“Trifecta of Macro Imbalances”

News

|

Posted 23/02/2022

|

6845

Crescat Capital’s latest research letter talks to a “Trifecta of Macro Imbalances” that presents what they call a “highly explosive mix” for the economy.

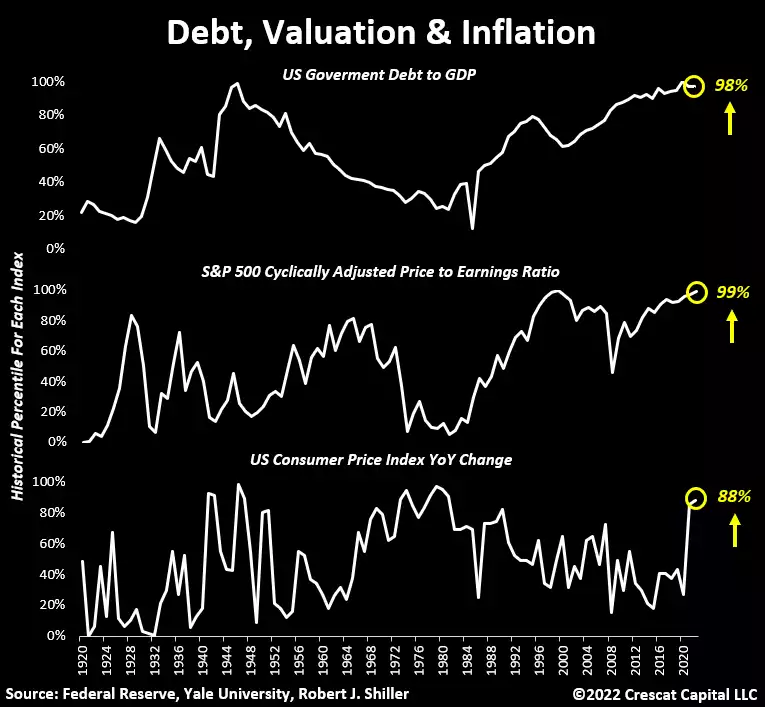

“For the first time in history, the US is experiencing a confluence of three macro extremes all at once:

- High government debt to GDP like the post-war 1940s

- Excessive stock market valuation on par with 1929 & 2000 bubbles

- A resource-driven inflationary crisis environment comparable to the 1970s

We’ve written extensively on the first two so let’s today let Crescat explain the third, inflation, in terms not often discussed but fundamental to investors in precious metals, particularly those used in industry being silver and platinum.

“Any one of these three economic states endangers the health of markets and the economy. Together they are a highly explosive mix. The disparities have evolved from an era of misguided monetary and fiscal policies. The unwritten plan may have always been to devalue debt by growing nominal GDP through surreptitious inflation. But the ongoing debt expansion, money printing, suppression of interest rates, and deception about the true rate of inflation has only created one of the largest speculative manias ever for financial vs. real assets. At this juncture, policy makers have become their own prisoners. Neither can they halt the rising cost of capital needed to stabilize financial markets nor can they put a lid on inflation.

Whether the Fed tightens or loosens financial conditions, it could only help further catalyze problems for financial markets and the economy. One would accelerate the bursting of historic bubbles in broad equities and credit, and the other would only fuel more inflation, a horse that is already out of the barn.

Chronic Underinvestment in Natural Resources

The fundamental problem that ensures an inflationary crisis either way, as Crescat’s macro research has uncovered, is the historic underinvestment in critical natural resource industries throughout the energy, materials, and agricultural sectors of the economy. We are convinced that both the investing public and policy making communities underestimate the significance of this capital investment shortfall and its implications.

This historic downtrend has not only constrained the current supply but is preventing future supply from being ramped up quickly. These are the commodities at the core of the supply chain for all goods and services. They represent necessities, including shelter, food, transportation, electricity, heating, and cooling. Demand for these basic needs is inelastic, i.e., not addressed by the Fed’s traditional inflation-fighting toolkit.

A major reason for the underinvestment in these industries has been a well-intentioned but uncoordinated environmental agenda that has obstructed the permitting process and thwarted the attraction of capital to finance new resource projects. The political and social pressure to go green has been massive, but the transitional planning on how to get there from an engineering and economic standpoint has been abysmal. As a result, an economic crisis driven by commodity price shocks is the tradeoff that we will almost certainly face. It will indeed take an inflationary crisis before there is the necessary political will to seriously reconcile these issues.

