“The Coming Bear Market”

News

|

Posted 21/02/2017

|

5897

Sven Henrich (aka Northman Trader) penned an excellent account of the current market last week titled “The Coming Bear Market”. It’s not short (and keeping our articles short & sharp our commitment to you) so below is a summary of key points but we recommend you take the time to read the full article by clicking here.

To set the stage, this is Henrich’s base position: “The entire global financial system is 100% dependent on central bank intervention and debt expansion and low rates. There is zero evidence that markets can organically support current assets prices anywhere in the world without any of these things.”

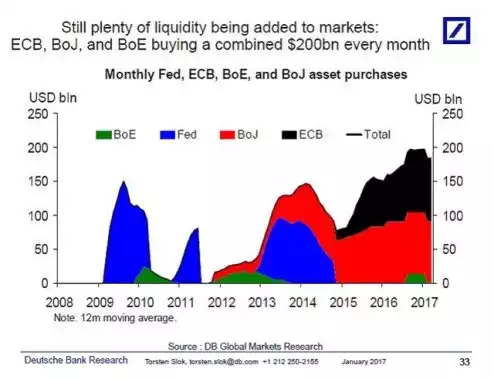

So whilst the US Fed is in ‘tightening’ mode, the Bank of Japan and European Central Bank have certainly taken the stimulus batton and run (and still running). China probably beats them all but the numbers are too hard to properly validate.

Henrich points out that when the next recession hits the world it will hit it at a time of “record government, corporate and consumer debt and pension funds severely underfunded. As far as markets are concerned it appears we are repeating again the cycles of the past major bubbles. Extreme high valuations, extreme high debt and absolutely no fear or concern of anything ever getting in the way. Indeed the current volatility compression is the most extreme in market history rivaling only the beginning of 2007.”

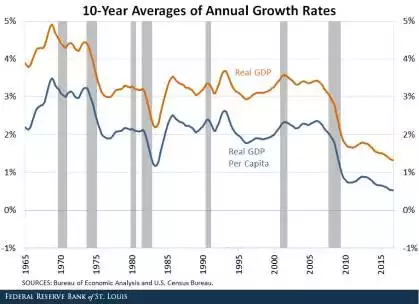

Despite all of this stimulus, real GDP growth has been ‘paltry’ indeed last week US Fed chair Yellen said that, after the 8 years depicted above of stimulus, “Economic growth has been quite disappointing” and as listeners to our Weekly Wrap know she wasn’t even sure of the future, saying “Considerable uncertinty attends the economic outlook,”. The following graph says it all….

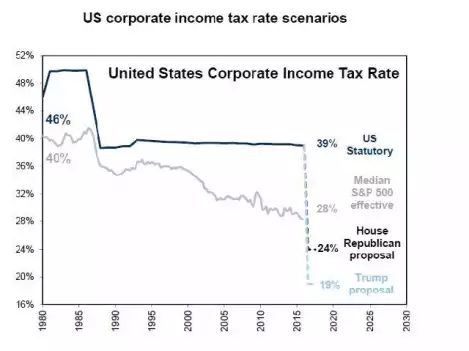

The other wind in the sharemarket’s sails at present is the promise of “huuuge” tax cuts. Henrich cites experts openly questioning this actually happening (as we have repeatedly done) and also highlights that in actual fact effective (that actually paid) corporate tax cuts are as low as they’ve ever been.

He points out that these proposed tax cuts are coming just as the US is about to hit $20 trillion in government debt and a debt ceiling next month. Or as the No.2 US Republican Senator put it “We know we’re going to have to pay for this. The question is whether we do it now or whether we send it to our kids and grandkids and make them pay for it. So that’s an important point that we need to achieve some consensus on.” Consensus on the debt ceiling has often proved difficult and it won’t be any different next month.

Henrich produces charts and data painting a clear picture of weakness beneath the share prices with weak tax receipts, gross capital underinvestment (courtesy of share buybacks not capex), personal expenditure using record high debt, real wages stagnated, and more recently banks starting to tighten on consumers. In summary:

“So what’s been driving the momentum into stocks here? It’s actually an easily understood trifecta. While we had central banks and buybacks in markets over the past few years the election of Donald Trump with promises of tax cuts, deregulation and infrastructure spending made it a trifecta: Folks piling in long as they are smelling free money.”

He cites some big warning signs, being very low volume in shares, a deterioration in the number of stocks trading above their 50 day MA, alarmingly low VIX (‘everything is awesome disease’) and sky high valuations. It is the classic, ‘this time is different’ scenario…

“No, it does not appear we’ve learned a single thing. Except this time around we’ve indebted future generations with an even higher burden. In fact we doubled global debt in just 8 years. And now we have no choice but to add more or it all falls apart. And that is the core basis of the bear case. The world is trapped in a spiral it has created. And the casino needs consumers to keep spinning the wheel despite their pensions withering away and real wages not keeping up with emerging inflation. But don’t worry, we got phenomenal tax cuts coming. How will we pay for them? Oh trust us growth will be coming. Right.”