Transitory Strong USD Gift to Gold Buyers

News

|

Posted 18/06/2021

|

6770

The fallout from the change in tone of the Fed Wednesday night continues with the USD continuing its march higher, shares faltering, bond yields falling and both gold and silver falling with them. Crescat’s Tavi Costa tweeted some perspective:

But regardless the market is swallowing the jawboning and that should always be cause for pause and consider various views. Raoul Pal is one who believes inflation will be transitory, the USD will continue to rise for a period but the US economy will weaken later this year. He tweeted a summary view last night and it is worth sharing.

“The dollar is always the KEY macro variable.

When it moves, everything moves. If the dollar rises sharply back to the middle of the range, it kills the inflation narrative for now.

The real guts of the inflation debate is more likely next year's story.

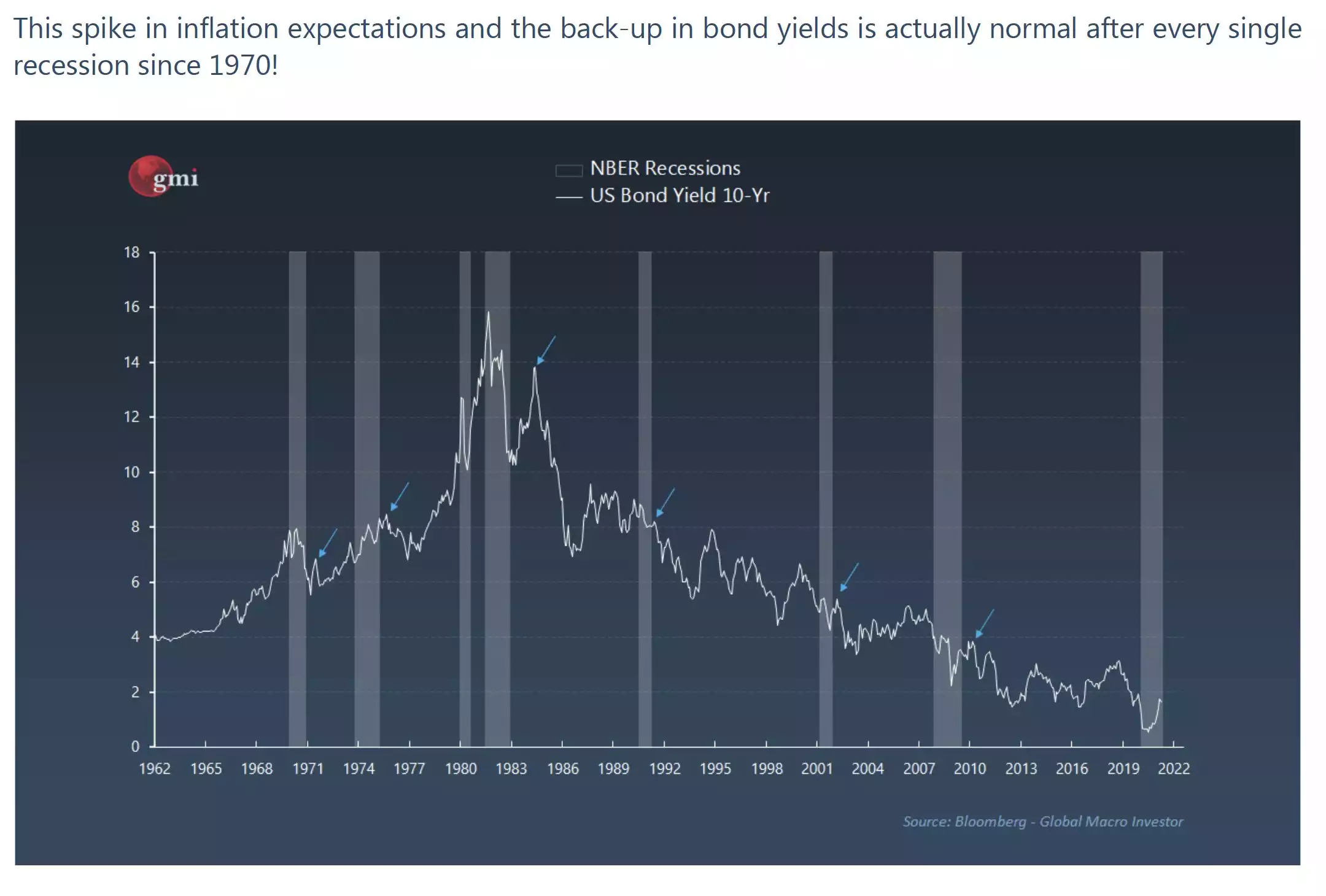

It is normal to see inflation fears immediately after recessions but they tend to ease sharply (or entirely reverse, as do bond yields).

