World Aflood With New “Money” – What Next

News

|

Posted 30/03/2020

|

22521

Last night our PM announced further economic support packages to help ease the impacts of this recession as are all governments around the world. It is interesting and scary at the same time to quantify this and Bank of America Merrill Lynch have done exactly that describing this as the "fastest crash, deleveraging, recession, policy panic in history"…

In the context of an $86 trillion economy and $13 trillion already in total central bank stimulus since the GFC, we have already seen since the virus:

- $7 trillion in monetary stimulus (QE and the like) or 8%!

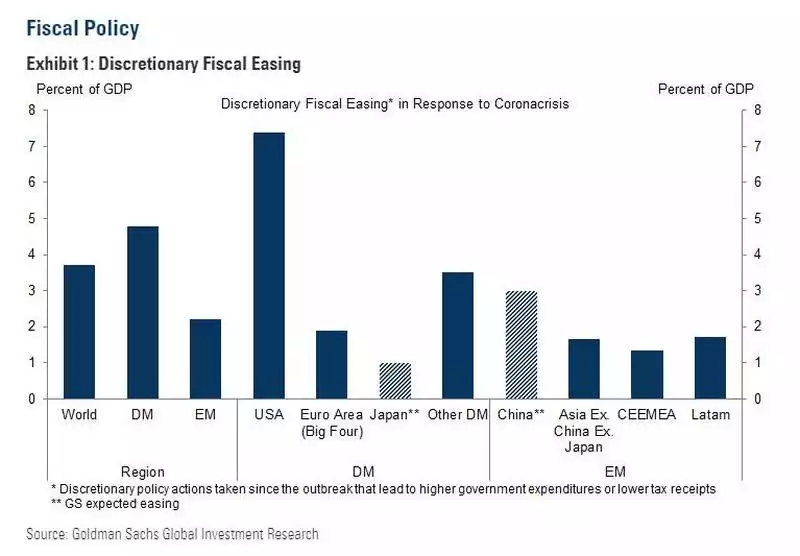

- $5 trillion in fiscal stimulus (wage support etc) or 6%

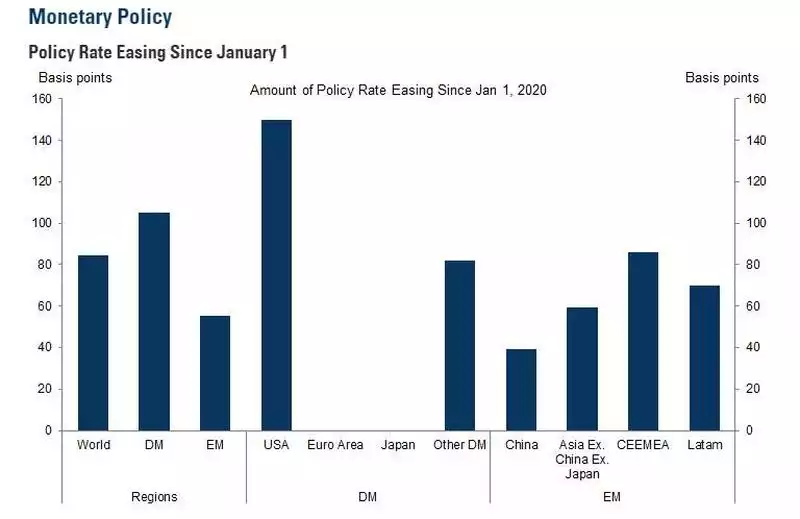

On top of the cash monetary stimulus global central banks have cut rates no less than 65 times this year already… and we are in March! This, remember too, is after rates were already at a low base with 853 rate cuts globally since the GFC.

These actions eased markets for a while but they fell again Friday night. BofAML’s chief investment strategist has a favourite saying “Markets stop panicking when policy makers start panicking.” These are not numbers associated with calm….

Goldman Sachs have put that into charts for you:

Everyone bought gold after the GFC thinking all the monetary stimulus would cause inflation. Gold rallied strongly right up to 2011. But it became apparent that the only thing seeing inflation was shares – i.e. Wall St not Main St. This time however there is a lot more direct fiscal stimulus, particularly in the form of helicopter money. We have also learned that the ‘don’t fight the Fed’ argument is not infallible. As we reported last week, Deutsche Bank are warning of coming hyperinflation from all this new money flooding into the sick patient that will one day recover. The Germans had firsthand experience on this during the Weimer period where they saw one of the worst hyperinflation events of a developed nation. More recently we have the lessons of Argentina, Zimbabwe and Venezuela as modern reminders. Gold in each of these countries accordingly skyrocketed for those smart enough to have bought it beforehand.