$30 trillion US Public Debt & What it means

News

|

Posted 07/02/2022

|

7397

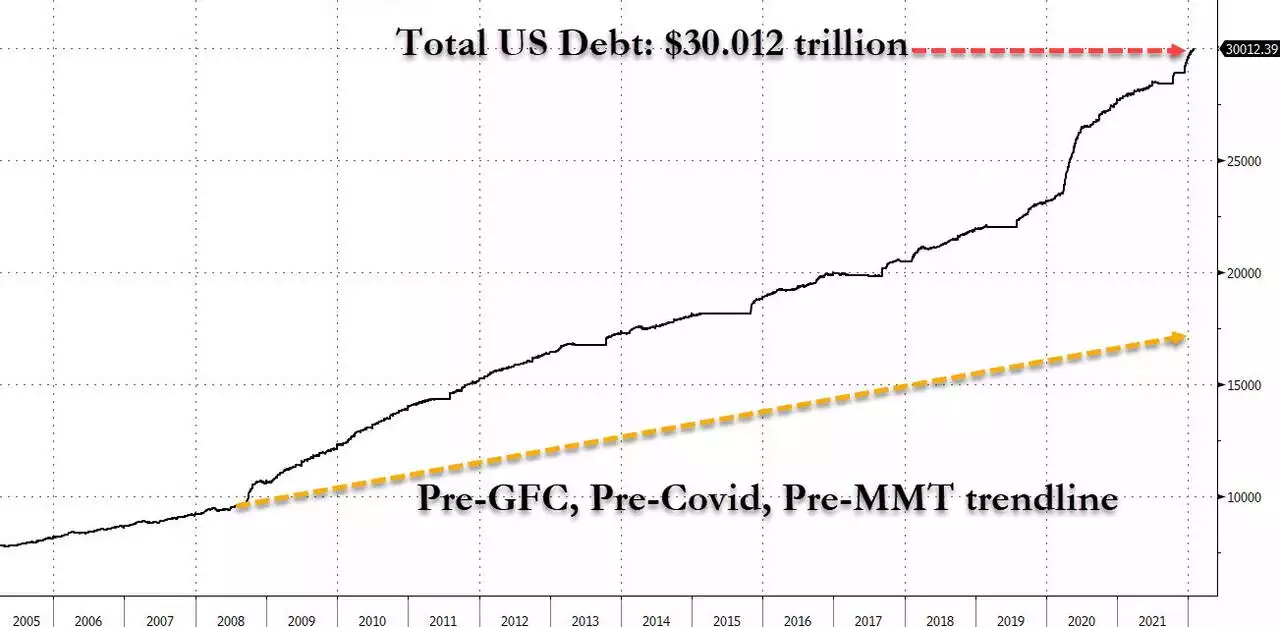

Last week the US hit a milestone no one could have thought possible only a few years ago. The US government is now the proud owner of $30 trillion of debt. As at the end of January they owed $30,012,386,059,238… The US national debt has tripled in just a decade.

In 2019, US GDP grew 4.0%, fuelled by 4.7% deficit spending. COVID saw a 2.3% GDP drop, albeit short but the sharpest in history. In 2021 their economy grew 5.7% off the back of an unprecedented 12.4% budget deficit spending program of $2.8 trillion. And now in 2022 they are getting strong resistance against the Build Back Better spending program and the Fed looking to not just print less more (‘taper’), but actually raise rates and sell some of their massive pile of bonds.

Zooming out one really sees this ‘exponential’ surge at what might be the tail end of an incredible credit cycle.

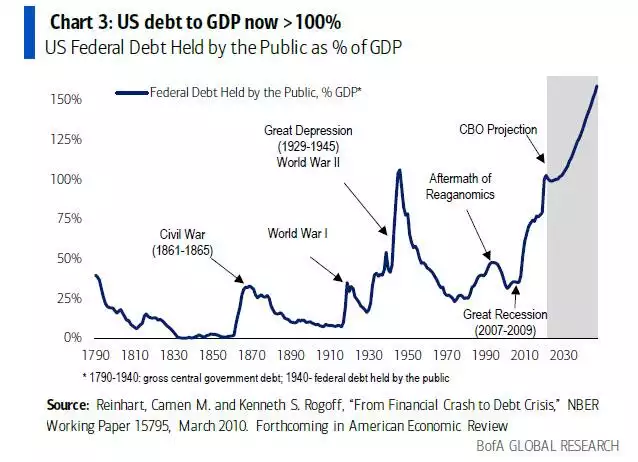

That $30 trillion tips the US over the ‘line in the sand’ 100% Debt to GDP…

Note in the chart above the US Government’s very own Congressional Budget Office is not even pretending there will be any slowdown of this massive debt accumulation seemingly without regard to how sustainable that may be.

The Fed announced late last year it would taper its $120b/month QE program to end mid 2022, but then December saw $107b printed and January over $110b. And THAT tanked markets in January….

