‘In Gold We Trust’ Preview – Inflation or Stagflation?

News

|

Posted 11/03/2021

|

6628

This is our third preview of the upcoming ‘In Gold We Trust’ report by Incrementum . The report is arguably the pre-eminent annual report on gold and silver, read by over 2m people in 2020. On Monday we gave the context of this epic setup for precious metals, yesterday talked to gold’s performance over time and particularly against US shares, and today we look specifically at the inflation genie and its evil brother stagflation.

Yesterday we illustrated the historic correlation between the gold price and real interest rates. Rising bond yields without meaningfully rising inflation (at least as officially measured) is putting pressure on the gold price. And so the elephant in the room is inflation..

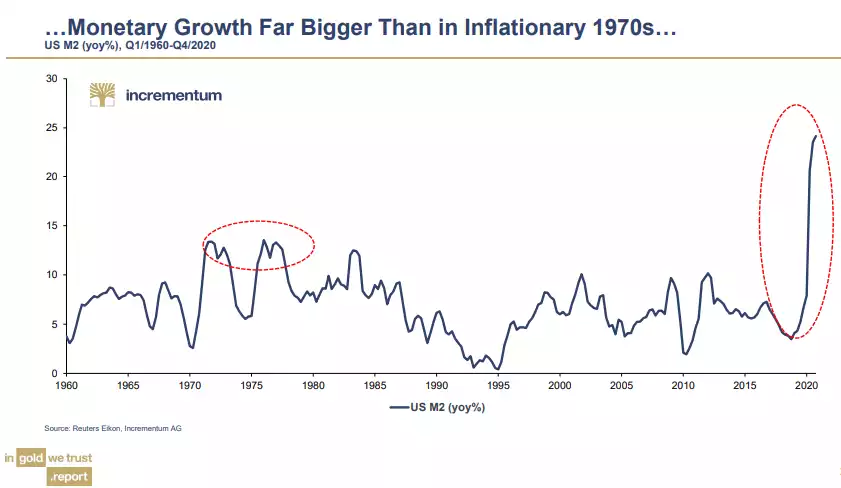

There are a number of factors pointing to coming inflation even if discounting the fact the $1.9 trillion US fiscal stimulus package was approved yesterday and another $3 trillion into ‘infrastructure’ is hot on its heels. The first chart below shows the current supply of US ‘money’ (its not btw, its Fiat currency…). The last bout of very serious inflation was the 70’s. Apart from leaving the discipline of the gold standard and other market factors, it saw rampant money supply growth. You can see in the chart below there were 2 programs, tripling and doubling money supply (M2) each respective time. That saw inflation rise from 3% to 12.4%, interest rates hit 20%, the sharemarket lost 50% and gold and particularly silver skyrocket 1750% and 1330% respectively. Pfft, 2020 saw a 5x increase in money supply!!

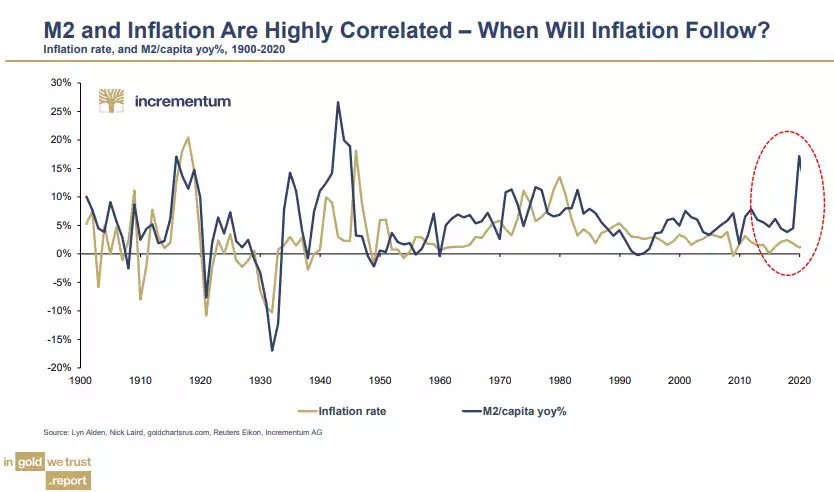

The correlation between M2 and inflation is high but so far all we have seen is financial assets such as shares inflate not CPI. We have discussed at length the very real social implications of that largely just enriching the top 5%. The chart below clearly illustrates this:

