“Biggest Housing Bubble in History”…?

News

|

Posted 24/02/2016

|

7479

Gold and silver are so called ‘hard assets’, much like property. For the same reason many are piling into precious metals amid financial market turmoil, many are looking at property too (and both can be put in your self managed super fund). If you are one of the latter, you would do well to invest $4 and buy today’s AFR (Australian Financial Review), read the front page story “Uncovering the big Aussie short”, and remember the investment 101 principle ‘buy low, sell high’.

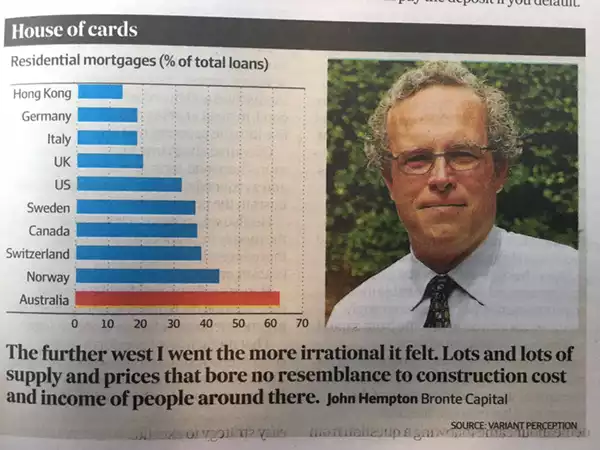

The story outlines how a hedge fund manager and an economist posed as a couple and went ‘shopping’ in Sydney’s west – the sort of ‘rubber hits the road’ analysis all too rare amongst analysts. What they experienced was nothing short of scary and certainly worth the read. It was a combination of oversupply, over-pricing, no deposits and systemic misrepresentation to get mortgages at record low rates that even then are often interest only. They specifically called it a Ponzi scheme and bluntly warn “Australia now has one of the biggest housing bubbles in history” and predict house price falls of up to 50% in Sydney and Melbourne and 80% in mining towns. They note that our real estate value to GDP is 3.8 times (above Japan and Ireland’s record 3.5 before their 50-80% property busts), that Australian household debt to GDP is the highest in the world, and most of that (per the crude photo of the chart below) in the form of residential mortgages. Needless to say they (their hedge fund) have gone short residential property and its implications (banks, AUD (which they predict will fall to 40c!), etc).

We are not saying this one piece of research gazumps any other but it has many fundamental elements that strike very true. It also mirrors growing concern in Brisbane particularly with oversupply concerns on apartments. BIS Shrapnel reported 2014-15 saw a record year of dwelling starts nationally and, critically, those starts exceeded underlying demand in all states.

Throw in possible negative gearing changes and it is a time when any new investment property purchase might be considered, well, ‘brave’….

The flipside to the ‘clay brick’ scenario is the gold and silver ‘bricks’ option. Gold and silver prices have (or are) appear to be coming through the other side of a price bottoming process. Now refer back to that economics 101 rule….