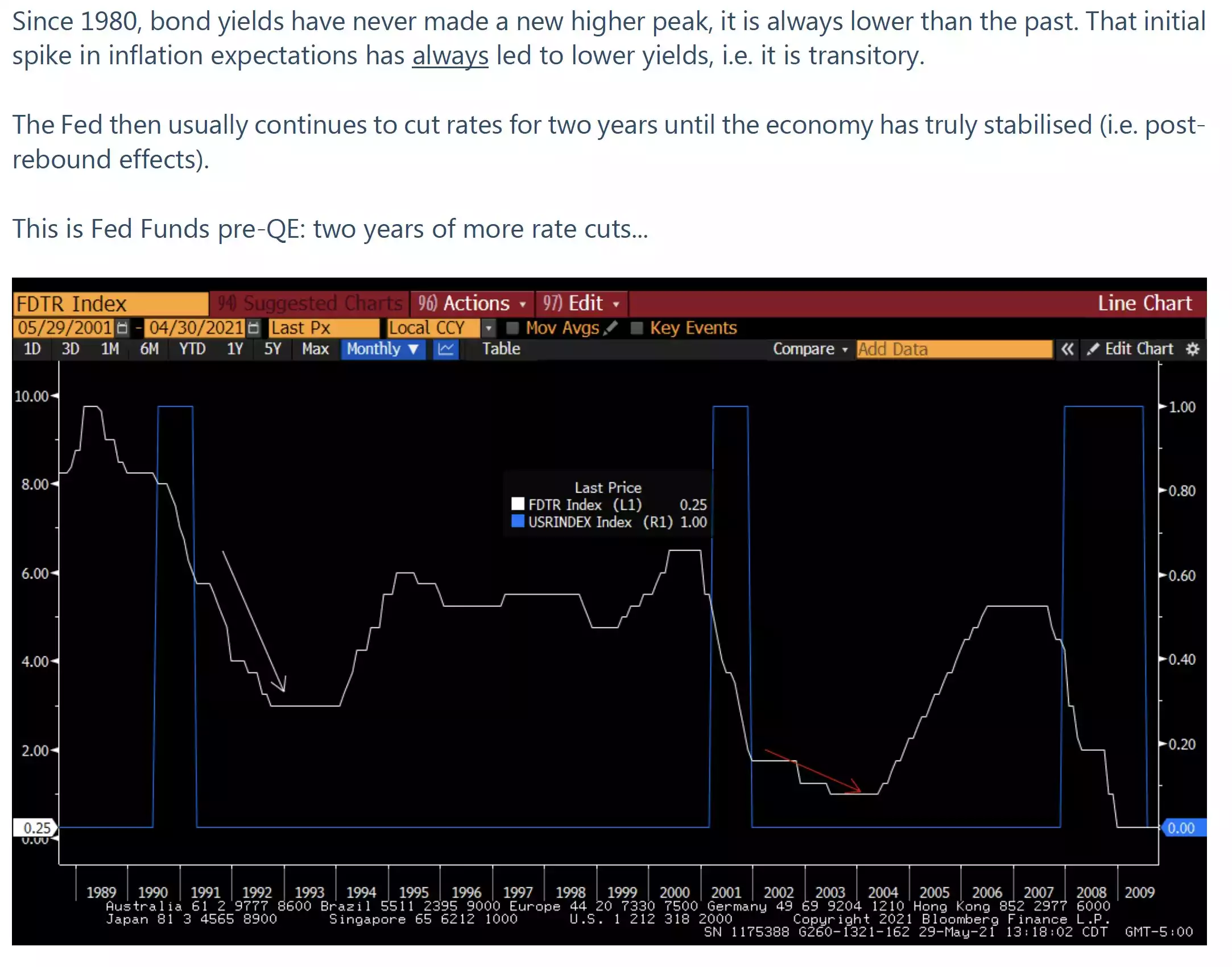

And The Fed always cuts again (for 2 years) after the recession as stimulus and re-bound effects wear off...

