“Brexit II”

News

|

Posted 07/07/2016

|

5142

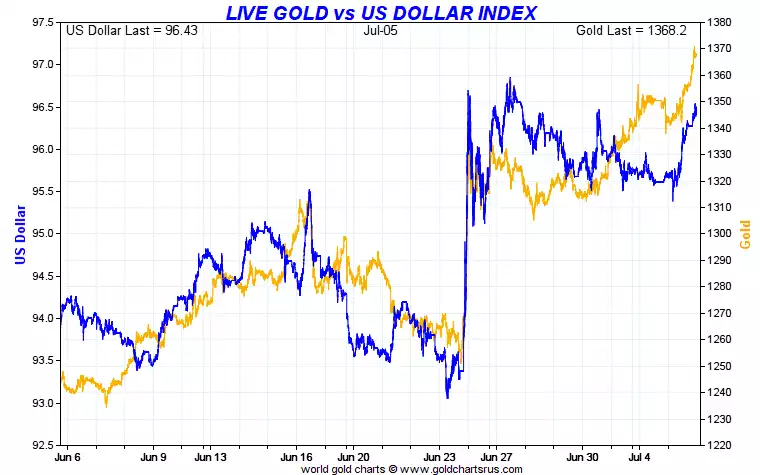

The front page of today’s AFR carries the headline “Brexit II pushes Aussie bonds to record low”. We spoke just yesterday about the ever declining yields on government bonds, with over $11.7 trillion now in the negative globally. The AFR article reports on Aussie bonds hitting an all time record low yesterday of just 1.84% for a 10 year bond. Such is the fear in markets that people are either happy to earn 1.84% for 10 years on a piece of paper debt OR they expect it to get worse and see gains in the bond price as more pile in to bonds. The other safe haven, gold surged to a high not seen since 2011 (and don’t get us started on silver). And for those who are fixated on gold coming off in a rush to USD’s check this out over the Brexit scare period…

So what has spurred on this Brexit II move in markets? Well for a start we had a move by large British commercial property funds to freeze $15.5 billion worth of assets after investors were rushing to withdraw their funds. Bank of England’s chief Mark Carney gave a stark warning of a “material slowing” of the UK economy and the Pound hit another post Brexit and 31 year low. But the bigger news is a deterioration of the Euro banking situation. There is growing tension over the Italian government’s proposed bank rescue package with strong resistance from Germany as it essentially breaks the EU’s (and G20) rules around no bail outs (government bailing out the bank), only bail in’s (shareholders and depositors bailing out their bank).

From AP:

“The country's third-largest lender, Banca Monte dei Paschi di Siena, has been ordered to sharply reduce its load of bad loans, and has until October to come up with a plan to do that. The bank has already tapped investors several times for more money. Its shares have plunged to 0.28 euro cents year from 1.28 euros at the start of the year.”

In response to the kickback from Germany on the proposed bail out the Italian Prime Minister quite bluntly reminded them of the scale of Deutsche Banks issues (as we reported here):

“If this non-performing loan problem is worth one, the question of derivatives at other banks, at big banks, is worth one hundred. This is the ratio: one to one hundred,"

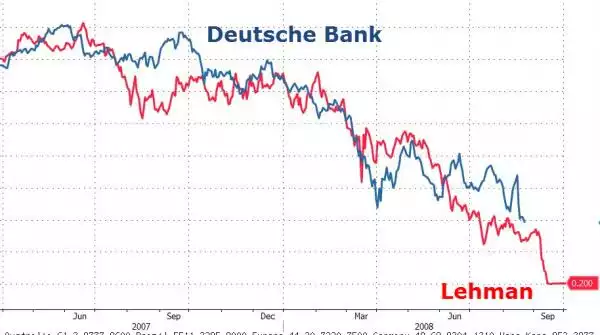

He is referring to the $400 billion in bad loans that can’t be repaid in Italian Banks compared to Deutsche Bank’s 100 fold derivative exposure… And just a reminder on how Deutsche Bank is going: