Deutsche Bank Warns of “Broken Financial System”

News

|

Posted 16/06/2016

|

6029

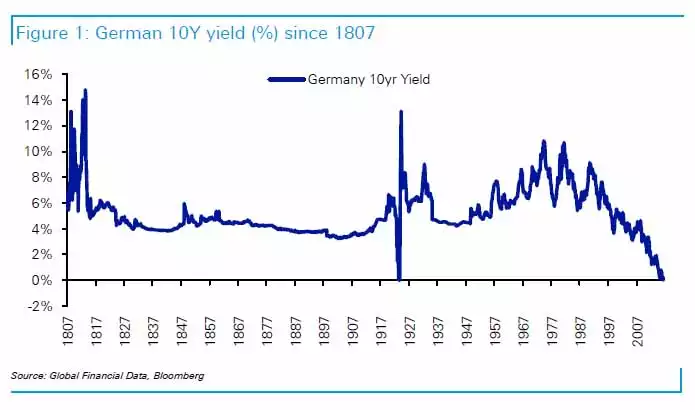

Following on from yesterday’s article on the sheer scale of negative yielding bonds we look at yet another warning on the implications as the German 10Y Bund went negative for the first time in history.

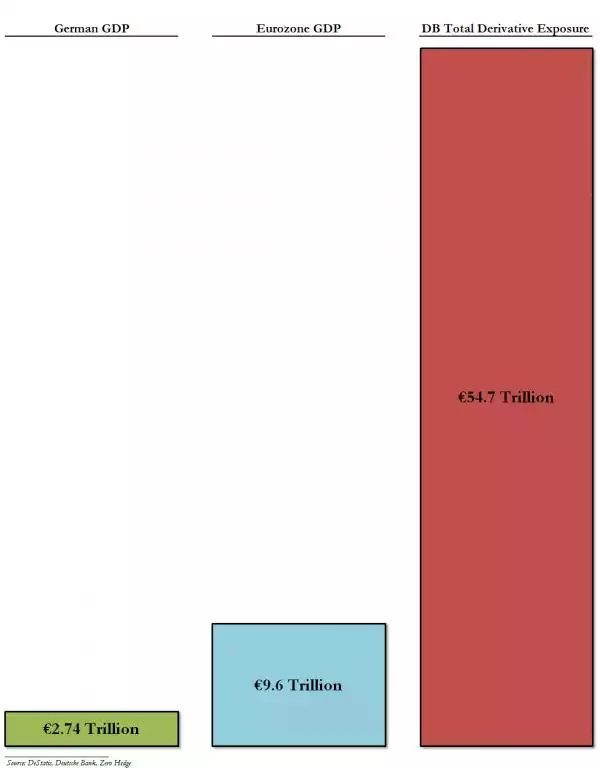

Germany’s Deutsche Bank is Europe’s and one of the world’s biggest banks. It would be fair to say things aren’t going well for them, what with a record low share price, the threat of Brexit, an ECB hell bent on money printing the EU out of it’s deflationary hole, a growing bad loans book and its exposure to the still unresolved Greek debt issue and growing concerns around Italy , et al. Moreover, in an economic environment as over inflated, fragile and interlinked as it is now there is of course their famous Eur54.7 Trillion derivative exposure. That’s not a typo, and yes it is about 20 times more than its host nation’s GDP…

They are one of the more vocal opponents to the current zero and negative interest rate policies too. They said it nicely a couple of days ago (referring to the graph below)

“If one wanted a simple indicator to reflect a broken financial system then this would be a strong candidate. [the chart below] show 10 year Bund yields back to the early 1800s to put this move in some perspective”…..”Let us stress that until Governments/central banks change policy, yields are likely stay at ultra low levels due to secular stagnation type themes and the overwhelming amount of QE hoovering up bonds. However it still reflects a broken financial system.”

Maybe topically, you may have seen the graph before too…