Is 60/40 dead? The “new investing regime”

News

|

Posted 23/06/2022

|

8436

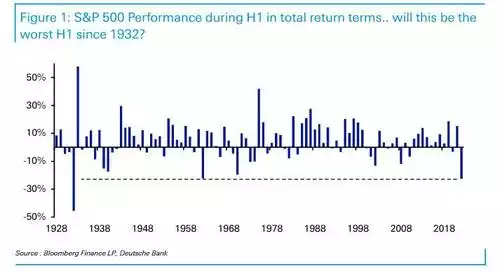

With 7 days left for the first half of this year, the S&P500 is posting its second worst H1 in history behind a little crash you may have heard of called the Great Depression. Deutsche Bank just released its professional subscription update and put the -22.3% drop so far this year ahead of the 1962 -22% but still well behind 1932’s -45%. So far. The chart below shows clearly how extraordinary this half has been in the annals of history.

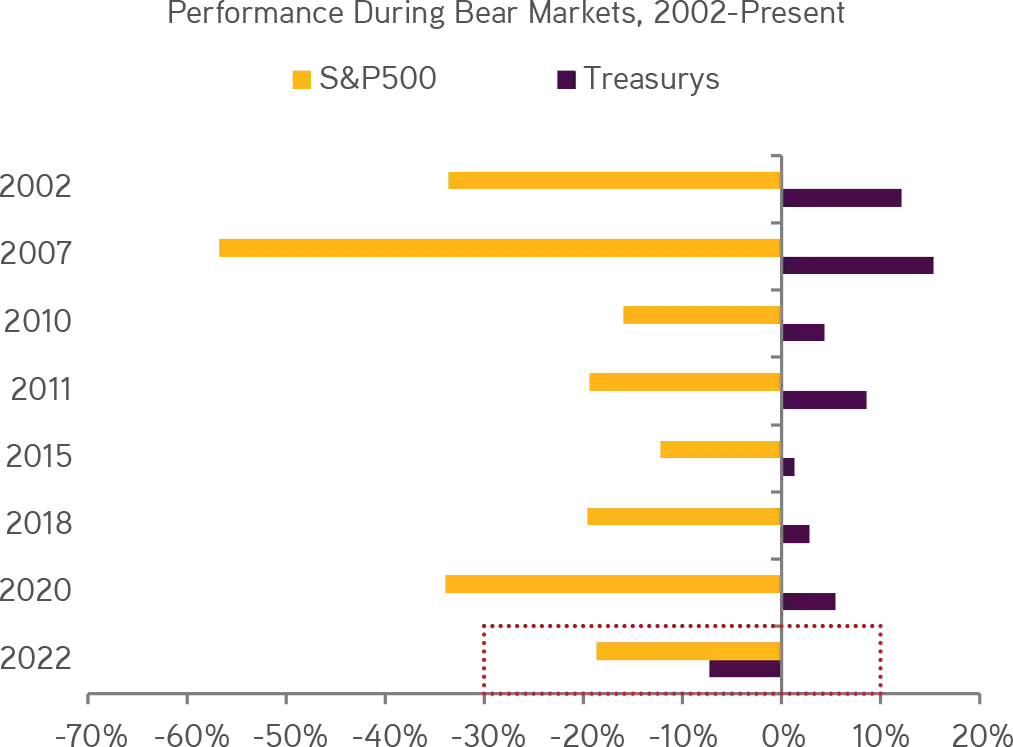

But it gets worse. Many high net worth investors traditionally have what’s called a ‘60/40 portfolio’ comprising the riskier 60% equities weighting with the ‘safety’ of 40% holding of US Treasuries. They are supposed to provide balance to a portfolio but skewed toward more upside potential in shares. The problem is, as bad as H1 has been for shares, 10yr US Treasuries are looking to post their worst H1 in over 234 years, worse than any year since 1788. The chart below shows the performance of each in the bear markets since the turn of the century.

