“Perfect Storm” For Gold – Real Interest Rates

News

|

Posted 22/01/2021

|

7165

Maybe one of the biggest questions for 2021 is that of inflation. Late last year we wrote to this and today we share just a couple of charts that paint a very clear picture of rates and inflation expectations and gold’s historic performance mapped against that.

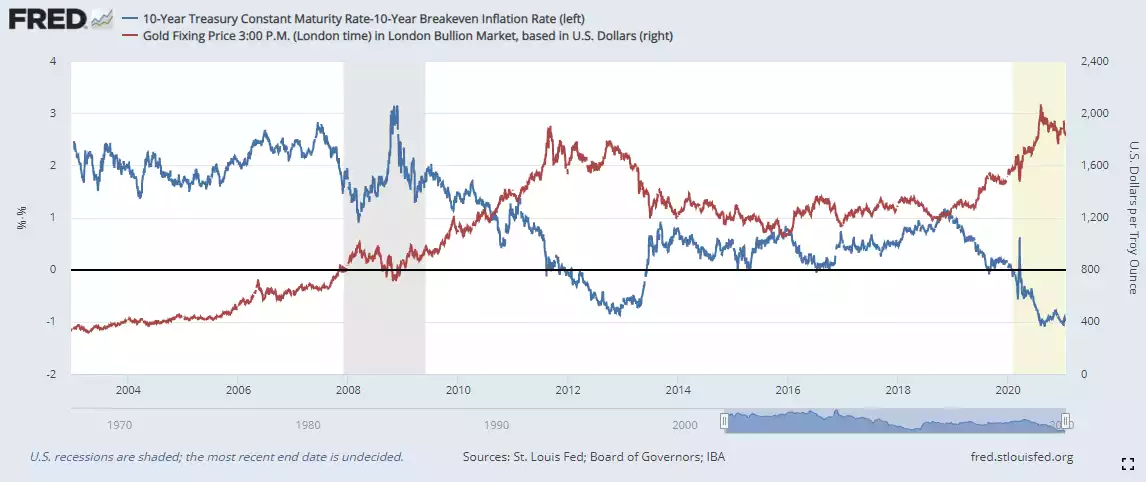

Below is a chart (somewhat ironically from the US Fed’s own site) that maps out clearly what the bond market is telling us about real interest rates and how that is, and has, mapped against gold. As negative correlations go, it doesn’t get much more perfect.

The blue line is the difference between the 10yr US Treasury yield and the 10 Year Breakeven Inflation Rate, the latter being the treasury market participants expectations on the average inflation over the next 10 years. As a reminder, real rates are the nominal rate less the inflation rate. You will note we are deep in negative territory so if your US Treasury note is yielding 1% but inflation expectations are 2%, you will go backwards on your investment for each of the next 10 years by 1% per year. The historic alternative is gold and the chart below tells you why:

Negative interest rates don’t necessarily rely on continued low or lowering rates if inflation takes off. Since August of last year when the 10yr UST yield plumbed an all time historic low yield of just 0.5%, it has been on a slow grind up and then popped a little over the last month on the certainty of ‘Blue Sweep’ in the US.

Not uncoincidentally gold has been in decline since that August bottom in rates when it hit an all time high US$2062 or AU$2860. But the nominal rate is only half the equation. Inflation is the elephant in the room and despite the climbing yield, the first chart above shows it is now starting to overwhelm that rising yield as inflation expectations continue to surge as you can see below:

The ‘perfect storm’ is a Fed incapable of raising rates under a market reliant on stimulus and a debt burden incapable of handling any increase in interest rates to service it. Coinciding with this is the spectre of inflation surging on the back of that very same stimulus, now about to be ‘doubled down’ with fiscal stimulus from a Biden/Yellen administration that is promising to “go big”. To be fair there is the prospect of rising rates (as we’ve seen already) despite the Fed not raising the cash rate just through the organic bond market. That would likely just mean the Fed has to be more aggressive in lowering the cash rate to counter those forces which it knows will be destructive to this precarious market. The US Fed has so far avoided negative rates, but the choice may be removed.

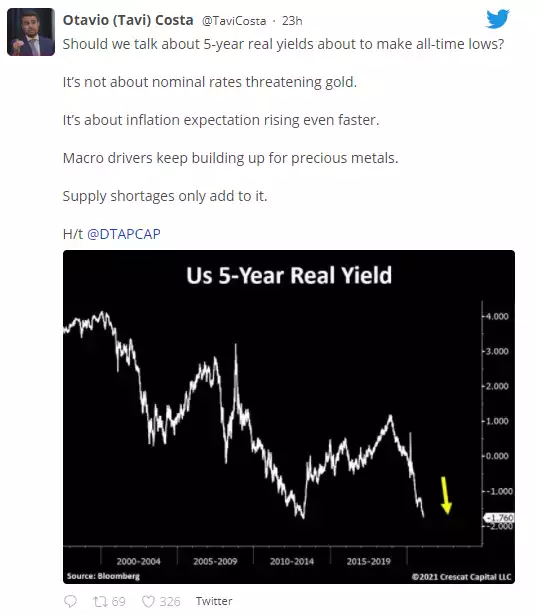

Yesterday the US 5yr Real yield was a whisker off an all time low. Crescat’s Otavio Costa tweeted to this just yesterday: