Why the fastest doubling of S&P500 portends trouble ahead

News

|

Posted 25/08/2021

|

5938

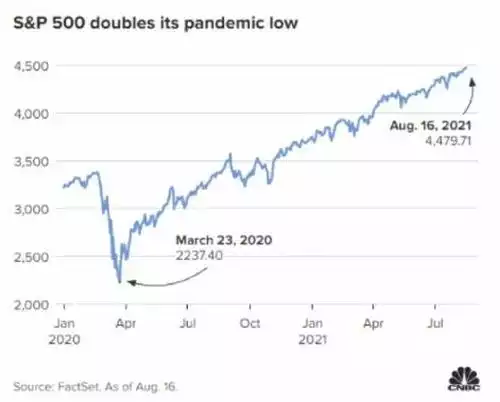

COVID and the response by central banks and governments alike have rewritten the record book in so many ways. Last week, just 354 trading days from the bottom of the deepest but shortest recession in history, the S&P500 doubled in value from that 23 March 2020 low. That rally to double is the quickest since World War II.

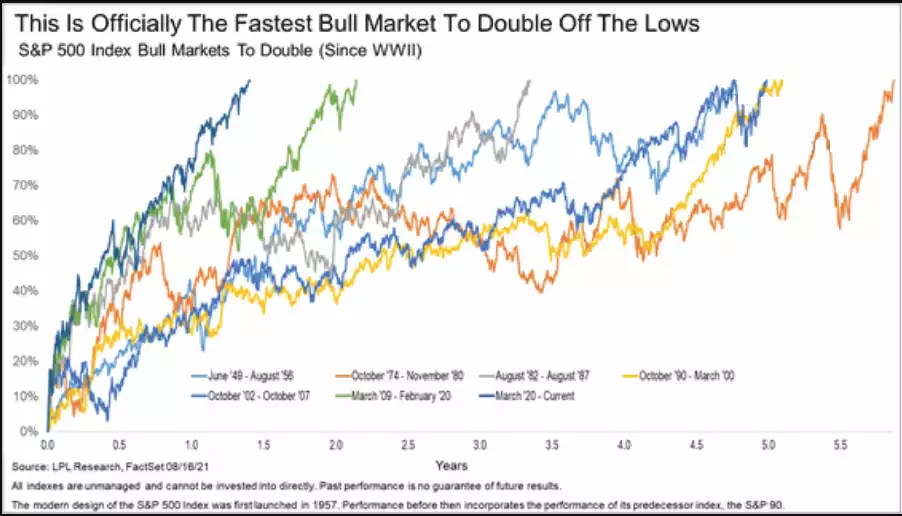

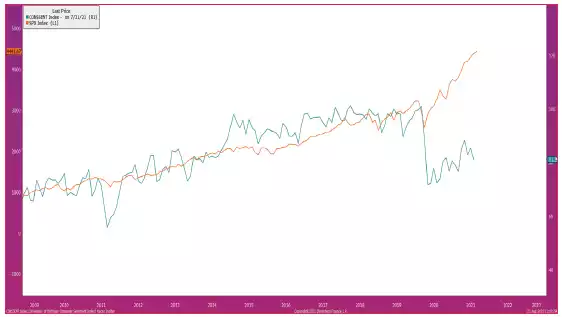

The chart below shows just how quick this was compared to previous doublings:

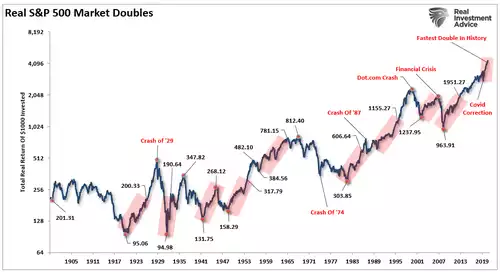

Lance Roberts from REA then puts these rallies in to perspective by broadening the picture around what happened before and then after these epic rallies. The chart below shows the S&P500 in real terms via the master, Dr Robert Shiller. The red bands mark each doubling event from a preceding low.

“1949-1956: The market rallied further before declining by 20%. That correction led to a second double that coincided with a level not revisited until the mid-1980s.