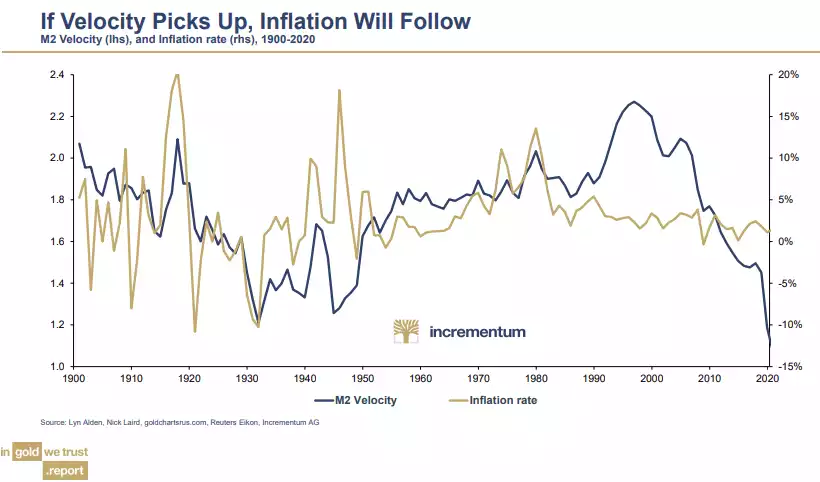

That has presented in very low velocity of money due in large part maybe because of the COVID shutdowns. The shutdowns (in the US at least) are now starting to dissipate, vaccines rolling out and hence the expectation that so too will velocity jump.

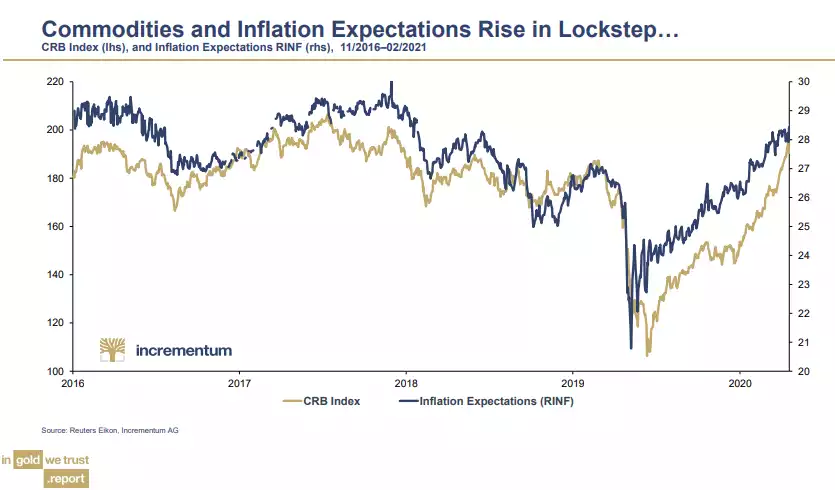

The other bellwether, parking chicken and egg arguments, is commodities. This is another very tight historic correlation as you can see below. You will note this is inflation expectations, not actual inflation, which for now is what matters as that is what the market is pricing…

