Why shares, precious metals and bitcoin are all rallying

News

|

Posted 06/11/2020

|

7793

Topically after yesterday’s article about central banks upping the money printing game last night the US Fed maintained its $120b/month QE program and indicated it has no end in sight. Powell also stressed that the recovery has a long way to go and that “fiscal policy is absolutely essential here”, or in simple speak, the US Government must recommence its own stimulus (deficit/debt fuelled stimulus directly into the economy) as QE alone won’t save the ship. When combined with the increasingly likely chances of a Biden victory and the expectation of much more government spending that comes with a Democratic administration, everything rallied last night except a tanking USD.

The Dow and S&P500 were both up 2% but the tech heavy NASDAQ surged yet again, up 2.6% continuing its recent tear. Gold was up 2.5% (1% on the stronger AUD) and silver rocketed up 6.2% (4.5% in AUD). Bitcoin was up another 8.3% and Ethereum 2.3%. The USD was smacked 0.9% lower which sees the AUD now at 72.8c.

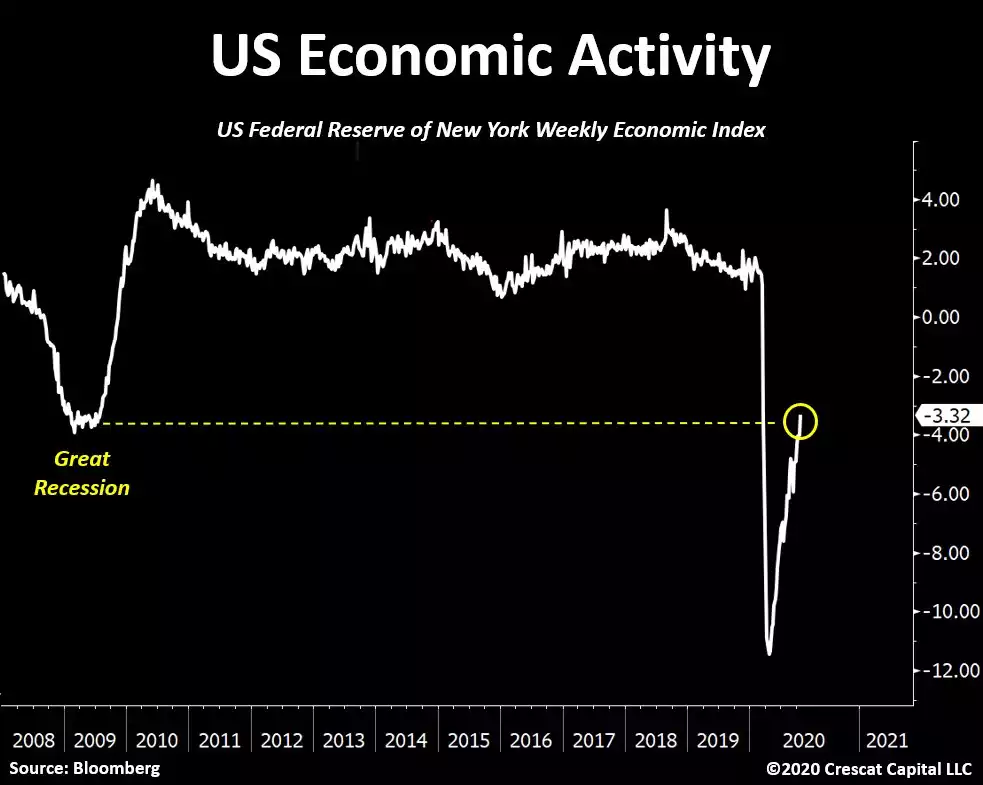

So when the Fed says there is a long way to go in terms of recovery the following chart is a reminder that we are now just back to where we got to at the very bottom of the GFC.

In terms of shares surging last night that might have you scratching your head around fundamentals, particularly the NASDAQ ahead of a potential new President with them in his sights and already sky valuations.

And indeed the so called Smart money (from Bloomberg’s Money Flow Index) is exiting the building:

Jeff Bezos has sold over $10b in Amazon shares this year, albeit still owning ‘just’ $170b worth… But part of him must be looking at the following charts and scratching his shiny head..

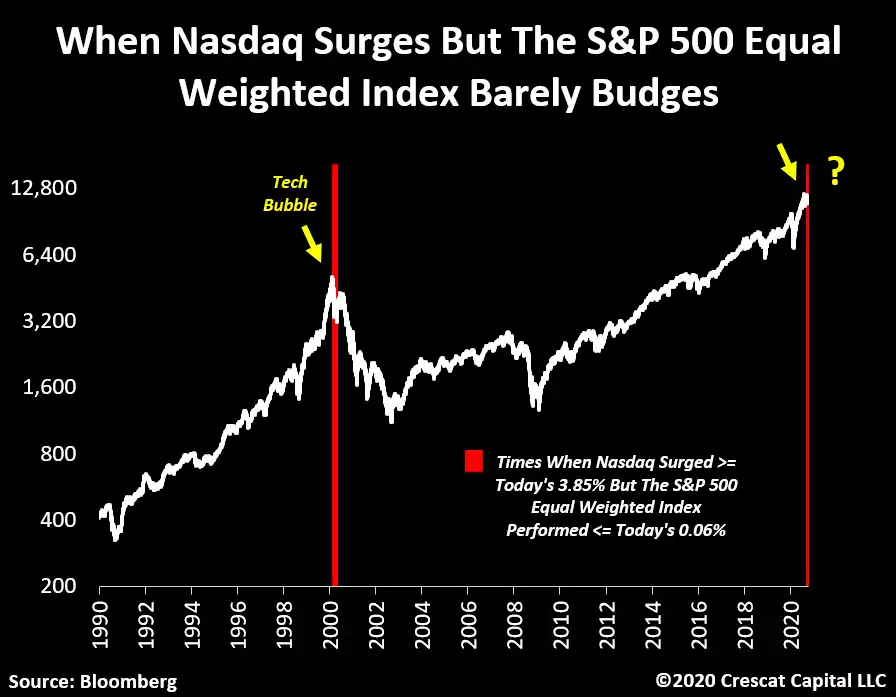

First we have the NASDAQ surging whilst the S&P 500 equal weighted index barely moves which has only happened twice before in history and both time in April 2000, just at the peak of the tech bubble.

Second we have tech share valuations up to 43% of GDP, 26% higher than they were in the dot.com bubble.

This sort of madness is why we are seeing gold and silver surge together with shares when they are normally negatively correlated. The smart money is positioning into gold and silver and bitcoin right now. Despite the surge in shares we have seen the critical break out of the gold to S&P500 ratio wedge that has been forming since the pandemic broke out.

Such gyrations are not unusual in an uncertain environment as we currently have with the US election and may not be particularly instructive on where we will be in days lets alone years. However what is abundantly clear is that there is a growing awareness of what is to come under either administration and that hard assets such as precious metals and bitcoin are a necessary part of a portfolio, particularly if you want to play the sharemarket casino.