Why Gold & Silver Dropped Amid Carnage

News

|

Posted 12/03/2020

|

20824

After yesterday’s ‘dead bat bounce’ Wall Street and global markets resumed their precipitous falls last night. After falling another 5-6% last night, the S&P500 and Dow Jones are now into bear markets (>20% fall) and we’ve just witnessed the fastest drop from market peak to bear market in all of history.

What has some confused though is why the safe haven of gold has seen falls, albeit comparatively small, over the last few days? This is not unprecedented at all and is easily explained. Part of the beauty of gold is its liquidity. We’ve shared previously the sky high margin debt on NYSE deployed into shares. Margin debt, as the name suggests, can see you have to top up your account when your shares fall below a certain level. If you are ‘all in’ you likely have no cash on the sidelines to do so and hence need to sell either shares or other assets to pay that margin call. Property is illiquid and you then have the choice of selling falling shares possibly worth less than you paid for them or your gold or bonds that have seen great gains. Psychologically the latter is more palatable even if less logical.

We have also seen the USD rally on demand as the hoards go to cash. One can only marvel at a rush into an increasingly precarious Fiat currency as opposed to real money. Like gold, US Treasuries, the other supposed safe haven, have corrected. This makes a little more sense as we reported last week, Goldman Sachs put it nicely:

“We continue to believe that gold remains attractive relative to bonds. It has a greater capacity to increase during the next recession as bonds may be constrained by the lower bound on central bank rates. Gold is also a better hedge against the risk of inflation overshoots.”

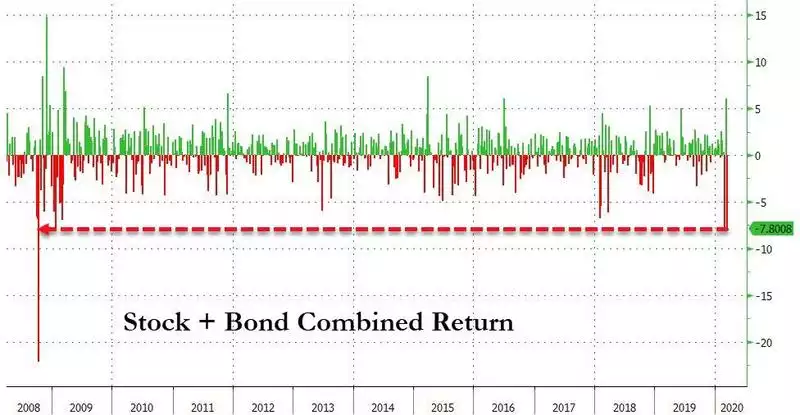

That classic Wall Street favourite 80/20 ‘Stock & Bond’ portfolio has just seen its worst week since the ‘Lehman moment’ of the GFC:

The rush to USD cash is exacerbating an already overstretched Repo market requiring the US Fed to again up their bailout limit, now to $175b as overnight we saw the biggest jump yet in this liquidity crisis. Even the Fed’s 50bp rate drop last week and $550b of Fed injections (notQE) has done nothing to ease these pressures.

Additionally we have seen such strong price growth in gold this year that early signs suggest jewellery and even central bank demand has reduced waiting for a correction to buy.

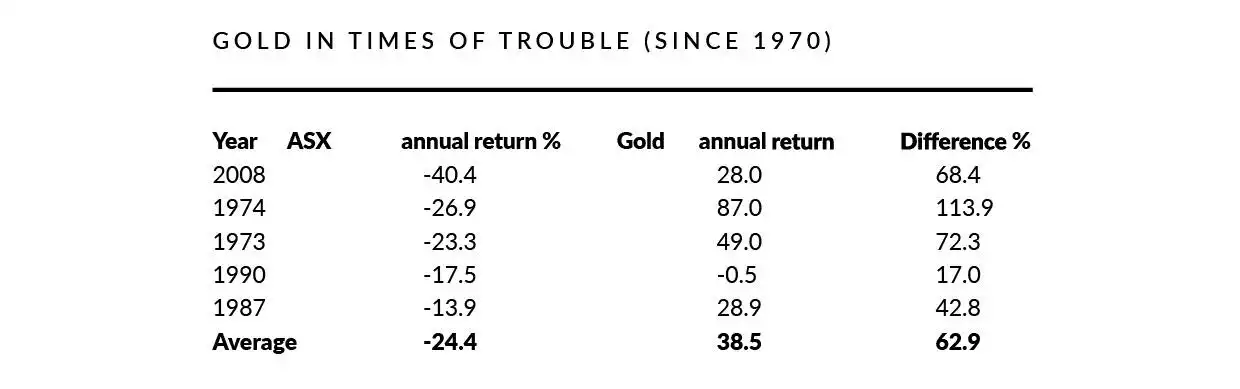

Many don’t realise too that this is exactly how the GFC played out. As markets tanked so initially did gold and silver on that same liquidity squeeze phenomenon. However as precious metals rebounded after the initial shock, shares went on to end up half in value and gold ended up double in value. Historically we’ve seen the same. Here again are the 5 worst years on the ASX compared to gold that same year. Remember financial crises don’t care for calendars so 2008 extended into 2009 to get the aforementioned numbers.

Anyone knowing this and thinking they will wait for that ‘dip’ are not factoring in the elephant in the room on this crisis and that is supply chains being disrupted by the virus. Will you be able to get your gold on that dip? Have we already seen the dip?

Toilet paper may be somehow deemed a necessary luxury for your butt, however it’s not going to save your butt like gold could. Let us again remind you of that oft quoted gold adage:

“Better a year too early than a day too late”.