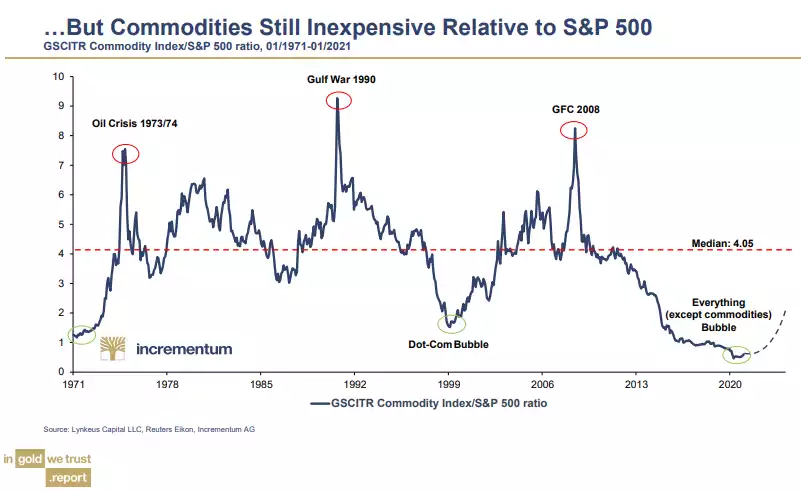

Looking at the chart above one might think you’ve missed the boat… the following shows just how very, very low commodities are historically. As a precious metals investor just consider what that could mean on the mean reversion alone…

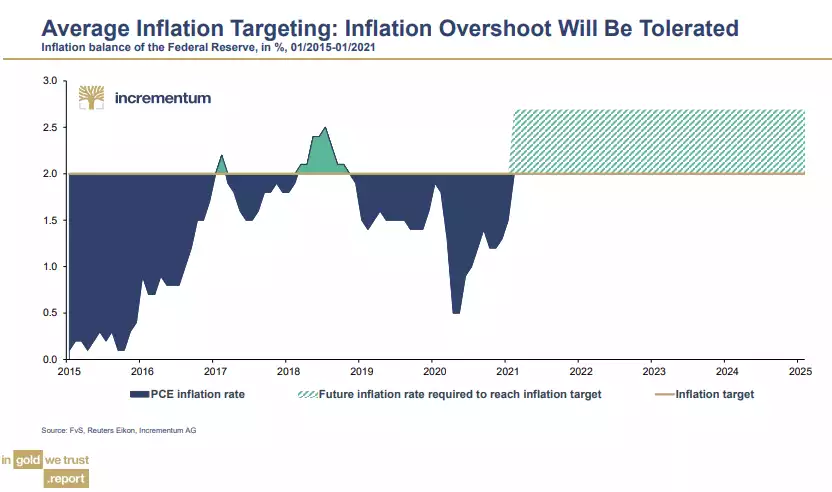

The Fed have made it abundantly and explicitly clear they will not fall into the trap of moving too quickly on signs of inflation. They will wait for sustained, ‘sticky’ inflation above their 2% magic line before acting to contain it. That may sound innocuous but is potentially huge as once inflation gets going when you have such an unprecedented amount of new money sloshing in the system, it could be very very hard to then contain.