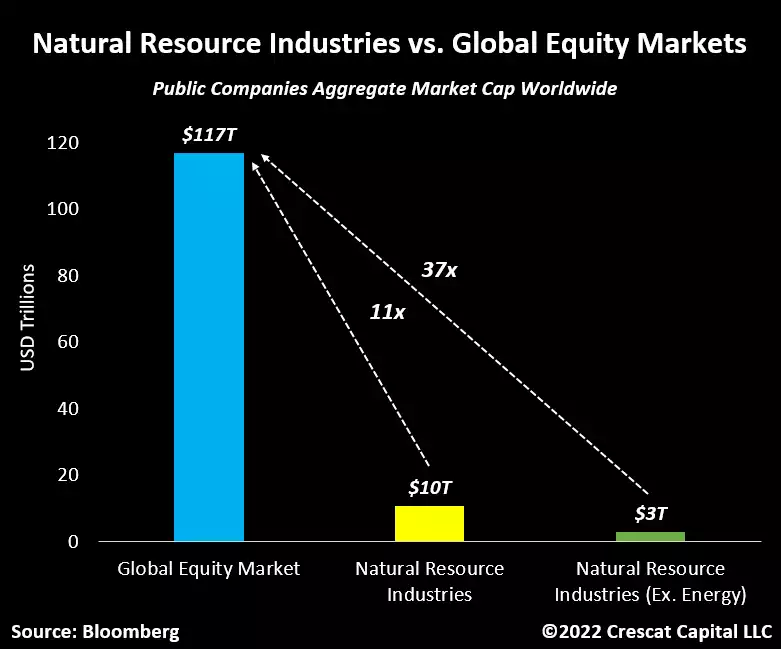

Driven mostly by technology related companies, global equity markets have grown to an aggregate amount of almost $120 trillion. That is 11 times the size of the overall natural resource industries worldwide. If we exclude the energy sector from this calculation, these industries represent a tiny amount of the global stock market, only 2.5% or $3 trillion of aggregate market cap.

We are finally beginning to see a rush of institutional capital into the resource markets as more investors are looking for ways to hedge inflation, but these industries suffer from a shortage of skilled management and labor to effectively deploy the capital. For example, there has been a decade long decline in college enrollment in geosciences. How can we possibly create a greener planet, including the raw materials necessary for clean energy, let alone our basic needs, when we have been minting less and less earth scientists every year? These imbalances simply cannot be resolved in the short term.

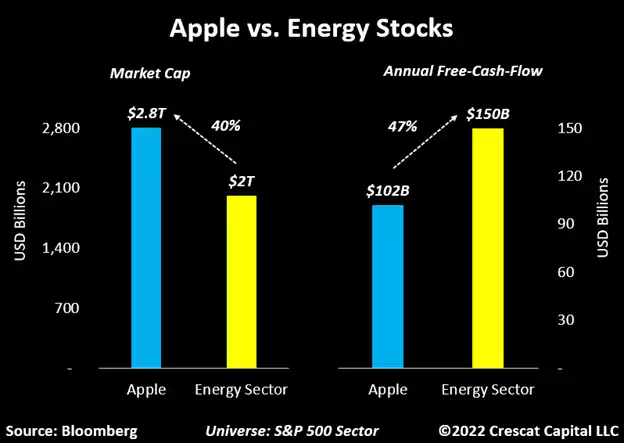

Fundamental Disparity

Too many years of inexpensive cost of capital and a financially repressive environment have lured investors into going out on the risk curve, drastically increasing their portfolio duration. These shifts in capital allocation have created enormous market inconsistencies. Today, for instance, Apple’s market cap is 40% larger than the entire energy sector. While most people justify this disparity due to fundamental differences, it is important to note that energy stocks generate almost 50% more in annual free-cash-flow than Apple. Will investors still prefer Apple when oil prices break out above $100/bbl?”

Just as the chart above so beautifully illustrates, we remind you too of the even bigger imbalance between the $300 trillion financial asset space and the $1.5 trillion investable gold space (and the much, much smaller again silver and platinum spaces). When rotations happen (from growth to value) as they appear to be in the process of right now, the prospects for gold, silver and platinum appear immense.