“Global Wave” Peaks – What Next?

News

|

Posted 04/06/2018

|

9767

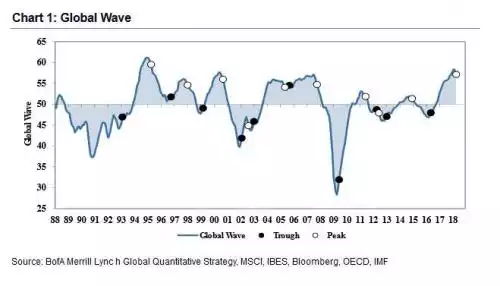

On Friday we wrote about BoFA’s Bear Market Indicators getting close to the danger zone. Over the weekend they’ve added another, this time their ‘Global Wave’ indicator which is an advance indicator of economic expansion and contraction. It has only peaked 10 times in the last 25 years and, whilst not all peaks have seen major troughs to follow (as you can see in the chart below), BoFA says previous downturns have averaged 12 months.

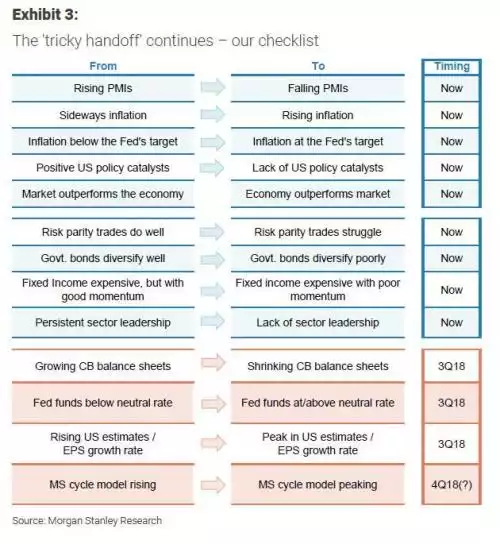

It’s not just BoFAML sounding warning bells, fellow banking giant Morgan Stanley are as well. They’ve warned we are at the “end of easy” and that "2018 is seeing multiple tailwinds of the last nine years abate", warning of a "tricky handoff" to a very late cycle economy "which suggests not just a harder environment, but a fundamental shift in how we approach the market." They have developed their “tricky handoff” checklist:

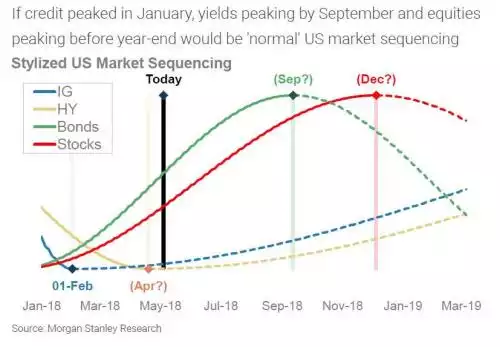

And even get bravely specific around timing…

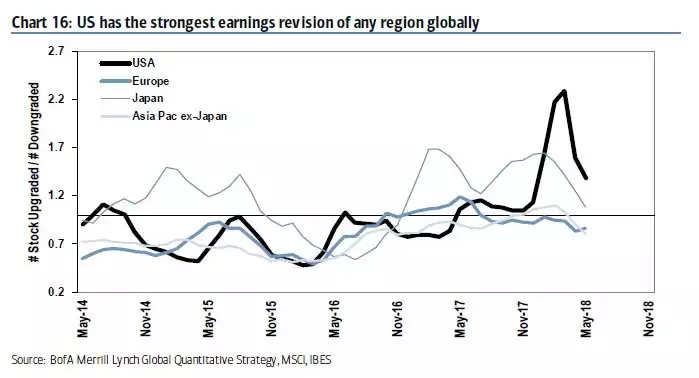

You will note in the checklist above one of the ‘unchecked’ boxes is earnings growth (EPS). Earnings have of late reinforced the ‘everything’s awesome’ narrative but are starting to look to be temporarily inflated through the ‘hit’ of the Trump tax cuts. You will remember from our summary of the “In Gold We Trust Report” their pointing out:

“We will stick to our conviction that we are currently in the early stages of a new gold bull market, which has been temporarily slowed down by the election of Donald Trump. The expectations of the political newcomer were clearly excessive – as we warned last year – and continue to harbor large potential for disappointment. “

And so it seems that might be playing out already according to BoFA: "Strong earnings revisions" resulting from Trump tax cuts have peaked and are now reversing. They remain negative elsewhere [around the world].

Topically, this reinforces the need to act now to balance your wealth both personally and in your superannuation. It’s something we covered last week in our interview with Nuggets News which you can view by clicking here.