“how a famine begins” Record CPI Before Effects of War Just the Beginning

News

|

Posted 11/03/2022

|

8175

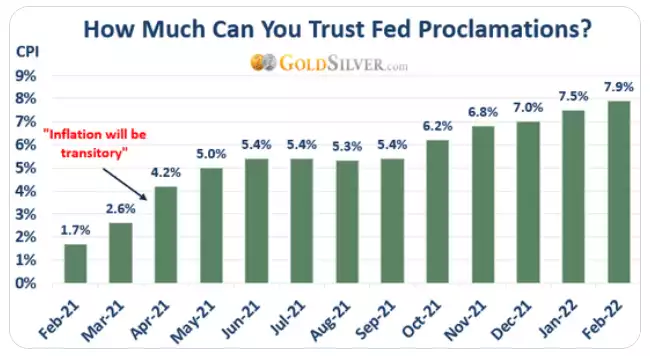

A MUST READ TODAY…The “transitory” inflation camp took another hit last night with the US CPI print for February printing 7.9%, up another 0.4% on January’s 7.5% and another 40 year high. Critically too, this is BEFORE the effect of energy prices from the Ukraine invasion. What is not being as widely discussed is food, and not just for the obvious reasons of energy cost effects.

But first let’s get a really clear picture of how horribly distorted this picture is right now. Firstly, lets pictorially visit that ‘transitory’ call of the Fed…

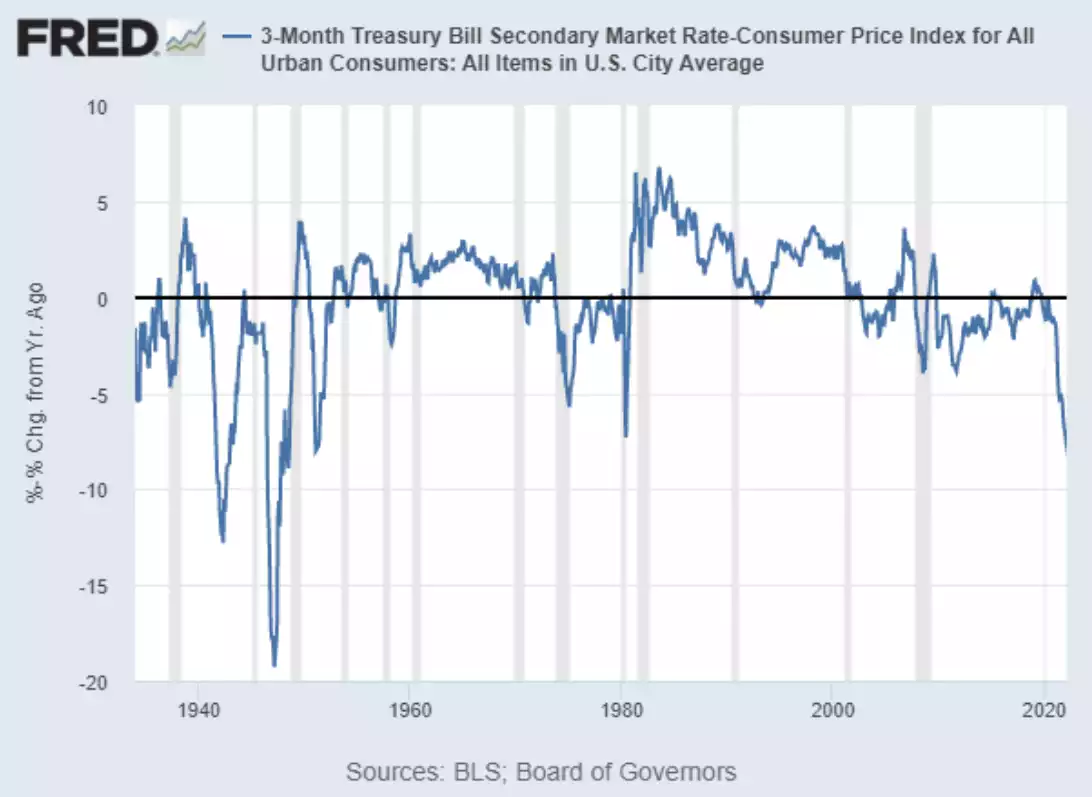

Whilst sticking to the ‘transitory’ narrative for 10 months, the Fed has maintained financial conditions at ‘full loose’ at a level not seen since the 1940’s…

