‘Make America Wait Again’

News

|

Posted 02/03/2017

|

4006

The US sharemarket had its biggest daily jump since the election last night, the Dow now over 21,000 and the S&P500 over 2400. Why, you ask?

It was all seemingly off Trump’s first joint sitting address to Congress where he spectacularly revealed… nothing new. Yep, there wasn’t a skerrick of detail on how he will implement any of the things the market is buying into. BUT, he didn’t blow up, he was moderate, and he was positive and that alone could be the reason for the biggest market jump since he likewise didn’t make a mess of his acceptance speech. Hope is alive. America waits for details on how that translates to reality.

One key reason for the scale of the jump looks like the market was piled heavily into short positions (bets on a decline) before the speech and when the market started to rally (because he didn’t scare it), all those short positions had to be covered and covered quickly, unleashing the classic short squeeze rally.

There was also some positive news in the better than expected manufacturing ISM print (but somehow wasn’t concerned by its sister PMI turning lower…). We’ll discuss both as usual tomorrow in the Weekly Wrap.

Bond’s were smashed in the process last night with US 10 year yields hitting a high of 3.07% but gold and silver rallied all session as the two safe haven stalwarts of bonds and precious metals decoupled.

So again whilst the headlines everywhere today will be all about raging share prices in the US and not a mention of the unusual fact that gold and silver are rising right beside them as the ‘smart money’ unloads their shares and gets their hedge on, let us remind readers that as of the time of writing, the S&P500 is up 7.2% for the year (Aussie All Ords up 1.6%), gold is up 8% (2% in AUD) and silver up 15% (8% in AUD).

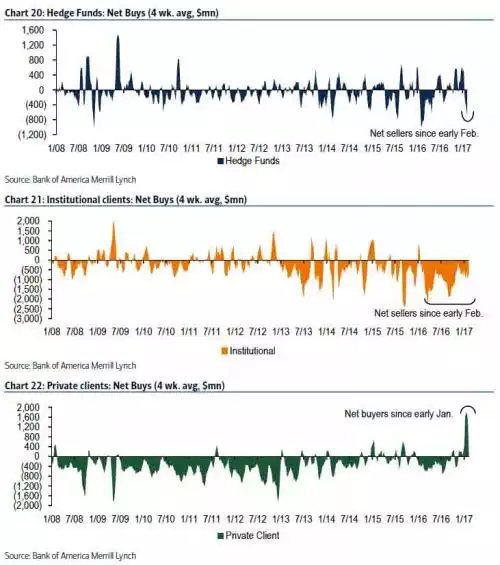

Per below, the big hedge funds and institutions are bailing out and leaving the poor hapless private individuals to catch the hospital pass…