1974-1980: The market double followed one of the worst bear markets in history. Unfortunately, the entire gain, on an inflation-adjusted basis, was lost by 1982.

1982-1987: The crash in 1987 followed the rally from the 1982 lows.

1990-2000: The market doubling in the 1990s ended in the “Dot.Com” crash.

2002-2007: Following the Dot.com crash, investors who just recovered losses got hit by the “Financial Crisis.”

2009-2020: The liquidity-driven rally from the 2009 lows is the strongest advance in history. The March correction surprised investors, but the pump of liquidity revived the “animal spirits.”

2020-Present: The fastest doubling of the market in history occurs at a time of peak valuations, economic, and earnings growth.

It is worth noting that despite 4-doublings from the lows, investors in 1905 didn’t break even until 1955 (That’s 50-years of zero returns.)”

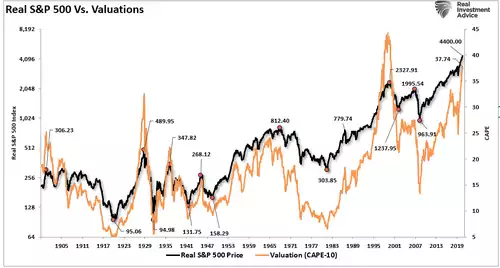

A critical piece of context for this rally, and as noted above, is that it started with valuations already high.

“While the jump in earnings and profits surged from the pandemic lows, valuations were not allowed to revert, as would typically be the case during a recession. If valuations corrected during the pandemic-driven shutdown, as prices fell and earnings surged, a more sustainable case might exist.”

That is clearly depicted in the chart below:

That might be more palatable if we were not seeing very clear signs of an economic slowdown ahead. In the US, consumption accounts for 2/3 of GDP. Roaul Pal, in his latest Macro Insiders “In Focus” report had this reminder:

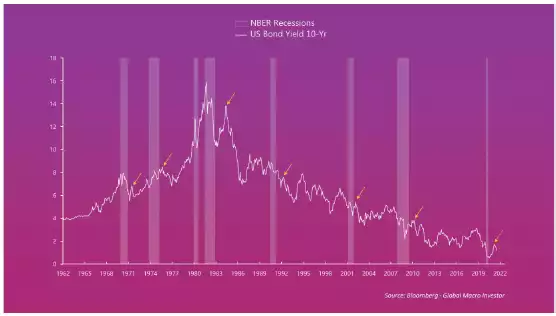

“Nothing better sums up what is going on than this chart of the SPX vs Consumer Sentiment...

I see no other outcome than a reversal of the tapering talk and in fact a shift to new stimulus. The new Powell pivot is coming... and it is not news to the bond market.

Every single post-recession period has seen 10-Year Yields rise and then collapse. The market is ALWAYS too early in forecasting a self-sustaining recovery. This time will be no different...”

Just as bond yields rolled over in March, so too gold bottomed and has been trending up ever since (albeit with a fair bit of ‘chop’). From the AUD low of $2189 to the current $2500 we’ve seen 14% increase in just 5 months. Pal often calls the bond market the market of truth. Gold still has some way to catching up to the usual correlation between the two. Regardless, both are telling you there is trouble ahead and their safe haven properties are being bought up by the smart money. From Pal:

“I think 10-Year Yields fall to 1% and pause. After that we can see if the slowdown is really significant, in which case rates will fall to new all-time lows. If investors realise the economy is not self-sustaining, I think they will entirely reprice the yield curve...”

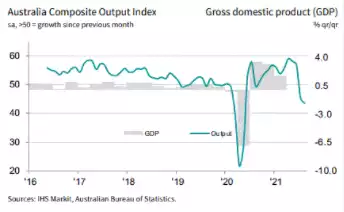

And before you dismiss this as a ‘US thing’: a. If the S&P500 crashes so do we and; b. the latest IHS Markit Flash Australia Composite PMI released Monday plunged us into a double dip recession whilst the ASX200 remains sky high.

Just as Pal expects bonds yields to tank toward negative, if you missed our article on Monday, the prospect for Australia is very much real too. Reality will catch up.