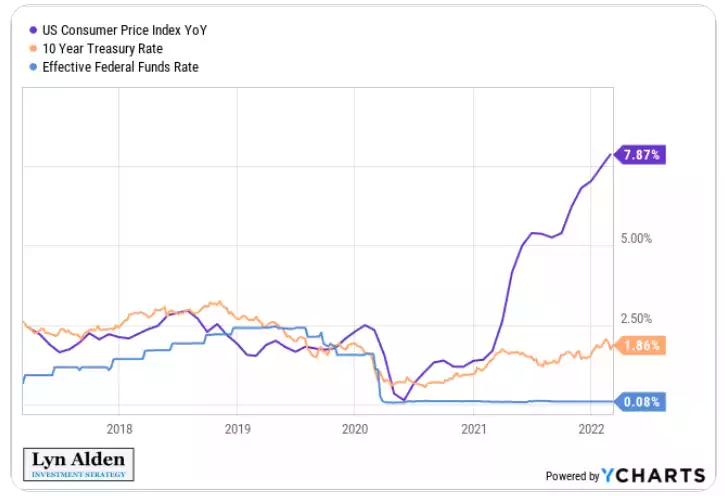

Zooming out a little more you can see the disconnect this century…

That puts real rates, inflation adjusted rates, at -7.8%, again the lowest since the 1940’s…

And again, this is BEFORE the impacts of the Ukraine invasion are included. The Fed had already made the biggest policy mistake in a generation, the effects of the war make this outright scary for those not holding hard assets. Importantly this is clearly not just a US and Fed issue. Europe and the ECB have the same problem albeit with a little lag. The ECB have been even more aggressive with loose monetary policy including negative rates. Last night they shocked the market by coming out more hawkish then expected. They announced a quicker taper of QE but left rates untouched, reduced growth forecasts dramatically and increased inflation forecast dramatically to 5.1%. That 5.1% surely must be taken with a grain of salt though. Italy, the 3rd biggest economy in the union, just printed a PPI (inflation at the factory) of 41.8%. 41.8%. That’s not a typo.

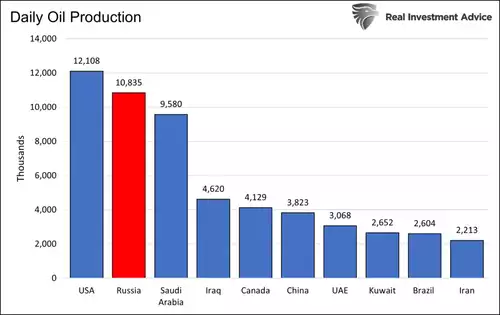

Russia is the world’s largest natural gas producer and edges out Saudi Arabia behind the U.S. in oil production. It accounts for about an eighth of global oil production..

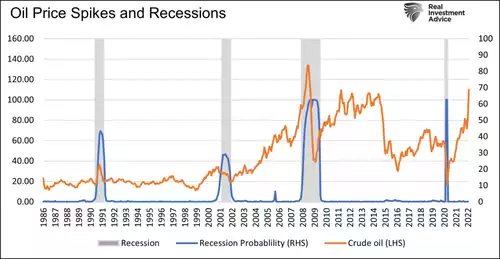

Given the world’s reliance on oil for the production and distribution of most goods it should not come as a huge shock to see that spiking oil prices coincide with every recession:

That said there is also a disproportionate fixation on energy itself as opposed to the impacts of the conflict on food costs in that CPI basket. The following is an excerpt from a Real Vision interview with geopolitical analyst Peter Zeihan on the impacts of the Russia - Ukraine situation:

“[a] global recession is in the bag at this point, we're going to lose 5 million barrels per day of Europe's crude within the next few weeks, and somewhere between five and 10 BCF of natural gas going to Europe. We're going to have a food crisis by the fourth quarter because the world's largest wheat exporter just invaded the fifth largest one, there isn't going to be any planting season in Ukraine this year. We have a phosphate fertilizer shortage because of what's going on in China because of natural gas prices. We now have a global nitrogen fertilizer shortage. And Russia and Belarus combined are the world's largest potash producers. A lot of farmers the world over are not going to use fertilizer this year, so we'll have a collapse in yields. That is how a famine begins. Global wheat stores are less than five weeks of usage.”

