92% Chance of Global Recession

News

|

Posted 22/10/2018

|

7381

The world appears to be a 2 speed economy – the US and the rest, and at the same time potential Black Swans circle ominously. Be it a looming failed Brexit deal, Italy’s tenuous relationship with the EU (and being downgraded to near Junk by Standard and Poors Friday), Khashoggi tensions with Saudi and the rest of the world, Russia’s anger at the US pulling out of the nuclear treaty or US plans to flagrantly cruise through the Taiwan Strait with a warship, the world is an ‘interesting’ place at the moment to say the least.

Just how long can the US keep the system afloat and just how long can the US economy withstand the coming hikes the Fed is hell bent on delivering.

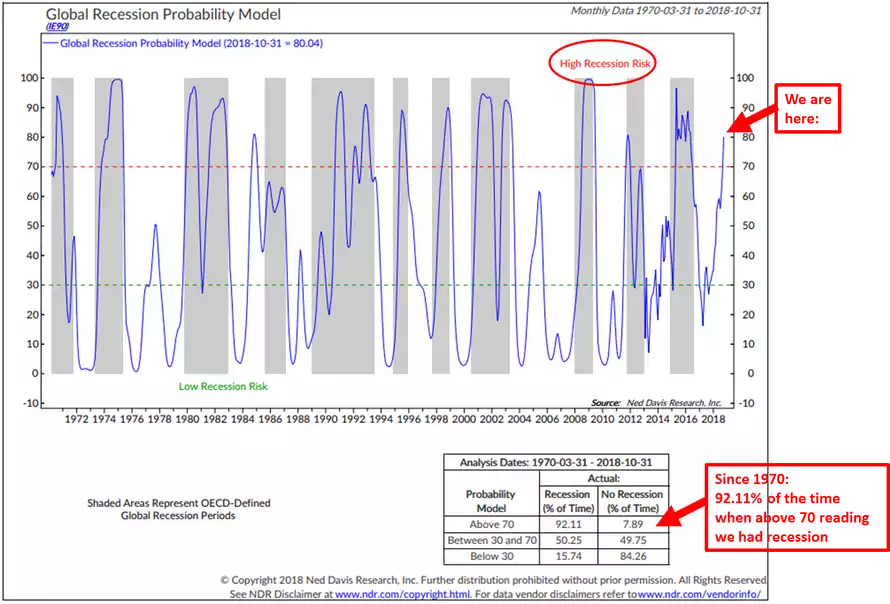

Ned Davis Research Group (NDRG) was just named the 2018 Wealth and Money Management Awards- Best Global Investment Research Firm. They have developed what they call their Global Recession Probability Model and its one with an enviable track record. This is how they describe it:

“The NDRG Global Recession Probability Model based on the Amplitude-Adjusted Composite Leading Indicators (“CLI”) created by OECD for 35 countries. Each CLI contains a wide range of economic indicators such as money supply, yield curve, building permits, consumer and business sentiment, share prices, and manufacturing production. There are usually five to ten indicators, which vary by type and weight, depending on the country, and are selected based on economic significance, cyclical behavior, and quality.

The Global Recession Probability Model uses a logistic regression method incorporating both the CLI level and trend data of all 35 countries to predict the likelihood of a global recession. A score above 70 indicates high recession risks while a score below 30 means low risks.

The CLIs are normally released on the second Friday of each month for the two months prior, or about a six-week lag. Meanwhile, the NDRG Global Recession Probability Model is a forward-looking model using a two-month lead in the CLI data.”

So to be clear, readings above 70 have historically (since 1970) delivered a 92% chance of a Global Recession. It just hit 80 as we see economic growth softening in China, Europe and of course Emerging Markets. Last time the US was in easing mode and got through it and probably prevented it getting worse for global markets. This time they are tightening and that represents a VERY different scenario.

NDRG are clearly not alone in their concerns. The last couple of weeks has seen a huge turnaround in the risk-on sentiment with speculative short positions in both the VIX (volatility index) and gold being squeezed. Gold has risen over $37 in October since the market nervousness re-emerged.

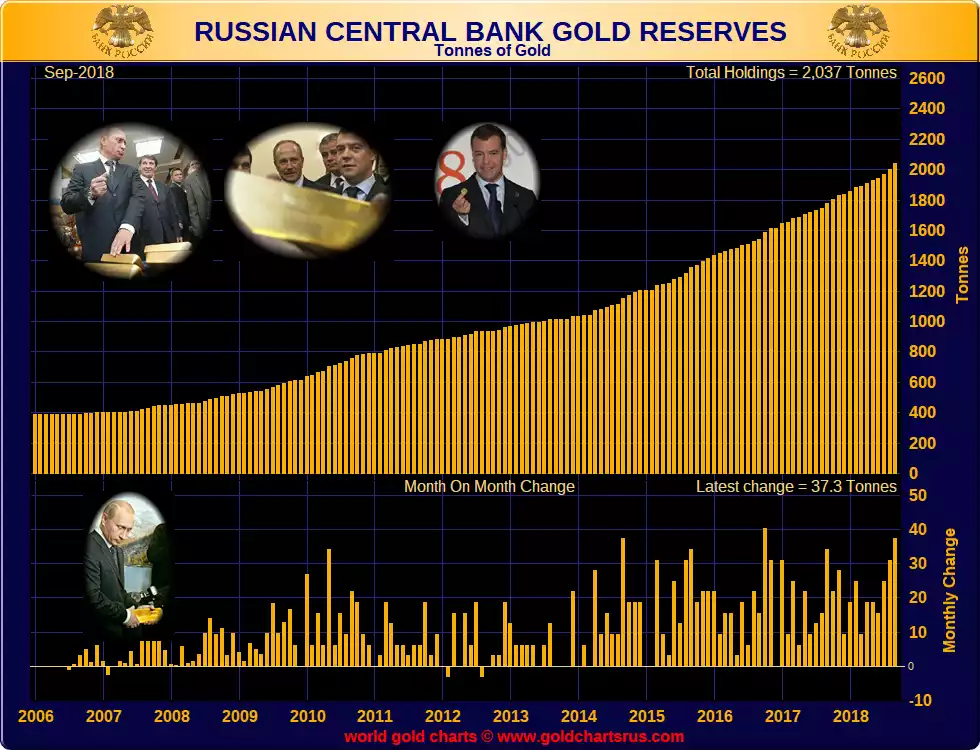

Last week we discussed Hungary’s 1000% increase in gold reserves. Well we just learned that Russia, whilst dumping US Treasuries (they’ve sold 92% of what they held in 2010) bought up 1.2m oz of gold in September alone, their biggest month in 2 years in their relentless accumulation of the yellow metal.