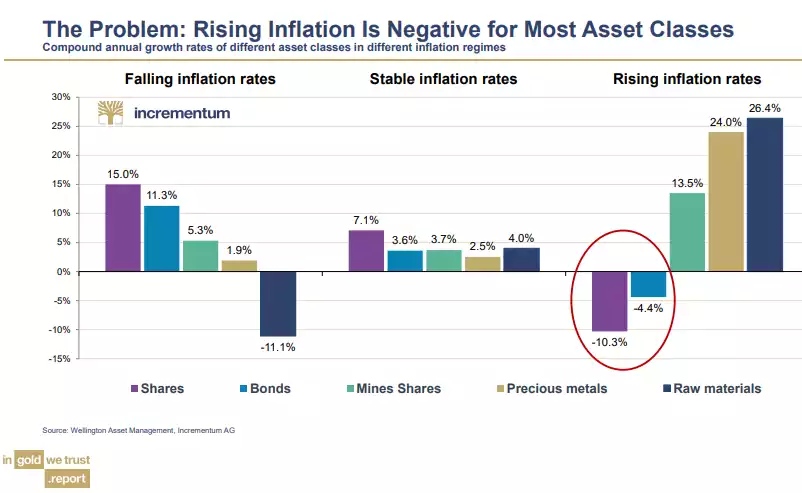

There is a misconception amongst some investors that rising inflation is positive for shares. The chart below firmly debunks that and shows gold is second only to raw materials, a proxy for that broader commodities index that is so bullish for silver (but more on silver tomorrow…). We are already seeing bonds falling and yields on the rise. It seems only a matter of time that shares follow, particularly at such unprecedented fundamental-less highs.

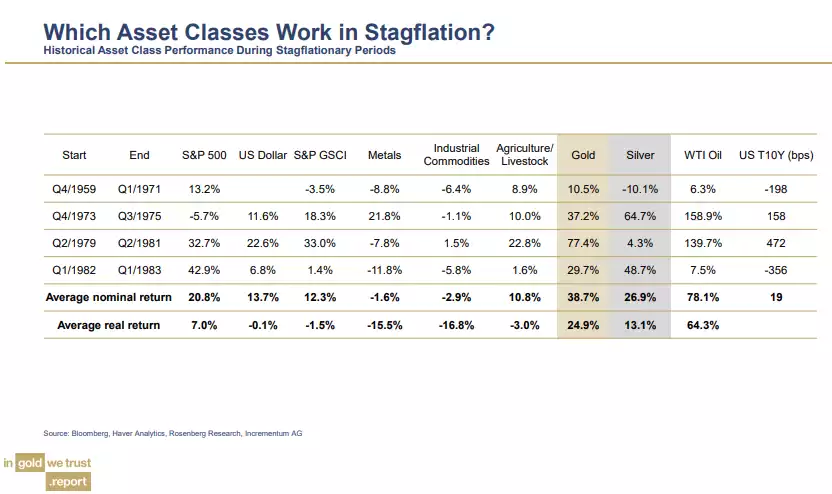

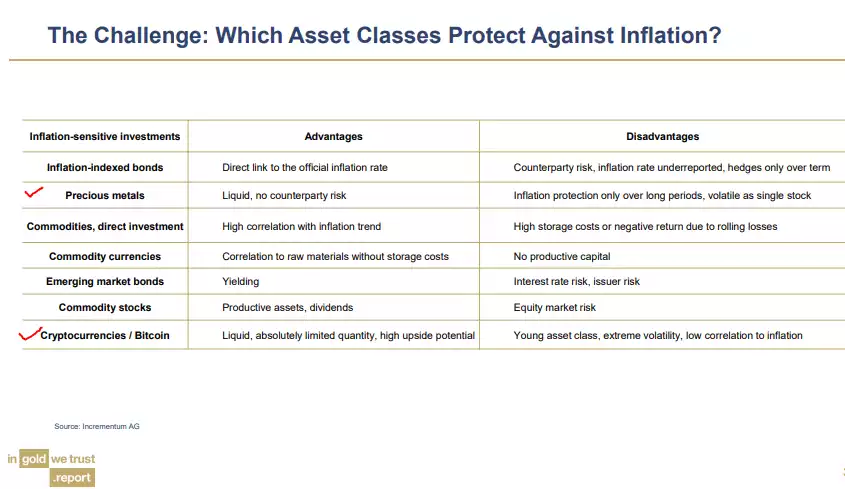

So how can one invest to best grow one’s wealth in such an environment? 2 of the best options in the table below are available from us right now:

However whilst all this talk is about inflation, what is likely more relevant to the post COVID economy is instead stagflation – that is inflation AND low growth and employment. That is a nasty mix. The 70’s again were the first real example of this and it is a brutal combination, debunking the long held belief that high inflation meant low unemployment. The structural changes likely in the employment market after COVID makes stagflation a very real possibility going forward. The chart below again illustrates gold and silver’s performance in such an environment: