“Value Is What You Get”

News

|

Posted 19/04/2017

|

5014

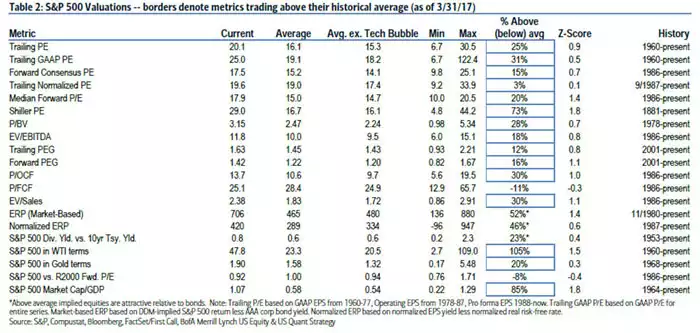

There are many ways to assess the value of a company that you buy shares in. The table below is courtesy of Bank of America Merrill Lynch (BofAML) and it details no less than 20 different measures of value of the S&P500 against historical averages

They highlight 15 metrics as being above the historical average and 3 of the 5 which are not highlighted are only because they are relatively ok compared to bonds.

Now averages being averages means being ‘above’ does not necessarily mean we are near a crash. However a quick scan of the table shows many are very much above that average and indeed the highly respected CAPE Shiller is nosebleed 73% above and the forward consensus P/E is at its highest since 2002.

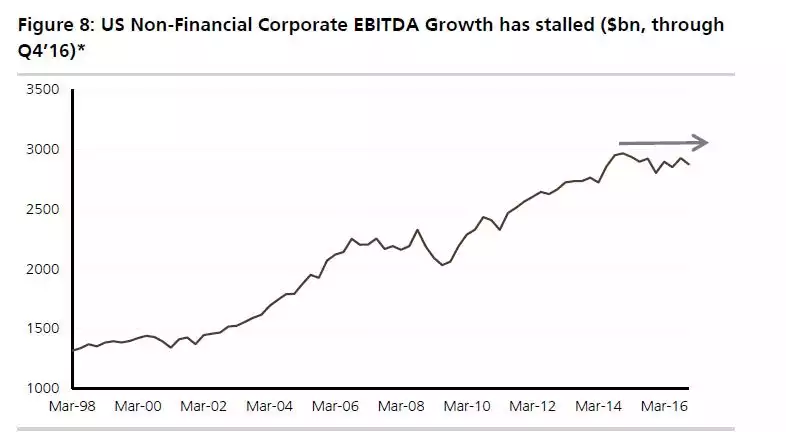

But again, if everything is awesome, than high valuations would be expected yeah? Yesterday the Atlanta Fed maintained their Q1 GDP forecast for the US of just 0.5% and graphs like the following paint a very clear picture of everything not being awesome yet the sharemarket is trading like it is.

We are reminded of Buffets famous saying:

"Price is what you pay. Value is what you get."