World Gold Council Q1 Wrap

News

|

Posted 08/04/2022

|

7801

The World Gold Council just released their figures for both the month of March and also Q1 of 2022. Unsurprisingly given the global geopolitical events and inflation issues before us gold demand was the highest seen in years.

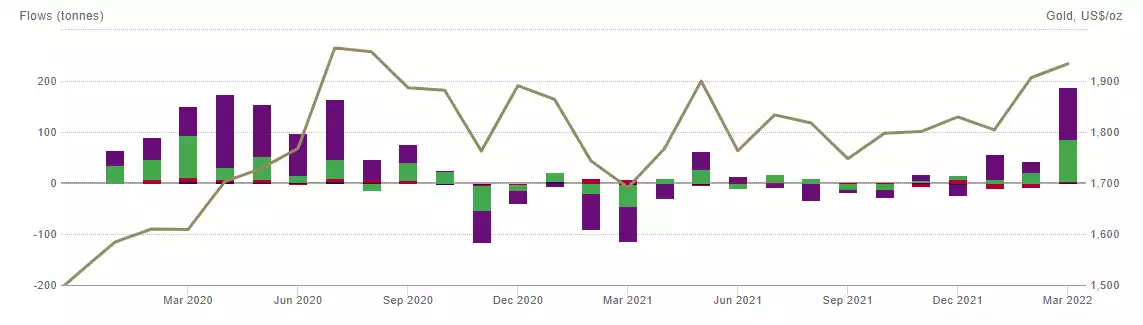

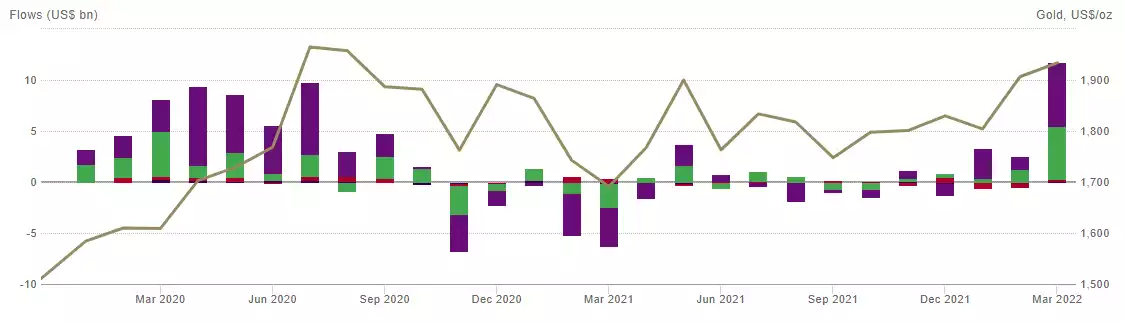

“Global gold ETFs had net inflows of 187.3t (US$11.8bn, 5.3% of AUM) in March, with assets just below the record of US$240.3bn, set in August 2020. March inflows were the strongest since February 2016, despite a significant rebound in equities and a strong US dollar performance. There were positive flows across all regions during the month, but most came from North American and European gold ETFs. March demand brought Q1 inflows to 269t (US$17bn) –the highest quarterly inflows since Q3 2020, as global equities had their worst quarterly performance since Q1 2020.”

You can see the scale of this from the following charts in tonne and dollars:

“Gold rose for the second consecutive quarter in Q1, ending 8% higher at US$1,942/oz – its best quarterly performance since Q2 2020. It was among the best performing assets amid significant weakness in both equity and bond markets. In a period marked by economic uncertainty and increased volatility, gold proved a reliable source of diversification and wealth preservation.

Gold’s Q1 performance was primarily driven by:

- rapidly rising inflation

- higher interest rates

- unexpected geopolitical risk.”

“The geopolitical situation remains an important driver for gold. A prolonged conflict in Ukraine will likely result in sustained investment demand. In contrast, a swift resolution, something which we all hope for, may see some tactical positions in gold unwind, but much like in 2020 we believe significant strategic positions will remain.

However, we believe that the opposing forces of inflation and rising rates will likely be the strongest influences on gold in Q2.

The post-COVID economic recovery and supply-side disruptions, which have been exacerbated by the Russia–Ukraine war, will likely keep inflation higher for longer.

Central banks have shown they are prepared to act. The Fed has begun to raise rates, following the Bank of England (BoE) which has now raised rates in the last three meetings. Even the European Central Bank (ECB), which has resisted growing calls to action, indicated a more hawkish stance at its most recent meeting. While our historical analysis shows that gold has typically performed well following the first rate hike in a tightening cycle, we believe gold may come under renewed pressure around the forthcoming Fed and ECB meetings.

But the war is also affecting the global economic recovery. This has recently prompted a number of ratings agencies – such as Fitch – to downgrade their 2022 growth forecasts. Widespread rising inflation expectations, low growth, and falling consumer confidence may further complicate central bankers' policy decisions.

They have also reignited the fear of stagflation, an environment in which gold has historically performed well.”

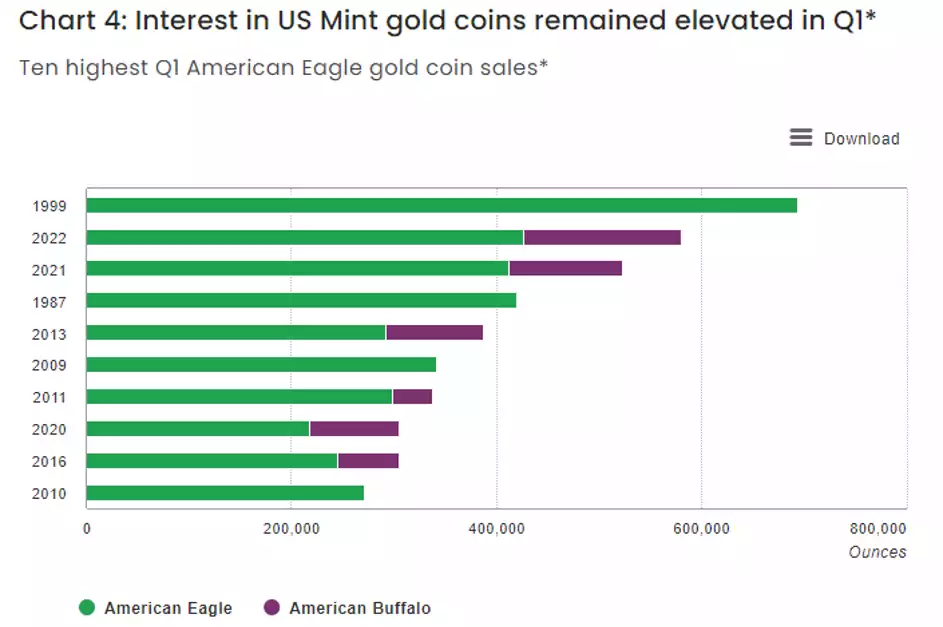

Finally they noted “US Mint data shows that gold coin sales (American Eagle and Buffalo) totalled US$427mn (220,000oz) in March. This pushed Q1 total US gold coin sales to over US$1bn (518,000oz), the second highest Q1 sales total in volume terms since 1999 (Chart 4). This performance clearly shows that the strong retail interest in physical gold investment products from last year has continued into 2022.”

Because American Eagles are not pure they attract GST in Australia (10% extra you’ll never get back) and hence the Buffalos are the more popular here. Ainslie has the Buffalo for sale here…