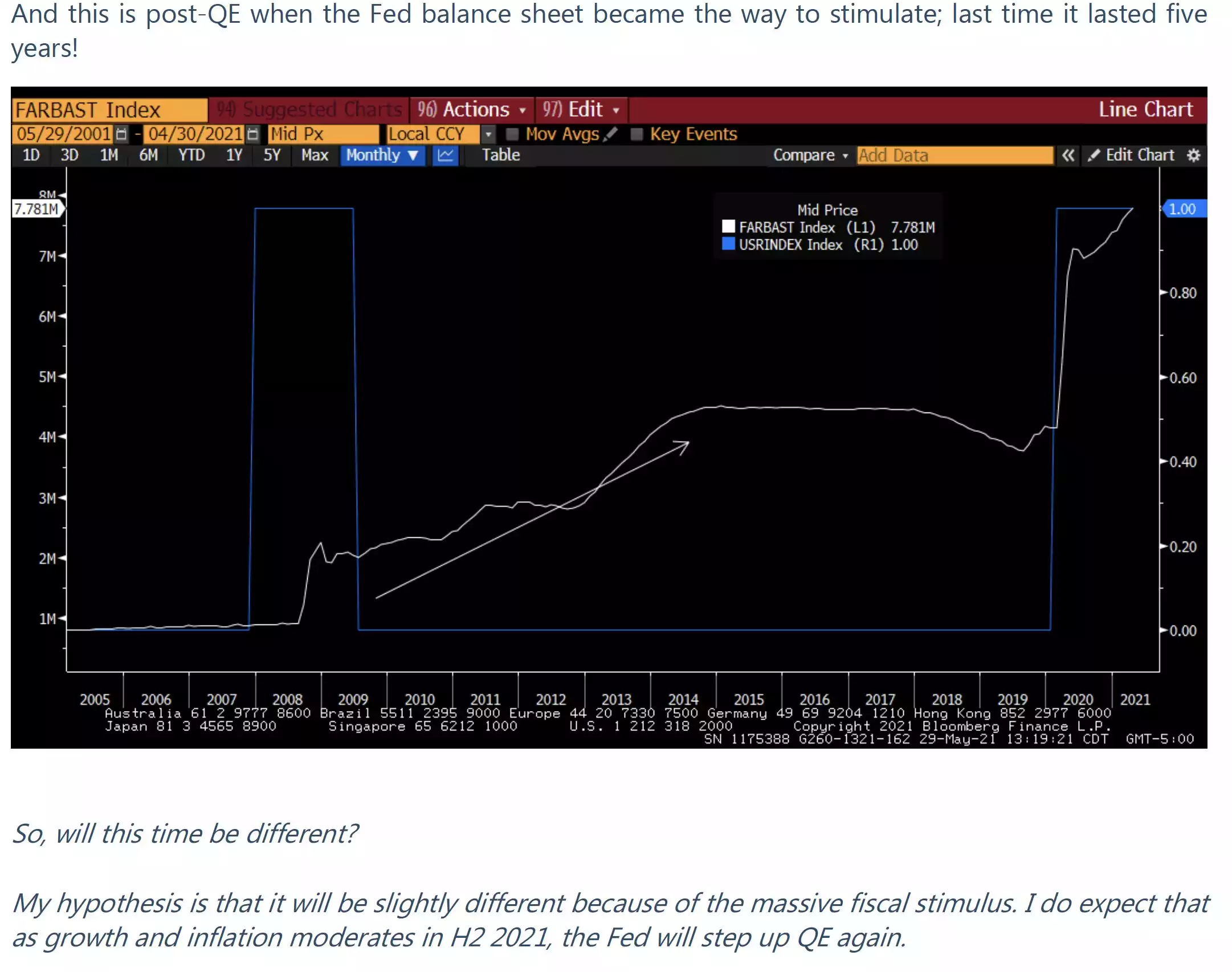

Same happened with QE after last recession

The government tends to push through one or two more stimulus (in this case I think they will be massive) and the Fed balance sheet will continue to expand, and bond yields should drop once more...

My view remains that H2 is weaker than expected and inflation fears subside for now, and growth looks patchy. That results in more stimulus (not tightening) in Q4.

What does it mean for markets? Well, the dollar keeps rising for a bit. Commodities correct. Tech and Exponential Age stocks rip higher.

Weaker data will eventually lead to Gold and Crypto moving sharply higher, especially once the dollar stabilises a bit.

We need to see the dollar break this inverse head and shoulders first...

But I think the dollar is range bound and heads to the 96 to 98 level before settling...

Let's see how it plays out... but keep your eye on the dollar. It is still the king, and remember 100% of all forecasters on Bloomberg at the beginning of the year suggested it was going to weaken a lot. They are usually wrong when consensus is so high.

But massive infrastructure stimulus that will keep coming will drive up commodities over time as long as the dollar is not ripping. But I think the first wave is possibly done and will correct for a while now.”

In the near sighted short term gold and silver are falling off the back of a rising USD (albeit cushioned for Aussies by a falling AUD) and goldilocks Fed narrative of subdued inflation and rising rates. However, whether you are in the transitory or sticky inflation camp, the outcome is likely the same later this year, and that is the Fed unleashing more not less stimulus. That drives rates down, less even what’s left of even transitory inflation will still be firmly negative rates and throw in a falling USD and you have great support for higher gold and silver prices. Rare is it that both sides of a macro economic debate lead to the same outcome of support for gold and silver.

That near sightedness is arguably gifting investors a dip buying opportunity right now for both metals.