And so here we sit at one of the most important economic junctures in modern history. We have a debt burden only matched by that of the WWII funding (measured against GDP), but an economy completely reliant on free money accumulating debt, rates already near zero, and money still being printed (albeit meagrely ‘tapering’) at circa $100b / month. Inflation is rampant which is good for reducing that debt burden but will see the whole system blow up if left unchecked. The economy is peaking but it is “hyper-financialised” and hence completely precarious. All economies ‘peak’ before they crash; it’s the central bank intervention cycle of things. Raise rates amid $30t of US public debt (100% of GDP), or $226t of global debt (99% of global GDP) and the already turning economy busts. Inevitably that sees central banks and governments back and doubled down with more stimulus further inflating a barely deflated debt bubble (hence the self aware CBO projection above). Do nothing and the bubble gets more and more unsustainably bigger as are credit cycle’s natural trajectory. You can see where this all ends yeah? There simply is no non messy end to this unprecedented global economic Ponzi scheme.

But take comfort in the fact we have been through this many times throughout history. We shared Ray Dalio’s (billionaire head of the world’s largest hedge fund) history lesson in this regard here. A must read if you missed it.

Dalio famously once said “If you don't own Gold, you know neither history nor economics.”

The asset that always survives and indeed thrives in these repeated cycles over 5000 years is gold.

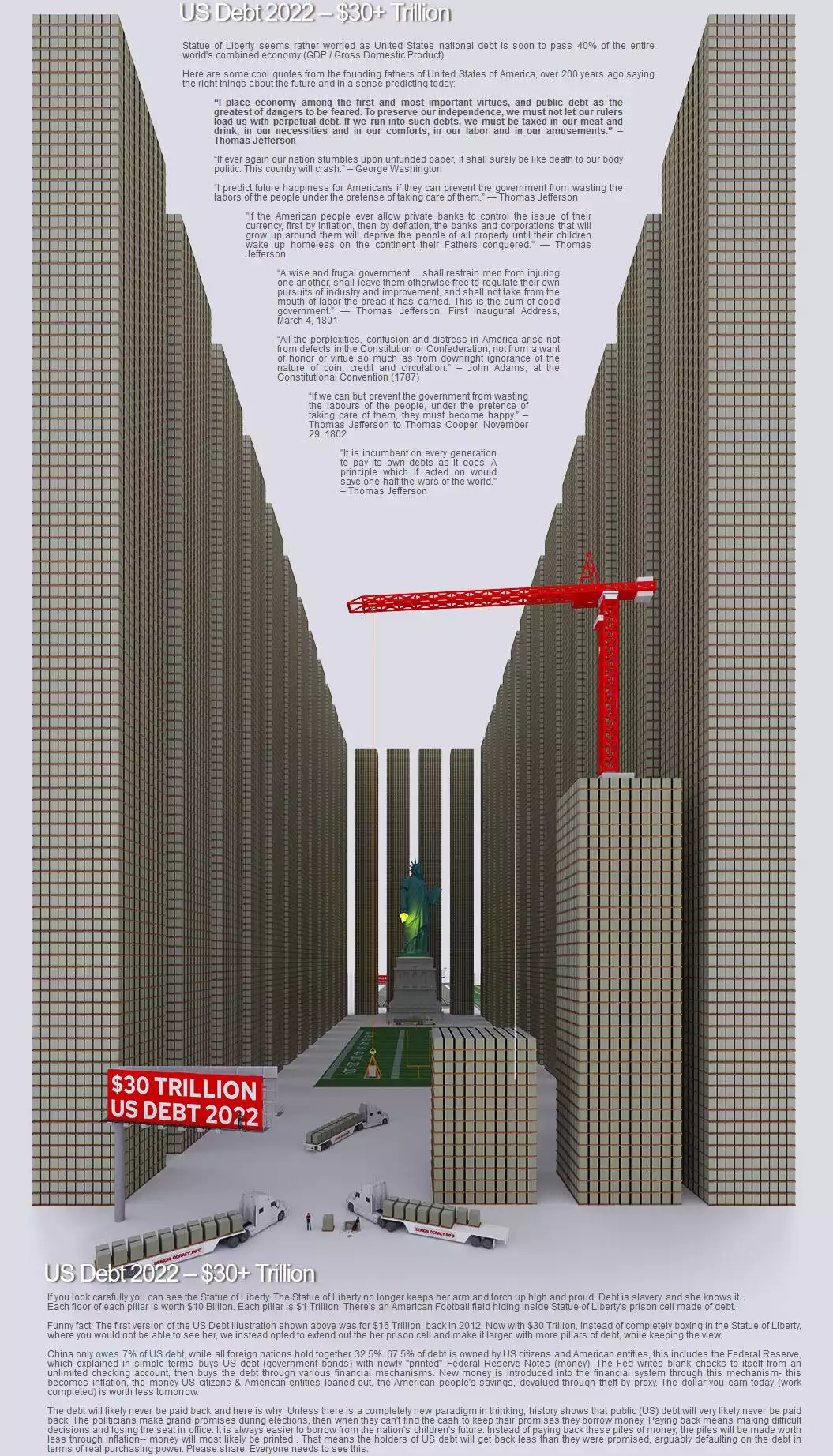

Still not convinced? If you can’t imagine what $30 trillion looks like, VisualCapitalist help below (click on the image to also see a video representation):