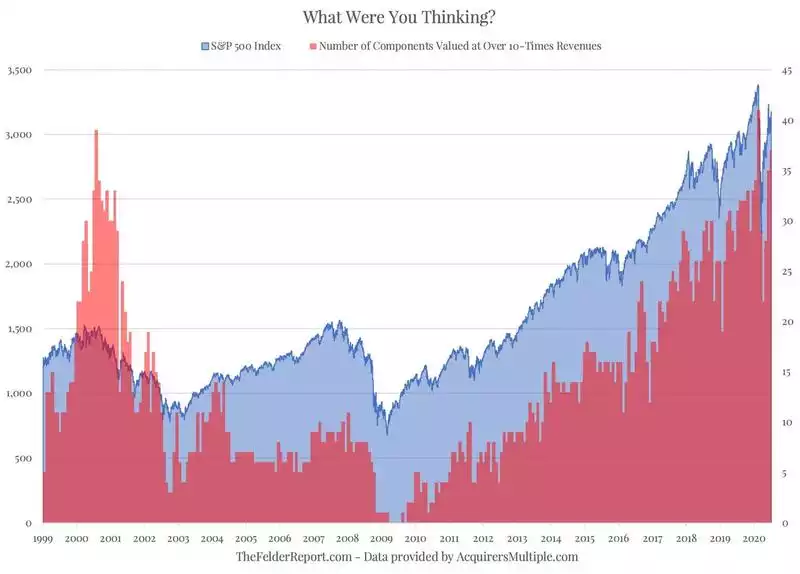

The last time equity markets were this “irrationally exuberant” was the famous dot.com bubble. Sun Microsystems were a poster child of that market. They saw their shares go from $10 to $60 in 1999. Their share price compared to revenues went to over 10x in that period. Their share price subsequently fell back to $10 within 2 years, an 83% loss if you bought at the top from which you’d then have to make 600% gains to get back to even. Their Founder and CEO, Scott McNeely famously said afterwards (with hindsight):

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

As we sit here today amid what could be the worst recession or depression in our lifetimes the S&P500, the biggest sharemarket index in the world, has more companies trading at over 10x their revenues than the dot.com bubble and nearly 3 times as many as before the GFC.

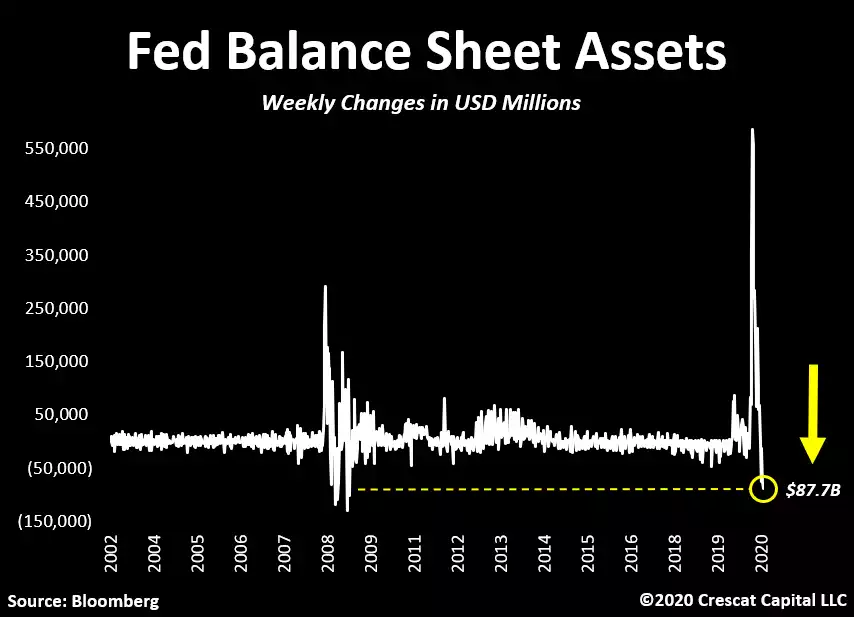

The crowd is again ‘all in’ and going hard. Their ‘this time is different’ narrative is being reinforced every day with new gains. Quietly behind the scenes the Fed has been unwinding the very thing the crowd think makes this trade invincible. Crescat’s Otavio Costa rightly asks the question in a recent Tweet:

If we look at the index going hardest, again coincidentally just like the dot.com it’s the tech heavy NASDAQ, and compare it’s trajectory to bond yields (which should be rising if everything is awesome) the following picture paints a thousand words and really, a thousand reasons to ask yourself, “what am I thinking”…

Bond markets and gold are telling us smart money is starting to take cover in defensive assets.

To finish off, we came across this little nugget of a quote that is oh so relevant right now…

“every trade you make based on flawed assumptions owes a debt to the truth, which must ultimately be repaid ....”