“Tightening” the Noose – SP500 hits new record

News

|

Posted 13/09/2018

|

7066

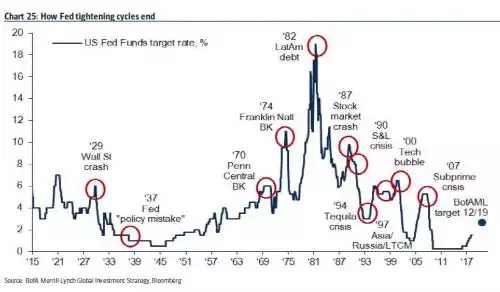

The S&P500, fresh off breaking all time highs and longest bull market in history records, just broke another. According to Crescent Capital it is now the strongest rally during a Fed tightening period. We have written numerous times about how all major crashes were preceded by the Fed tightening its policy, and normally too late.

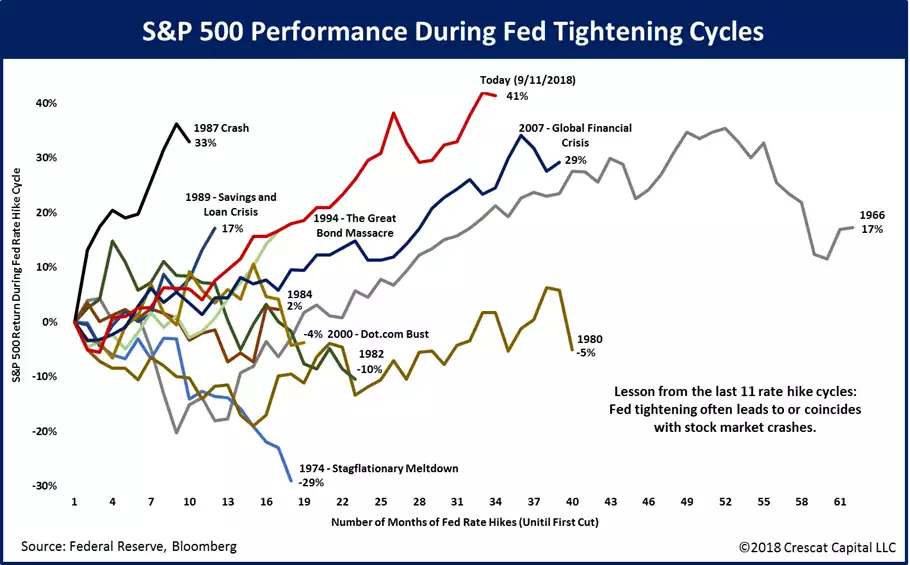

Since the Fed’s first rate hike of this tightening cycle in December 2015 you can see below it has been stronger than any other before it.

You can also see quite clearly the 2 next highest preceded the infamous ‘Black Monday’ crash of 1987 and of course the more recent GFC.

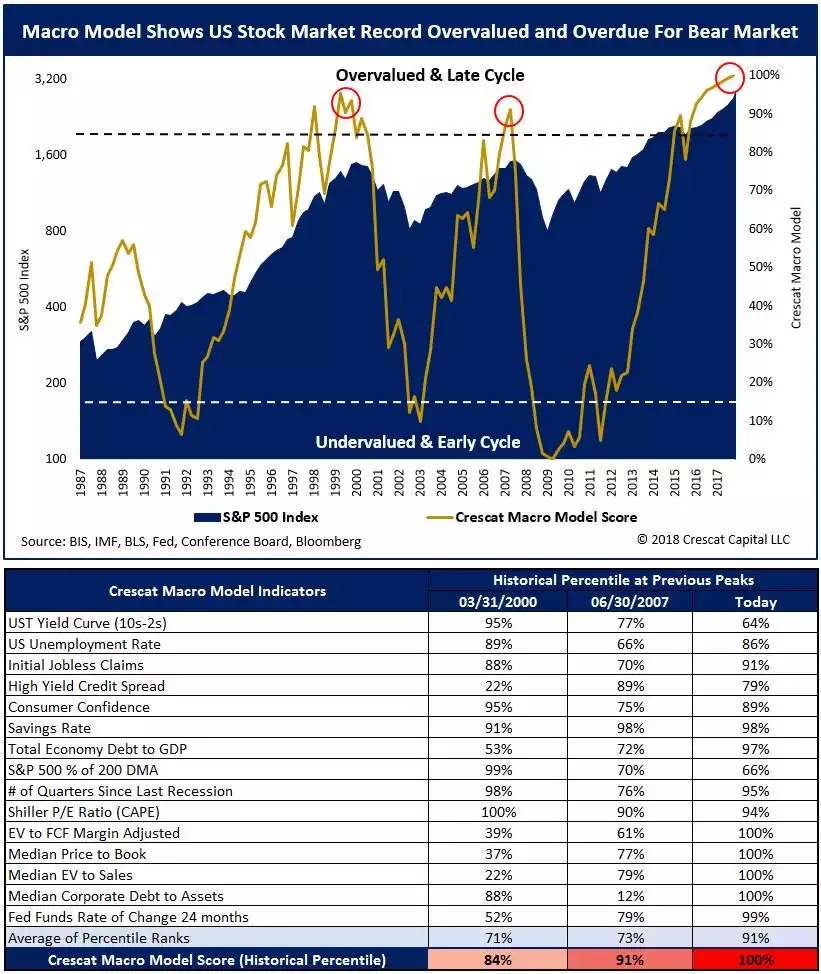

Arguably, given this rally like no other has been debt and central bank stimulus based, the results of higher interest rates in this tightening cycle could be the worst. Crescent also highlight just how high the valuations behind this market are at present:

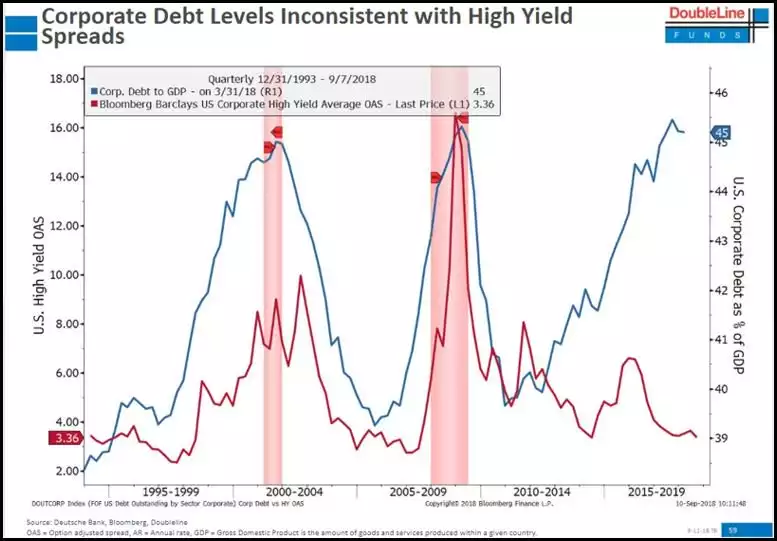

This is all playing out whilst US corporate debt as a percentage of GDP is at record highs but the US corporate yield spreads are at cycle lows not highs?

Any dispassionate pragmatic assessment of that presented above in the context of rising interest rates surely must surely have your gut asking very serious questions about whether this time really is different and whether seeking insurance in the form of hard or digital monetary assets would be a prudent move.