“profound changes in the global economy” & How to Profit

News

|

Posted 28/04/2022

|

7432

Crescat Capital released their latest monthly research letter late last week and as usual it provides clear and concise insight into macro markets at present backed up with ‘runs on the board’ through the outperformance of their funds.

Their summary intro sums up the current situation:

“We are currently experiencing profound changes in the global economy that are likely to unleash a plethora of early-stage secular trends in a new inflationary regime. These are long-overdue structural shifts powered by decades of easy money policies and record levels of debt-to-GDP among developed economies:

- Governments and central banks to seek high-quality international reserves in attempt to restore the credibility of fiat currencies; gold will play a major role as a monetary asset

- Monetary metals and other tangible assets to regain relevance in crowded 60/40 portfolios as inflationary hedges

- Central banks ultimately forced to cap long-term yields creating a major tailwind for inflationary assets

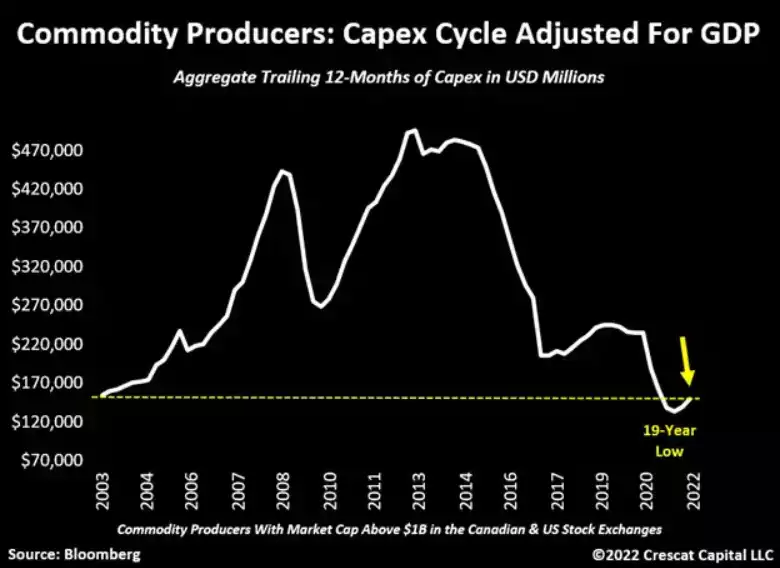

- The beginning of a commodities cycle after chronic under-investment in natural resource industries

- A new “Exploration Age” for commodities as major producers address their supply cliff

- Deglobalization trends prompt a long-overdue manufacturing re-build in developed economies including a boost to non-residential construction

- Rising geopolitical tensions spur increase in defense spending from historic low levels compared to GDP

- The continuation of one of the most extensive fiscal agendas in history, driven by the Green Revolution, social equality programs, infrastructure revamp, and defense spending

- Ongoing flood of sovereign debt issuances and persistent inflationary pressure to cause long-term interest rates to rise globally

- Overall corporate margins to be squeezed by the rise in cost of capital, commodity prices, and labor cost as the Fed tightens monetary conditions

- The resurgence of fundamental analysis and value investing principles as profitability becomes a priority

- A re-pricing of long duration growth stocks from record valuations as cost of capital increases

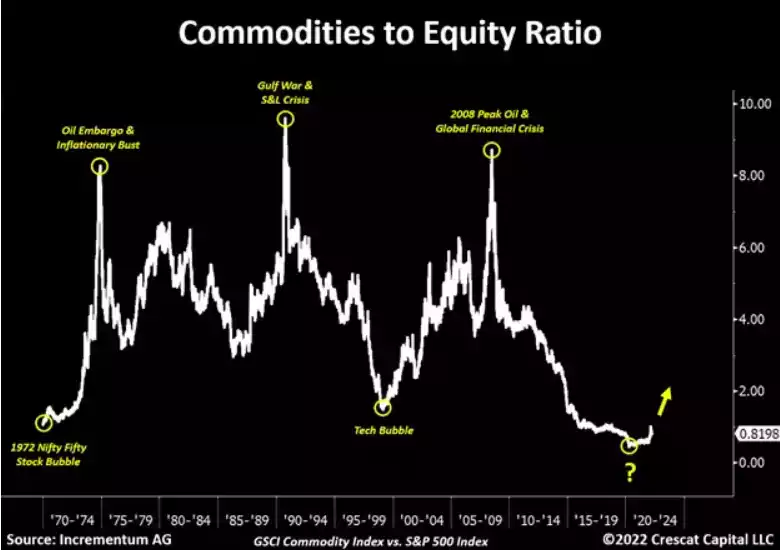

- A major shift in market leadership from technology to natural resources related businesses

- Geopolitically neutral and commodity-driven economies to gain relevance on the global stage, i.e. Brazil

- Upcoming challenges to historically indebted net importers of commodities, i.e. China

Unparalleled to any other time in history, the current macro imbalances have drastically distorted the market perception of value and risk. This scenario is setting the stage for significant changes in portfolio allocations from crowded and overvalued assets to unloved and historically cheap alternatives. For macro investors, we think this is one of the most opportunistic times ever.”

Their report is quite lengthy so lets just flesh out a few of their main points.

We often talk about the lack of exploration and new mine investment for gold and silver combined with longer and longer approval periods before being able to start. The chart below illustrates this clearly and begs the inevitable question of future supply…

Despite talk of the ‘commodities boom’ the reality is that, compared to the S&P500 and looking at all commodities (clearly gold and silver among many others have not seen the huge rises in some headline commodities) they are still near record under-priced compared to shares dominated by the tech heavy growth stocks. The chart below this is in the process of reversing. The confluence of the free money being removed for those growth stocks and inflation driving up hard asset commodities is one for the ages.

And don’t get them started on silver!

“Silver remains one of the most mispriced opportunities in financial markets today. While the overall commodities market has drastically risen, this high-beta version of gold remains at historically cheap levels. If silver were to just catch up to the move in other tangible assets, it would imply a doubling from current levels.”

Tomorrow we will look further at the truly historic macro economic setup and where gold and silver fit in history’s playbook.