“Gutwrenching Global Bust” Beyond the Fed’s Control

News

|

Posted 23/08/2019

|

9149

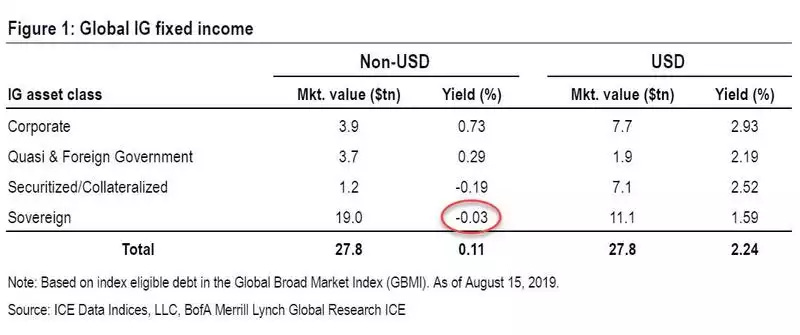

These are interesting times in which we live. Despite the Fed dropping rates in July, the US dollar continues its upward trend because in our globalised economy, everything is relative. We now have not only by value $17 trillion in negative yielding bonds (some even 30 year!) but also the average of all non-USD sovereign (Government issued) bonds has turned negative. To say that this is the first time in history seems superfluous..

The US 30 year Treasury bond is sitting at an all time low of under 2%, and as you can see from the above table, the average of all UST’s is just 1.59% which is still 1.62% above the non-USD average. That of course sees money flock to them and raise the USD in the process on that demand. The extent of this even has some concerned about a liquidity squeeze of USD.

Normally gold and the USD have an inverse relationship but this is happening in unison with very serious concerns around where all this ends and the safety that gold also represents without the counterparty risk associated with a US Treasury note. And so gold has risen 20% in USD terms off its low this year.

One can’t also look at that table above and not note the elephant in the room of corporate bond yields. We have written extensively in the past on corporate bonds being many analyst’s pick of the trigger for a disorderly unravelling of this ‘everything bubble’, the most recent here. Non-USD corporate bonds (companies selling their debt) are averaging a yield of just 0.73%. Recent reports noted 14 Euro junk bonds with a negative yield. Remember yield is your return for taking on the risk of funding a low grade debt issuing company. There is now $7.7 trillion of US denominated corporate debt averaging a yield of just 2.93% with all the risk that represents. That completely dwarfs the $1.5 trillion of subprime debt that catalysed the GFC.

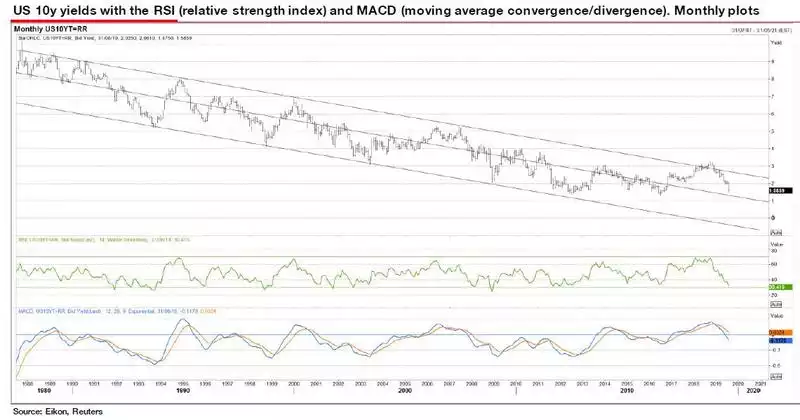

One of the big assumptions from bullish equities investors is that the Fed and other central banks will unleash more stimulus and continue the sharemarket rally despite a recession, particularly US shares given the relative strength of their economy, and that somehow this bond market rally (remember bond prices go up as yields fall) is a bubble that will burst. French giant Société Générale’s strategist Albert Edwards strongly disagrees. He maintains this bond market rally is acting normally, within a long formed channel of movement and has plenty left to go and that:

“this government bond rally is not a bubble but an appropriate reaction to the market discounting the next recession hitting the global economy from all overleveraged corners of the world (including China), with close to zero core inflation and precious few working tools left at policymakers’ disposal……the bubbles are not in the government bond market in my view. They are in corporate equities and corporate bonds."

When you look at that long term trend of the 10yr UST (chart below), you can see that whilst on trend, it has been in the upper band since 2013 because of the relative strength of the US economy. Should it continue its current intra band trend down the bottom is minus 0.5% by the end of next year!

As to the view of those believing that somehow central bank stimulus will again save the day he asks (rhetorically):

“Does anyone seriously believe that in the next global recession equity markets will not collapse? Do market participants really believe fiscal stimulus and helicopter money will save us from a gutwrenching global bust that will make 2008 look like a picnic? Has the longest US economic cycle in history beguiled investors into soporific complacency? I hope not.”

Bonds and gold continue to rally and sharemarkets are becoming increasingly nervous because more and more investors are not adopting such a hope based strategy…

So whilst all eyes are on Jackson Hole this week in the hope of a change in tact by the Fed to more stimulus (even if a ‘sign’), any such change is arguably too late and ineffectual beyond a short celebratory rally.