While we were away and hello 2015!

News

|

Posted 12/01/2015

|

3842

Happy New Year from the Team at Ainslie Bullion! We hope you are well rested and ready for what is set to be a very interesting year ahead.

So what happened while we were away? Well for a start, as we alluded was likely, Greece has been forced into a general election and the front runner to win is the anti Euro party of Syriza who want to exit the union and default on their EUR400b of EU debt. Get ready for plenty of “Grexit” talk and don’t believe the spin that Germany is “OK” with them exiting. Germany more than anyone needs this Euro mess to stay together and letting Greece exit would breach the precious ‘contagion firewall’. The impacts this presents the Euro, and the world as a whole, should not be underestimated and to make matters worse the Euro zone is now officially on the brink of outright stalling. Markets are already betting (rising shares, crashing Euro, and lowest Euro bond yields since the 14th century) on the ECB finally starting its much telegraphed QE bond buying (money printing) program to try and kick start the economy (because that worked so well for the US and Japan… not). Set your diaries for 22 Jan as that is their next meeting.

Oil fell to new lows below $48 which contributed to a decent correction in global sharemarkets, the worst start of a year in the US since 2008, but all of which was regained late last week on news from the US Fed that interest rates won’t rise at least until after April (we say way beyond that) and the Fed weighing in on the need for ECB stimulus as the rest of the world economy languishes. i.e. in short the free money game continues so let’s buy more overpriced shares!

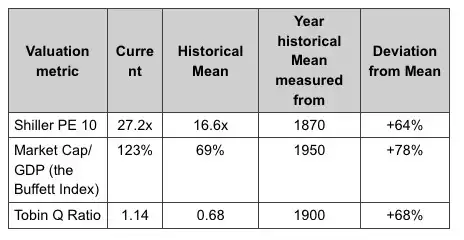

On that point, consider the following table courtesy of The Daily Reckoning on the US sharemarket and ask yourself if this particular market is due to a reversion to (and usually well beyond) the mean?

Again may we remind you of the 4 most expensive words in investing – “Its different this time”

Are you ready for a crash in 2015?

Finally as an interesting and telling titbit, on the very last day of 2014 the US Treasury added $100b to the US’s over $18t in debt. The significance? That equates quite closely to the value of all gold produced globally in all of 2014, and China and India alone consumed that same total of metal in its entirety…