Since that interview Russia has announced it has suspended exports of fertiliser apart from “friendly countries”.

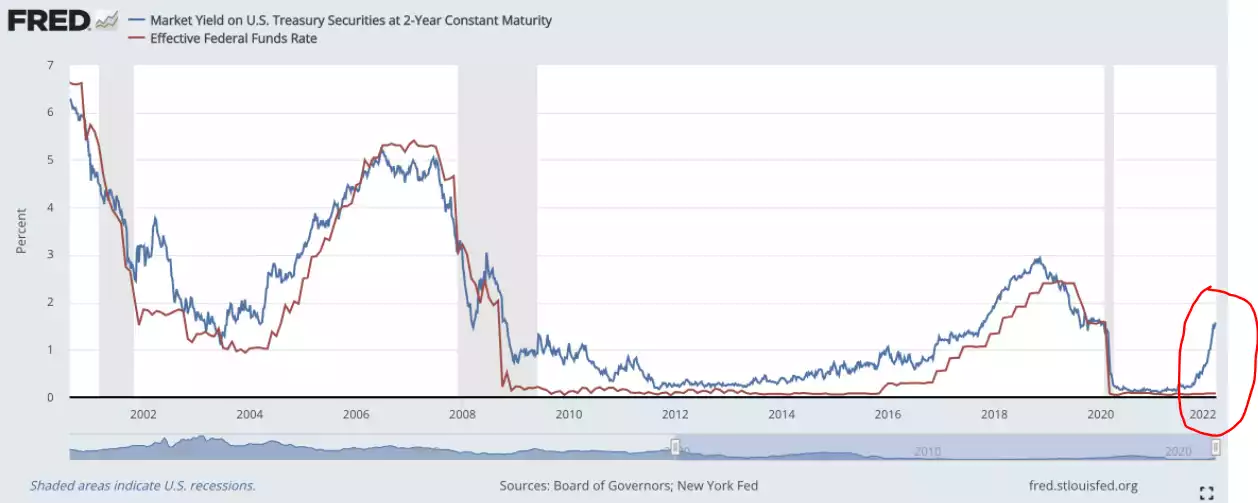

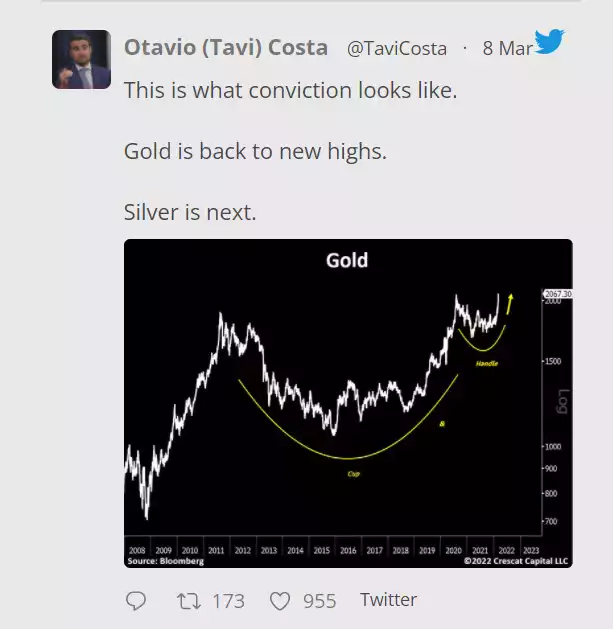

And so here we sit, the yield curve racing to zero and beyond, inflation, or as we discussed yesterday, stagflation, now a certainty, growth shares falling, and gold just starting to break out of a massive cup and handle technical formation.

Or for comparison…