The authors of the chart above, investment house and fund manager KKR, state “Specifically, what this means is that we think we have entered a new investing regime – and we do not make this statement lightly. There are three underpinnings to our thesis as to why this time is different: too much stimulus, heightened geopolitical risks, and sticky supply side constraints.”

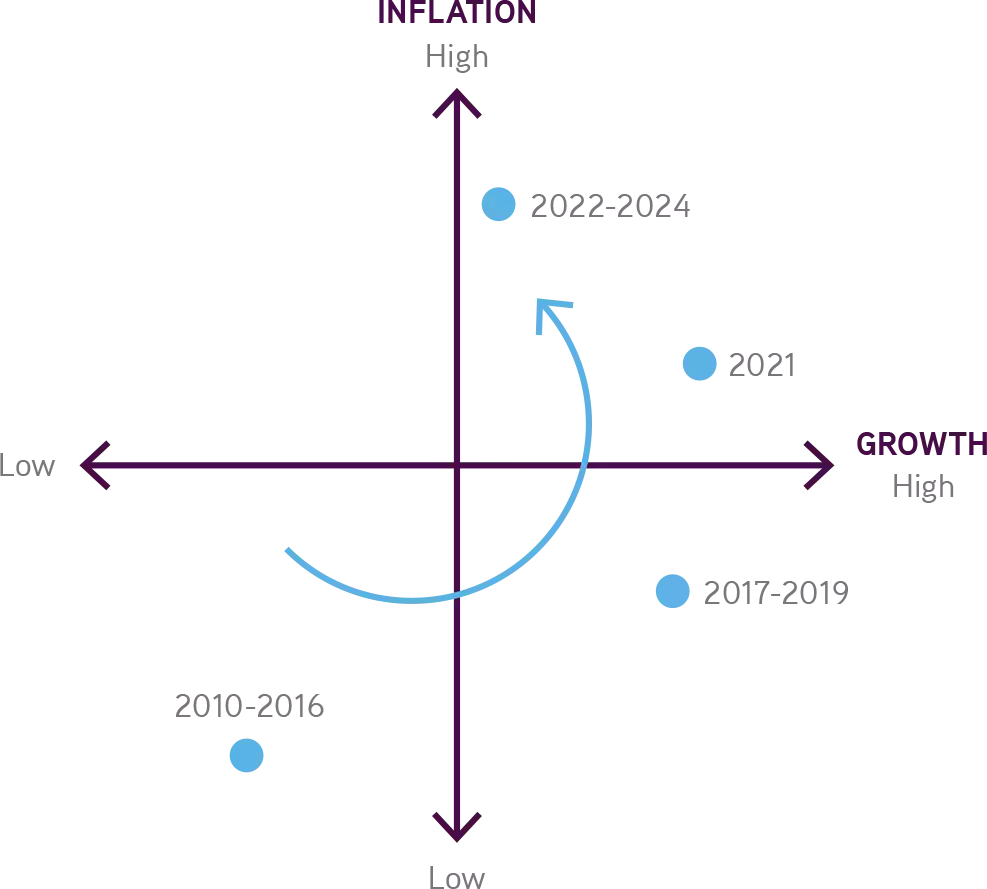

What should concern investors more is where they think we sit in the cycle between inflation and growth. The chart below clearly screams stagflationary warnings.

Expanding that out from the US, we see that globally the news is no better. Since we saw ‘peak awesome’ late last year off the back of unprecedented monetary stimulus, global bonds and shares have shed a staggering $36 trillion in value completing a round trip from and to the start of COVID.

So with the H1 performance of shares seeing 90 year lows and bonds 234 year lows how has gold gone in H1 and since that peak in the chart above that has seen $36,000,000,000,000 wiped from investors pockets? H1 to date AUD gold is UP 6.7%. November 2021 (the peak above) to now, gold is UP 12%.

Whilst the ‘traditional’ 60/40 portfolio has served investors well in the past, there seems little doubt we are in the “new investing regime” KKR describe. When a 40 year old investment expert and fund manager who has seen many market cycles come and go say they ‘don’t say that lightly’ its probably worth listening to. Gold seems to know this regardless as it has solidly performed whilst the rest fall around it.